Crude oil struggles around $80.00

Crude oil struggled to rebound from the weekly low and is edging lower once again. This week has been a volatile week for crude oil.

The US Dollar is sitting at 16-month highs and inflation at 30 year highs, prompting expectations that the US could adopt measures to ease the price of oil such as releasing strategic reserves.

Whilst supply remains tight demand continues to rise, particularly as air travel and trans-Atlantic travel picks up.

OPEC cuts its demand outlook for Q4 by 330,000 barrels per day from last month.

Baker Hughes rig count data is due later today.

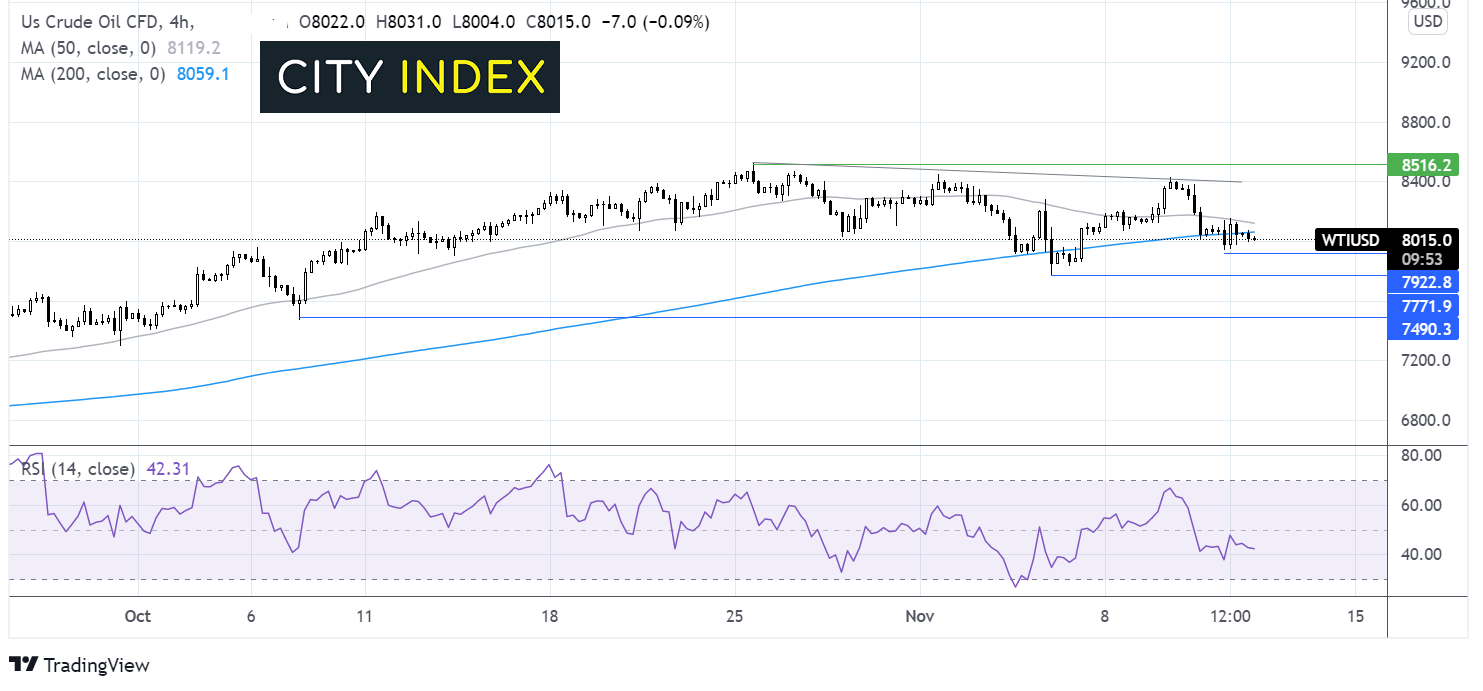

Where next for WTI crude oil?

WTI crude oil has been trending lower since October 25th. The price hit a low of 77.70 on 4th November and has been attempting to rebound.

However, failure to retake the 200 sma and the bearish RSAI suggests more downside could be on the cards.

Immediate support can be seen at 79.43 the weekly low. Beyond that the November low of 77.70 comes into play and 74.80 October 7 low.

Buyers need to see a move above the 200 sma at the 80.60 and expose the 81.30. A move above the falling trend line at $83.95.

DAX flat as DTE raises outlook EZ industrial production due

The Dax is opening roughly flat along with its European peers in what is expected to be a relatively quiet session.

Concerns over the surprise jump in US inflation appear to be easing.

Deutsche Telecom beat forecasts for earnings and raised its full year outlook for the third time this year.

Eurozone industrial production data is due to show a contraction of 0.5% MoM in September, after -1.6% contraction in August.

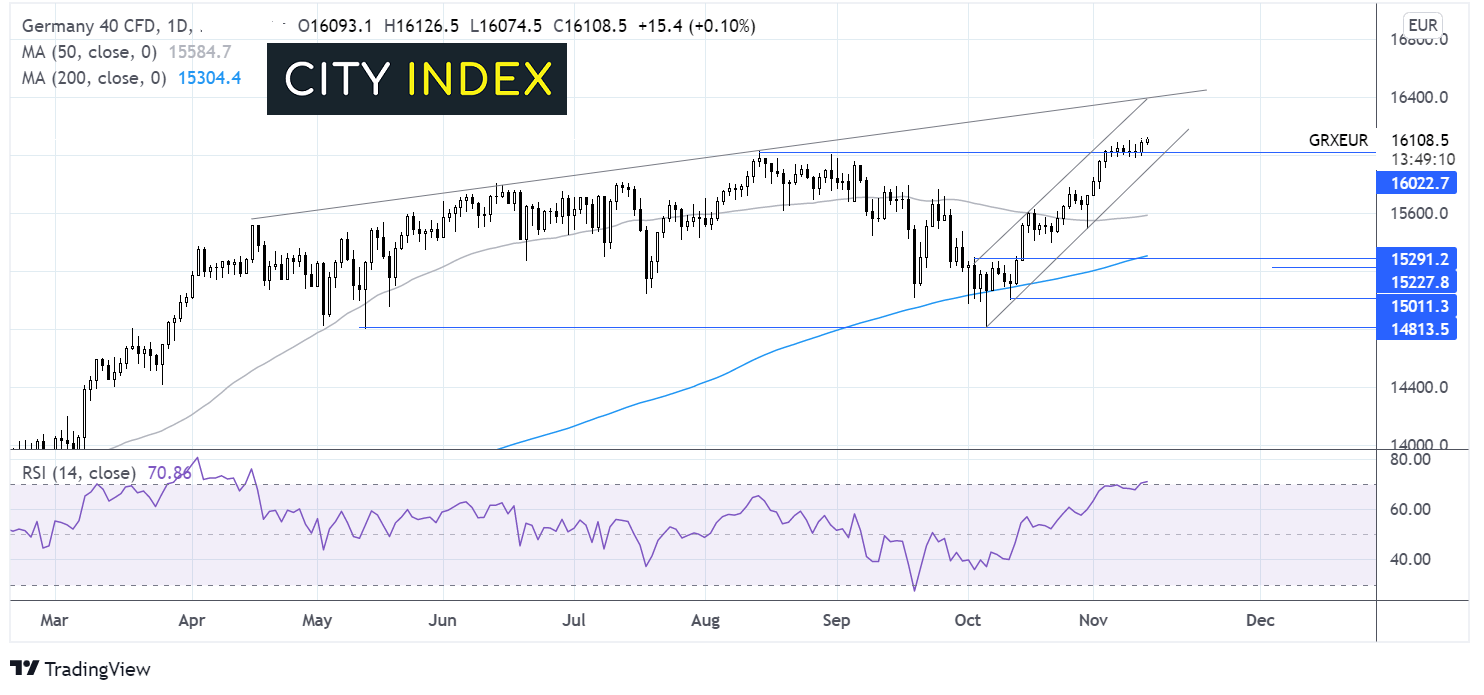

Where next for the DAX?

The DAX is extending its rebound from 14750 struck at the start of October, the uptrend remains. The price has been in consolidation mode over the past week, holding above the key 16,000 level.

Buyers could look for a move above 16106 for a bullish breakout towards 16430.

Meanwhile sellers might look for a move below 15985 the weekly low to indicate further losses.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.