WTI oil looks to the OPEC+ decision

Oil is edging just a few ticks lower at the start of the week, stalling around 75.60 as investors look ahead towards the OPEC+ decision.

In the July meeting the group agreed to up output by 400,000 barrels per day. However, the group is deciding whether to increase further as demand recovered fast than expected, pushing Brent to a 3 year high last week.

The surge in natural gas is boosting the appeal of oil which is comparatively a cheaper energy option.

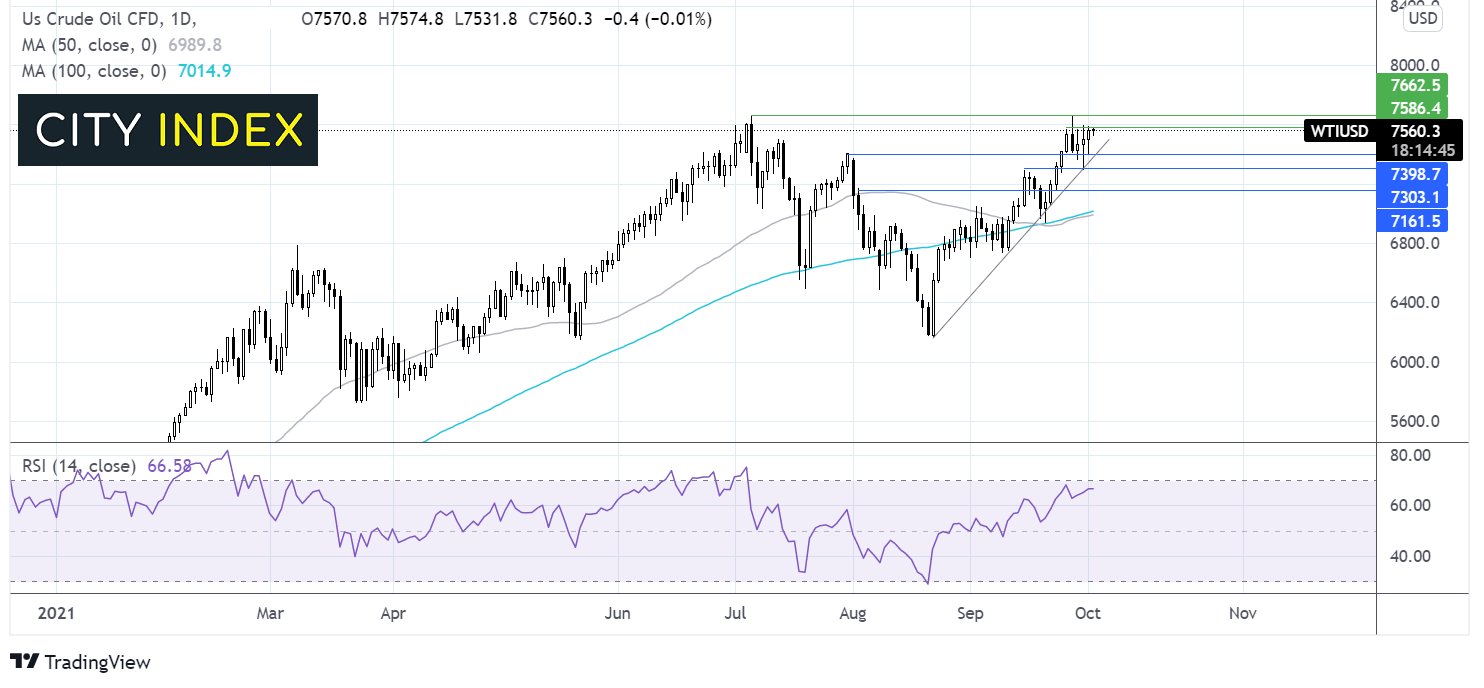

Learn more about oilWhere next for WTI oil price?

WTI oil trades has been extending its recovery from the late August low of 61.72. It trades above its ascending trendline and the RSI is supportive of further gains whilst it remains out of overbought territory.

However repeated failures to break above 75.80 could see the sellers extend a move lower towards 74.00 the confluence of the ascending trendline support and July 30 high. It would take a move below 73.00 to negate the near-term uptrend and expose 71.60 Sept 23rd low and August 3rd high.

On the flip side, a push through 75.80 could open the door to 76.64 and fresh recent highs.

FTSE futures pare gains as Evergrande concerns grow

European indices are pointing to a mixed open in what is expected to be a quiet start. Stagflation and the energy crisis are expected to remain a key theme this week.

Concerns over Evergrande defaulting and contagion across the broader Chinese property sector are back to haunt the markets. Reports have emerged that Evergande is in the process of selling 51% of its property management unit which would help ease liquidity issues.

Meanwhile upbeat news on drugs to fight COVID is offering some support. On Friday, Merck announced that molnupiravir a drug in R&D stage could be used as a pill to fight COVID.

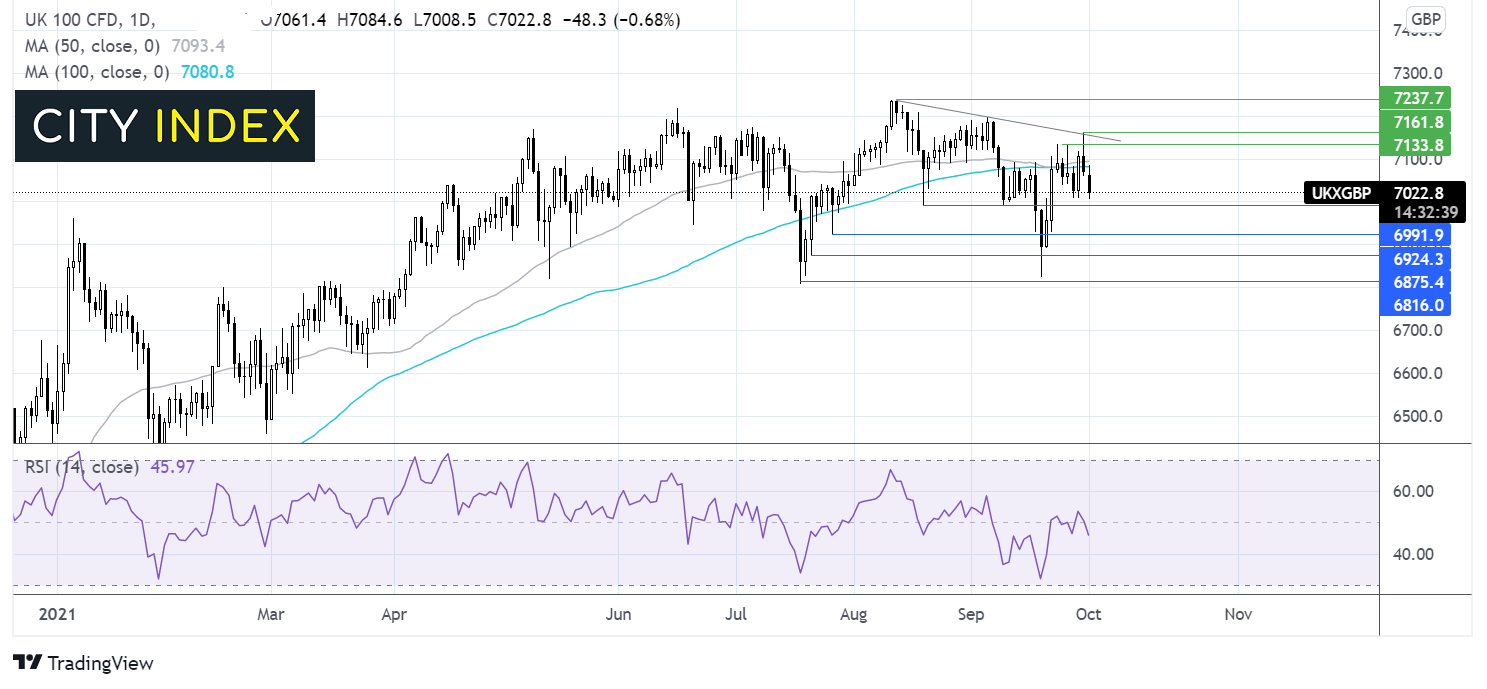

Where next for the FTSE?

The FTSE’s rejection at 7160 the falling trendline resistance sent the index back below its 50 & 100 sma on the daily chart. This along with the bearish RSI is keeping the seller’s hopeful.

It would take a move below 6990 for the bears to gain traction and head towards 6930 the low July 27. A break below here could open the door towards 6880 July 22nd low.

Strong resistance can be seen at 7080 today’s high and the 200sma. A push beyond here could open the door to 7133 high 23 & 27 September and 7160.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.