WTI falls for second day

Oil prices are heading lower for a second straight session after a surprise build in US crude oil supplies.

API data revealed a build of 4.127 million barrels well over a draw of 2.333 million barrels expected and after a 6.1 million draw recorded the previous week.

Attention will turn to EIA data which is due later. Should this confirm the build, it will be the first build in 2 months.

Oil rallied hard across the past week on tight supply concerns and as demand rises as countries emerge from pandemic lockdowns. The OPEC world oil outlook report sees demand outstripping

An energy crunch in Asia is also helping to underpin the price of oil.

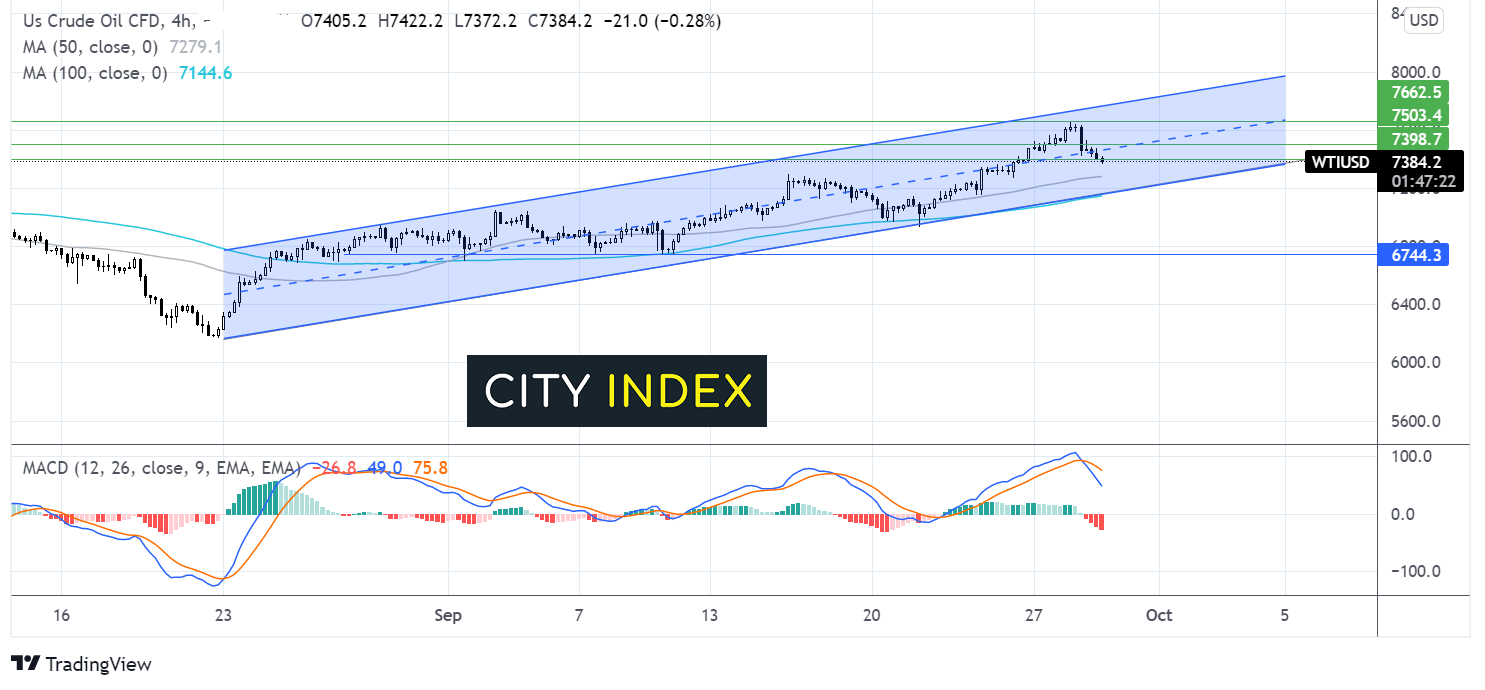

Where next for WTI oil prices?

WTI oil continues to trade within an ascending channel dating back to August 23rdon the 4 hour chart. After finding resistance at 7660 the July high, the price is falling lower, taking out support at 76.00 and 74.00 the previous double tops. The bearish crossover on the MACD supports further downside.

It would take a move below 72.63 the 50 sma and 71.35 the lower band of the rising channel for sellers to gain traction.

A recovery would need to retake 74.00 and 76.00 in order to make another attempt of 76.60

EUR/GBP looks to economic data

EURGBP posted its largest gain in six months, taking the pair to a two-month tops.

The Euro rallied following upbeat German consumer confidence whilst the Pound slumped as the outlook for the UK economy darkened. Supply chain bottlenecks, labour shortages, no petrol at the pumps combined panicking investors who sold the pound.

Looking ahead Eurozone consumer confidence data will be in focus in addition to speeches from ECB’s Lagarde and BoE’s Andrew Bailey.

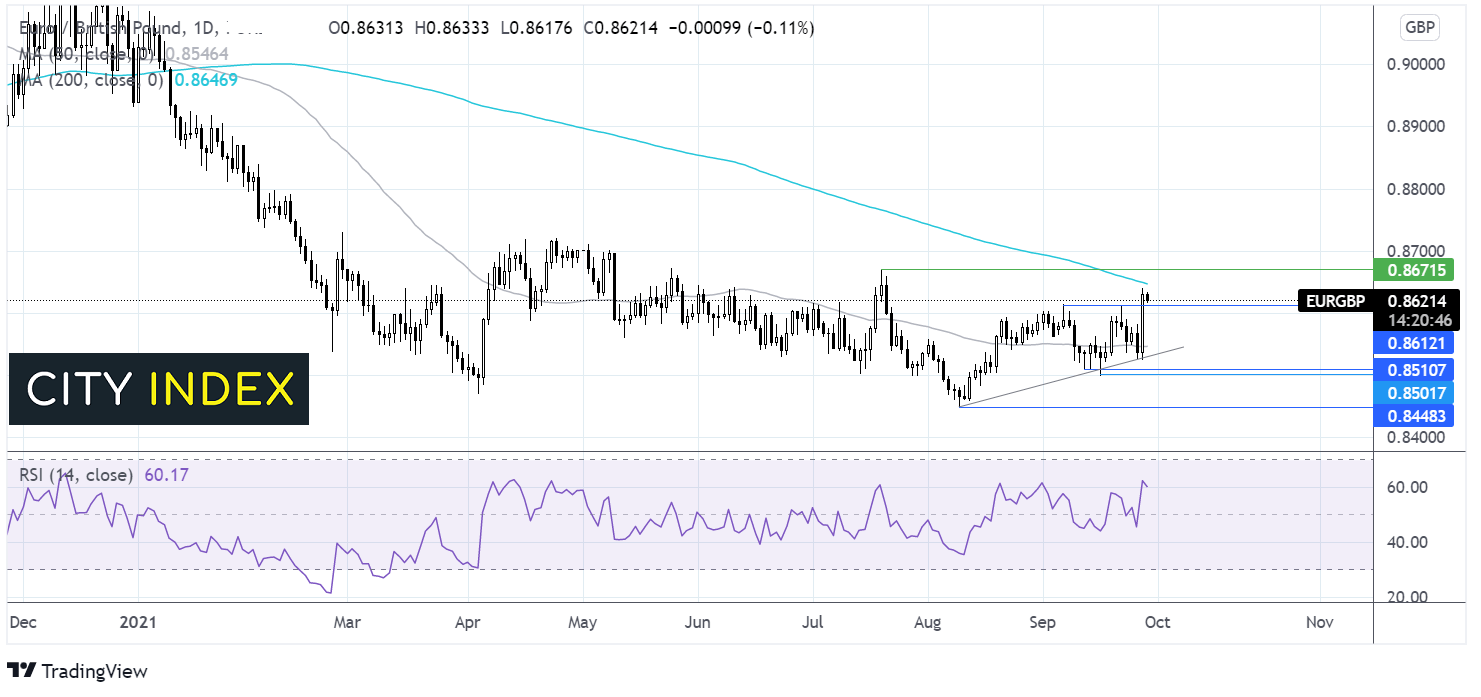

Where next for EUR/GBP?

The rally in EUR/GBP found resistance just shy of the 200 sma in the previous session at 0.8641. The price is seen easing in early European trade. Should support hold at 0.8613 the high September 7th & 23rd the bulls will remain hopeful of another attempt of the 200 sma at 0.8650.

Meanwhile a move below 0.8613 could bring the 50 sma at 0.8550 into focus. It would take a move below the rising trendline support at 0.8530 for the sellers to change the bias.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.