Oil gains after cyber-attack of US pipeline

Top US fuel pipeline operator Colonial Pipeline Co. was hit by a cyber attack on Friday and forced to shut its entire network.

The timeline for restarting its main pipeline is unclear.

The pipeline supplies almost half of the fuel consumed on the East Coast of the US.

Accelerating vaccine rollout continues to lift the fuel demand outlook.

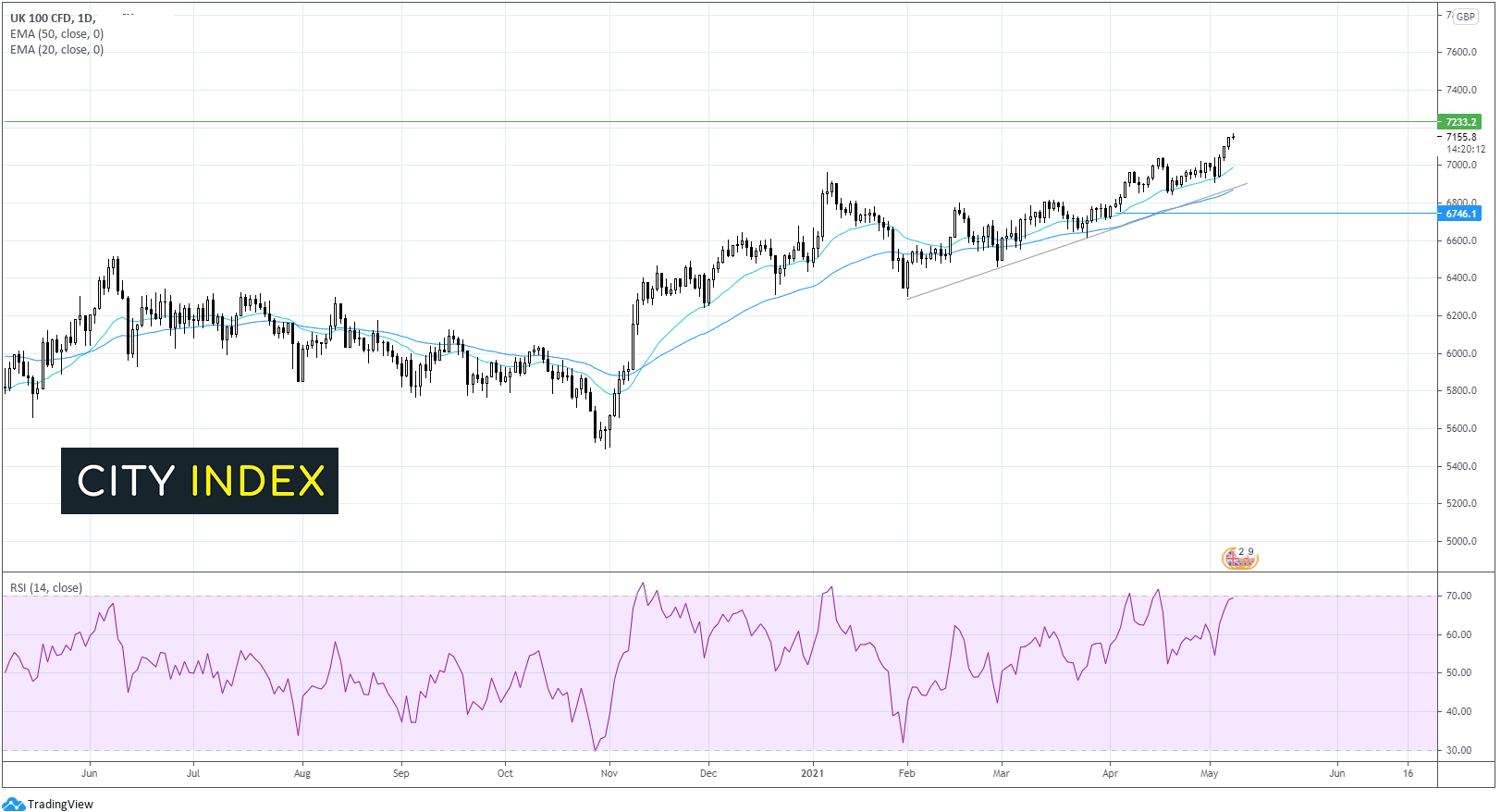

Where next for WTI crude oil?

WTI crude oil continues to trade above its two week ascending trendline. After finding tough resistance at 66.60 last week price has eased lower.

The price is testing the ascending trendline support at 65.00 which is also is 20 EMA. The RSI is pointing higher but only just in bullish territory.

Should the support hold, WTI crude oil price could look to attack 65.93. A move beyond 66.70 last week’s high could see the price target 68.00 March’s 14 month high.

A move below 64.50 the 50 EMA and high April 19th could negate the current bullish trend and see the price head towards 62.90 support low May 3rd.

Learn more about starting to trade oil

FTSE rises after record highs on Wall Street

The FTSE is setting off the week on the front foot, following on from record highs on Wall Street after disappointing US jobs numbers.

Stronger commodity prices and successful Tory local elections are supportive of the FTSE.

Scottish pro-independence SNP failed to win an absolute majority by 1 seat.

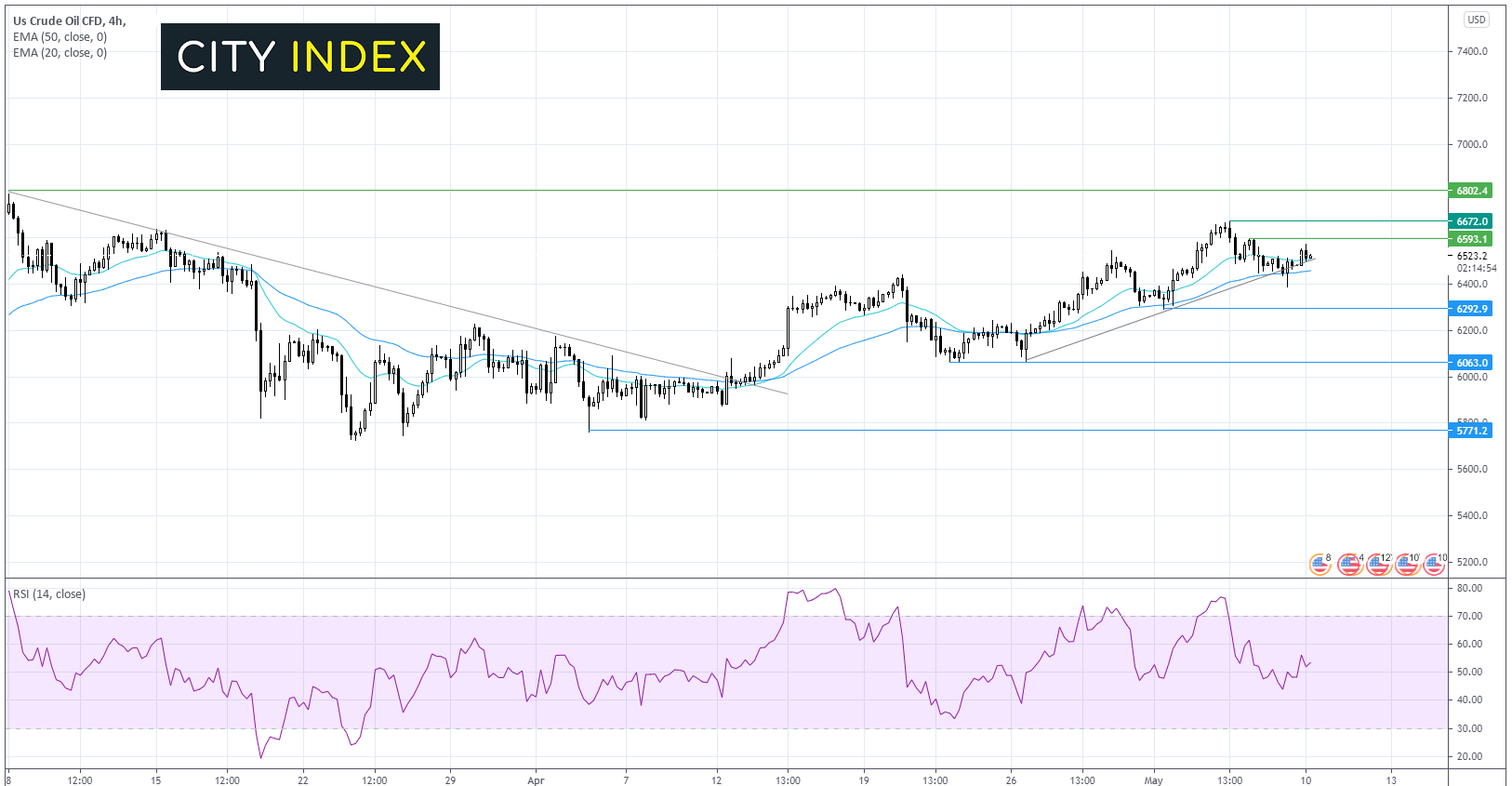

Where next for the FTSE?

The FTSE continues to advance trading above its ascending trendline dating back to late January, its 20 & 50 EMA on the daily chart. The RSI is approaching overbought territory. Whilst it remains below 70 more upside could be on the cards, a breach of 70 on the RSI could spark a pull back.

The next target on the upside it 7230 low Feb 3rd & high Feb 25th.

It would take a move below 6860 to negate the near-term uptrend and set off a deeper sell off towards 6750.