UK banks are set to report Q1 earning in the coming week. The results come after the sector saw a stellar start to the year outperforming the broader market in the first quarter.

Part of the banks' share price out-performance has been because of the sector’s share price under performance last year. Banks are cyclical and their performance is closely tied to the health of the broader economy.

What to watch:

Loan impairment charges

As the prospects for the UK economy have improved so have the prospects for the banks. Banks reported strong fourth quarter 2020 results. The majority of banks beats on profits forecasts thanks principally to lower bad loan provisions.

Loan impairment charges this quarter are expected to remain low thanks to government support packages meaning fewer businesses are defaulting on borrowings. In a similar way that we have seen in the US, there is an increasing chance that write backs could be on the cards, particularly in light of high provisions put aside last year.

Investment banking

Investment banking revenues have also been strong across the pandemic thanks to increased market linked activities. Given the strong investment banking revenues in US peers, expectations are for those banks with large investment banking businesses to see a strong performance – namely Barclays and NatWest.

Net Interest Income

Given that UK interest rates remain at 0.1% a historically low level, net interest income for the banks is expected to remain depressed. However, mortgage lending has been strong thanks to the UK’s mini housing boom. This is particularly good news for Lloyds.

Card spending is also likely to be picking up as consumers looked ahead to the easing of lockdown restrictions. Retail sales data today revealed that sales surged for a second straight month in the UK. The more of this that was on credit cards, the better for the bank’s income.

Already priced in?

The question is, given the strong rally, whether a lot of this good news has already been priced in? It could take further clarification surrounding dividends or the full easing of lockdown restrictions for the share price to see strong moves higher.

Learn more about trading equities

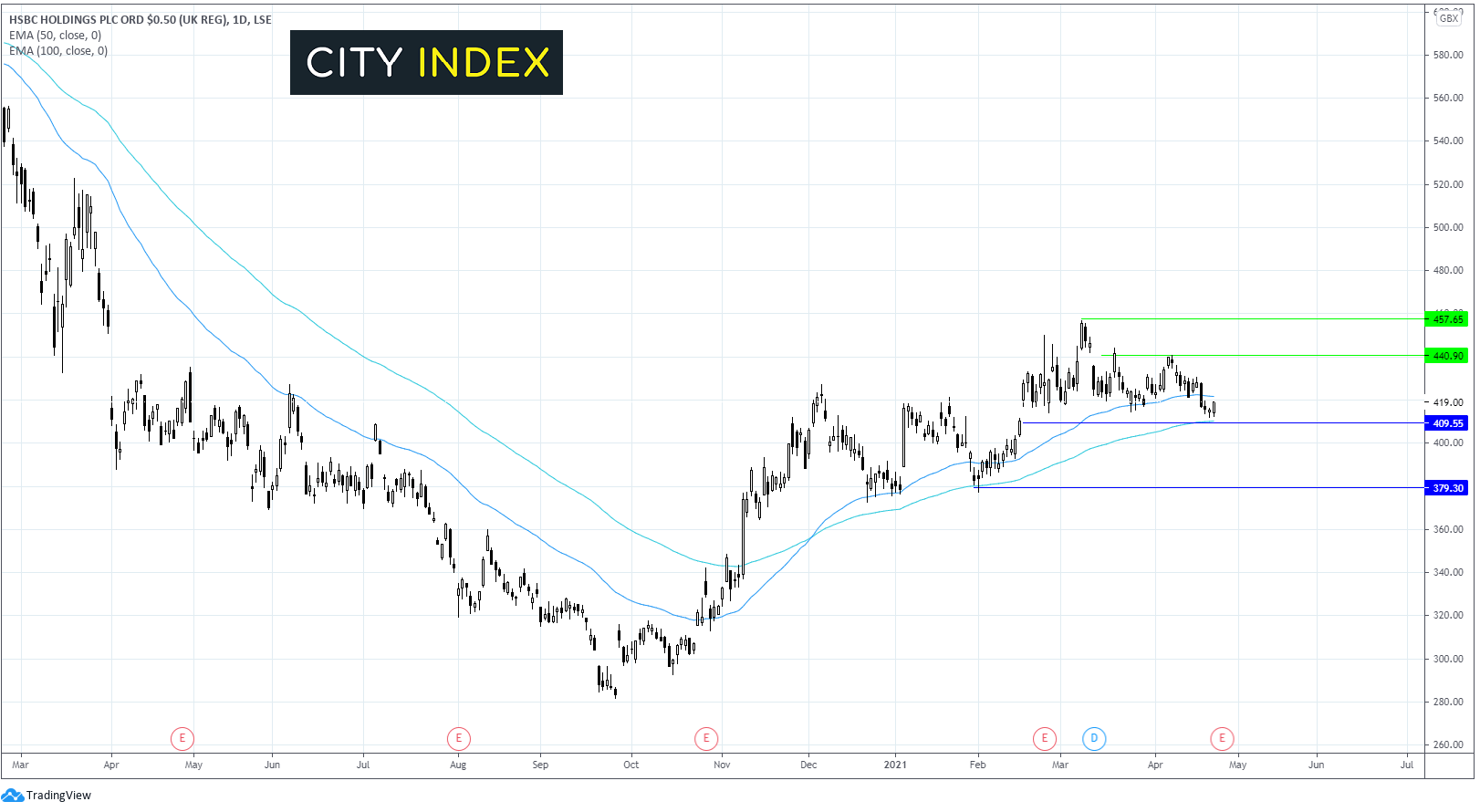

HSBC – Tuesday 27th April

Where next for the HSBC share price?

After trending higher from October and hitting a post pandemic high of 456p in early March, HSBC has been trading in a holding pattern, capped on the upside by 440p and the lower band by 410. The 100 EMA is also at at 410p which could make it a tough nut to crack even on disappointing numbers. Sells might look for a break below this level for a deeper selloff towards 380. Meanwhile a move higher could look to break above 440p and towards 456p the post pandemic high.

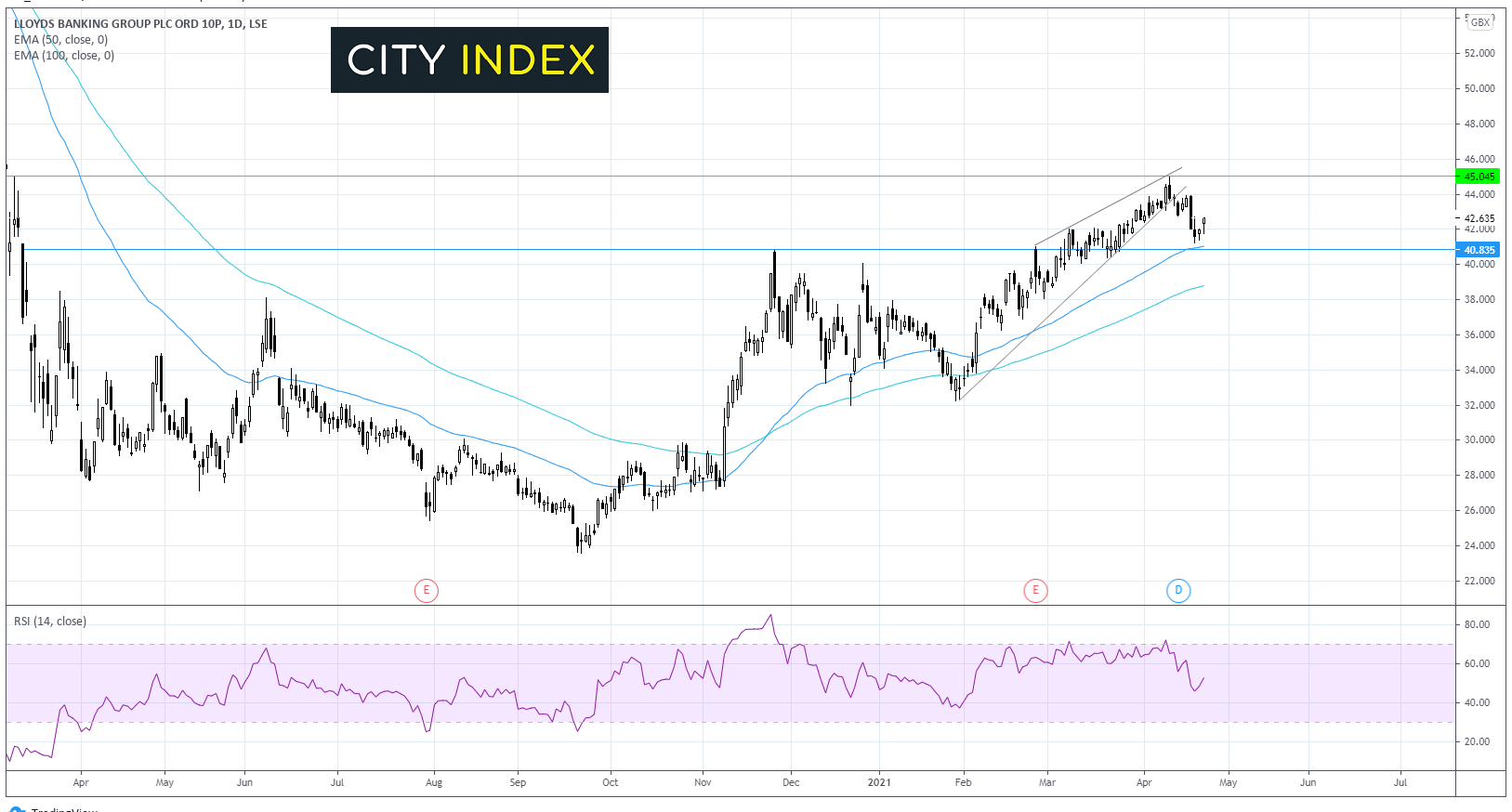

Lloyds -Wednesday 28th April

Where next for Lloyds share price?

Lloyds formed a rising wedge pattern, which after hitting a post pandemic high of 45p, resulted in a price reversal. The reversal found support at 41p the 50 EMA on the daily chart and also the high November 25. It would take a break below this level to negate the current uptrend and head towards the 100 EMA at 38p. A serious upside surprise and or unexpectedly strong guidance could see the price head back towards 45p for a break-out to the upside.

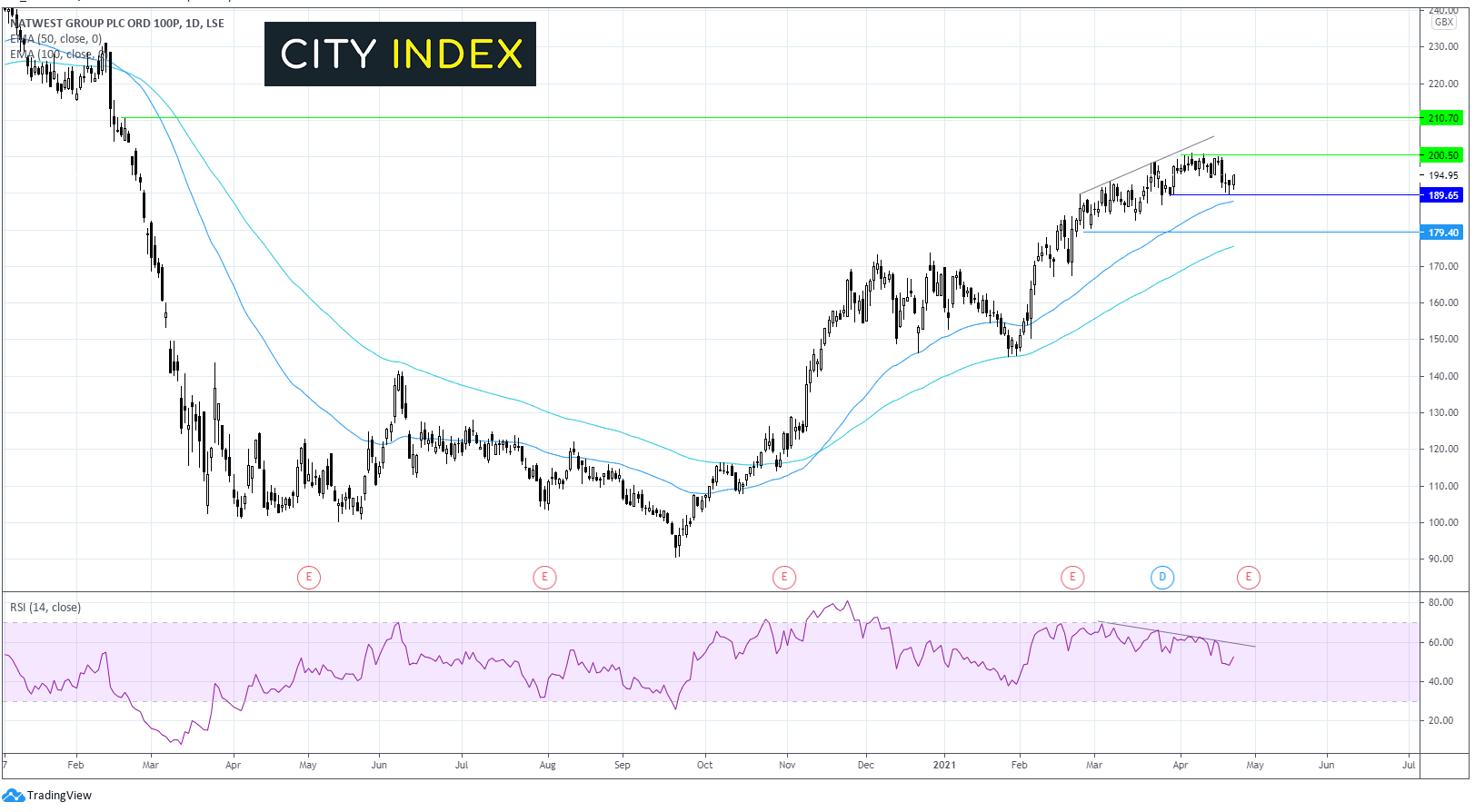

NatWest – Thursday 29th April

Where next for NatWest share price?

After hitting a post pandemic low at 90p before, the price has been trending higher, consolidating between 160p – 170p before extending gains to the post pandemic high of 200p this month. Bearish divergence with the RSI points to the marker action losing momentum and weakening, potentially indicating a reversal. A break below the 190 area, horizontal support and the 50 EMA could see a deeper selloff towards 180p support from early March. A move higher could see the price look to break through resistance at 200 and head towards 210p a level last seen in mid February 2020.

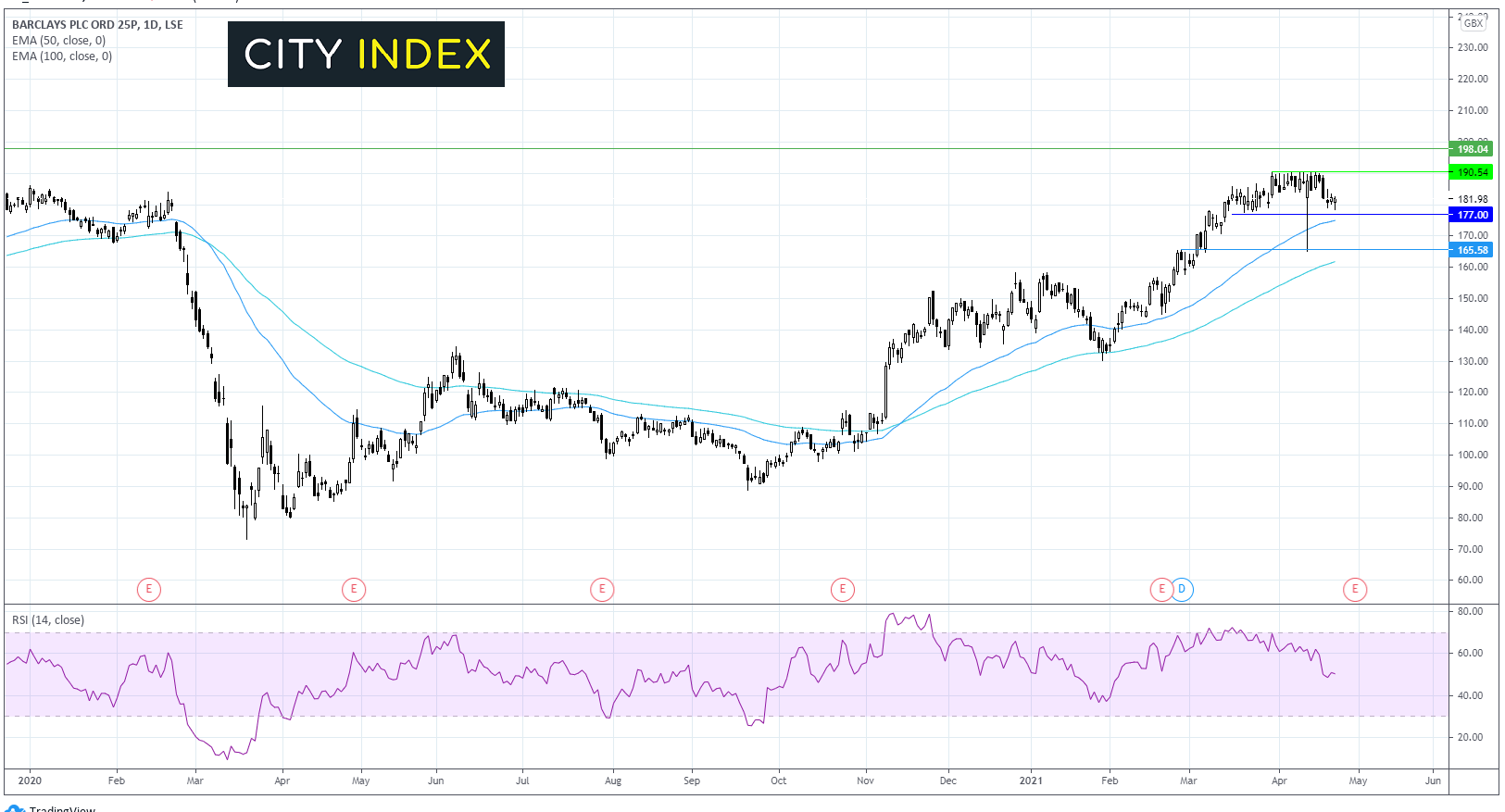

Barclays – Friday 30th April

Where next for the Barclays share price?

Barclays, as with some of its peers has been trending higher since late October. After hitting a post pandemic high of 190p the uptrend has lost momentum and the bias is more neutral ahead of the results release. Upbeat earnings could be the needed catalyst to push the price through tough resistance at 190p. Beyond here the uptrend could resume. Any disappointment in the numbers of the outlook needs to take out horizontal support and the 50 EMA at 175 in order to look towards 165p. It would take a move bellow 160p 100 EMA to negate the current uptrend. For now this looks unlikely.