WTI crude oil hits $70

Oil prices are on the rise amid signs of strong demand from western economies. The successful vaccine rollout and summer driving season in US and Europe fuel demand expectations.

Data from TomTom showed congestion in 15 European cities is at its highest level since the pandemic started.

Meanwhile the prospect of Iranian oil re-entering the market faded as US Secretary of State said that sanctions on Iran were unlikely to be lifted.

API crude inventories fell by 2.1 million in line with forecasts.

EIA stockpile data is due

Where next for WTI crude oil?

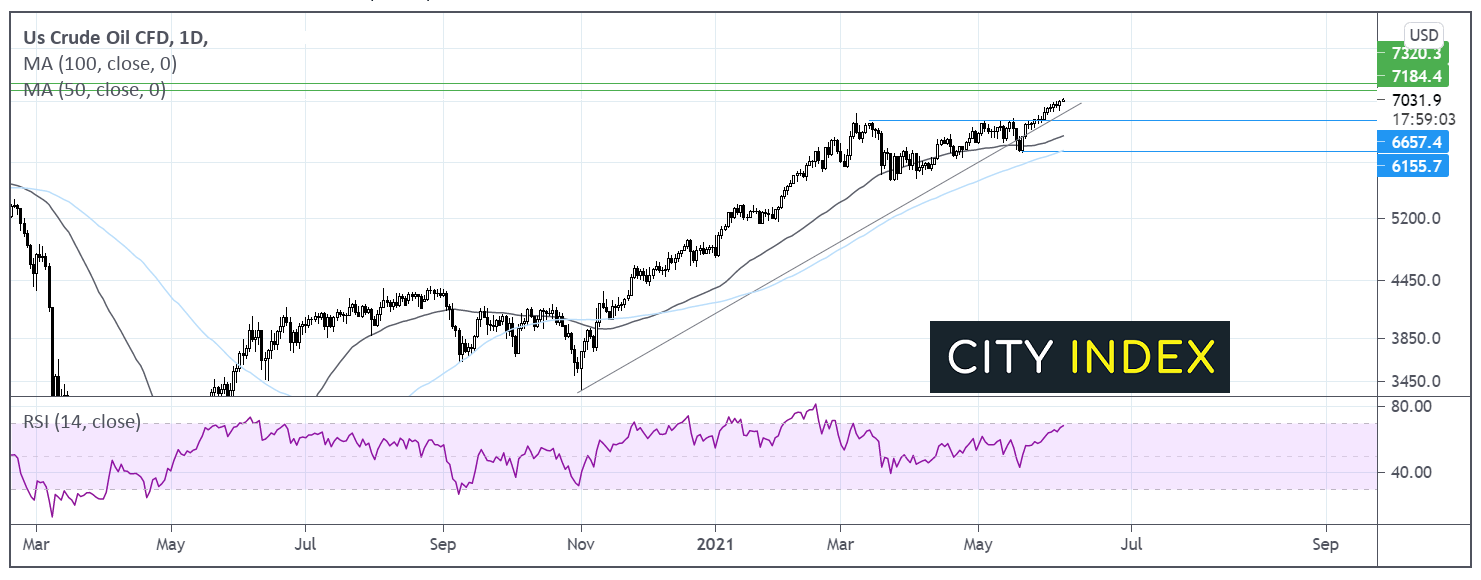

WTI has just pushed over $70 following a period of consolidation around the 32 month high.

WTI trades above its ascending trendline dating back to November. It trades above its upward pointing 50 & 100 sma. The RSI is supportive of further gains whilst it remains out of overbought territory favoring a move towards $72.0.

A breakthrough $72 could bring $72.85 the May 2018 high into play.

It would take a move below 66.50 to negate the near term uptrend.

Learn more about what moves oil prices

USD/CAD looks to BoC for direction

The bullish run on oil prices is underpinning the commodity linked loonie, as WTI crude oil hits $70 for the first time since 2018.

Investors look to BoC for fresh impetus. The BoC has been more hawkish as the first major bank to cut back on its pandemic stimulus programme at the April meeting. It also brought forward -guidance for the first rate rise to H2 2022.

The US Dollar Index trades flat after booking mild gains in the previous session. Investors remain focused on tomorrow’s CPI data amid concerns of rising inflationary pressures.

Where next for USD/CAD ?

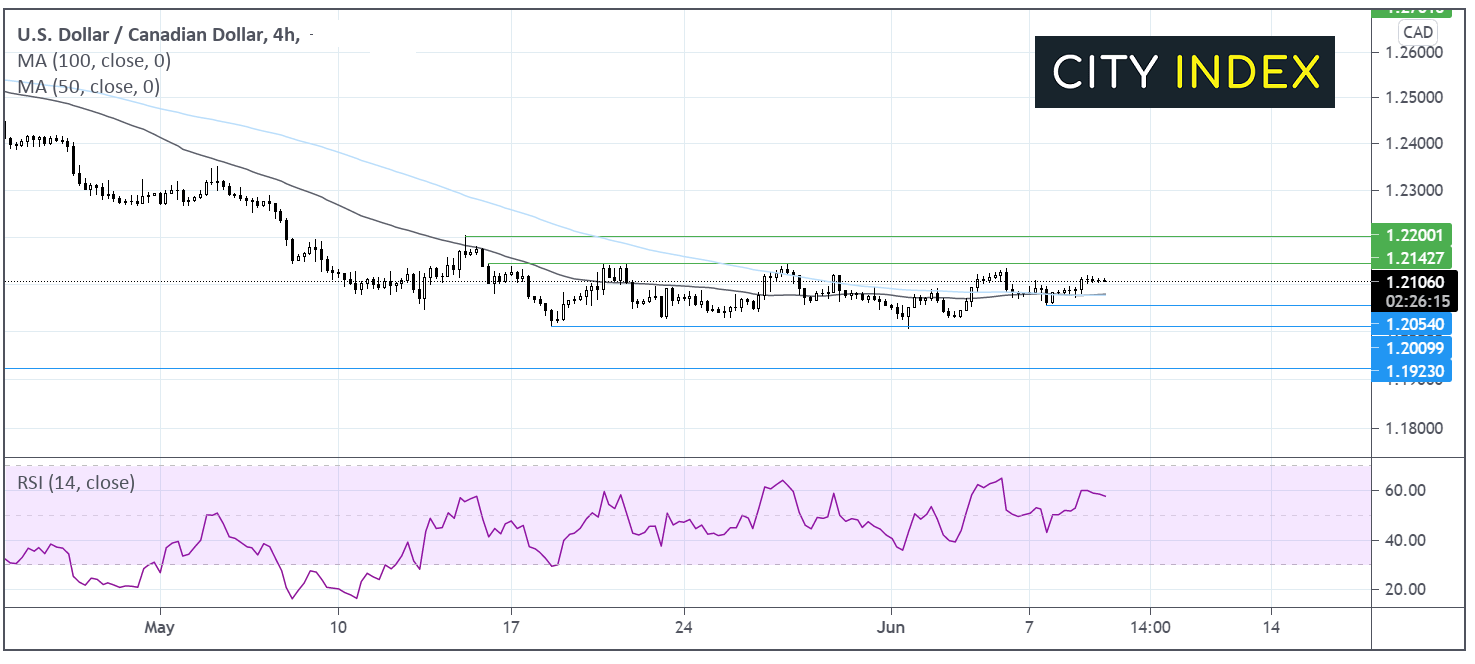

USD/CAD has been consolidating over the past month, capped on the upside by 1.2150 and on the lower side by 1.20 in a pause in the recent downtrend.

Failure for the pair to register a meaningful move higher suggests that the bear trend could still have more legs to run.

Any recovery in the pair would need to retake 1.2145 in order to push ahead to 1.22.

Support can be seen at 1.2050 the weekly swing low. A breakthrough here could open the door to the key 1.20 psychological level. Failure to defend this level could see USD/CAD decline towards 1.1920 the low May 2015.

Learn more about trading forex

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.