Oil looks to OPEC

Oil prices are on the rise after two straight days of declines as investors look towards the OPEC+ decision over supply policy. However gains are being capped by Omicron concerns.

Oil prices have declined by $10 per barrel since Omicron was discovered last Thursday. Fears over how contagious and the severity of the new COVID variant are clouding the oil demand outlook. So far, some travel restrictions have been imposed but it's unclear whether new lockdown restrictions will be required.

These developments raise questions over the ability of OPEC+ to raise output as planned. Should OPEC+ press ahead oil prices could fall.

Meanwhile the Biden administration said that it could delay the planned release of strategic reserves.

Learn more about trading oilWhere next for oil prices?

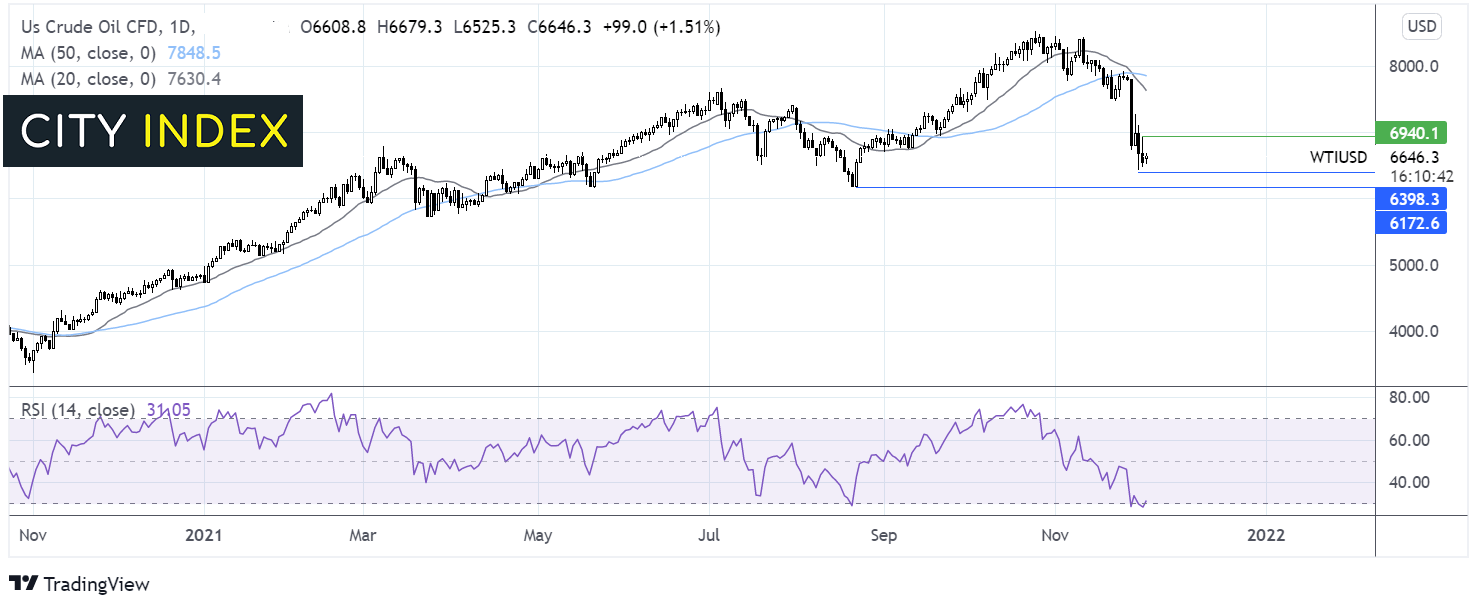

WTI oil is attempting to rebound from 64.70 the three and a half month low reached yesterday. Oil trades below its 200 sma, the 20 sma also crossed below the 50 sma in a bearish signal. The RSI is teetering on oversold territory so there could be some consolidation or even a move higher before further downside.

Sellers will looking for a move below 64.70 to open the door to 61.80 the August low.

Buyers will be looking for a move over 69.309 yesterday’s high ahead of the 200 sma at 69.80

Dow Jones falls 3% in 2 sessions, jobless claims Omicron headlines in focus

The Dow Jones, along with its peers on Wall Street closed lower in the previous session as the first case of Omicron was identified in the US.

Concerns over the rapid spread of the new COVID variant have unnerved investors as they wait for more information on the severity of the strain. COVID cases in South Africa doubled from Tuesday to Wednesday raising fears that Omicron is more contagious than Delta.

Today US futures are trying to move higher. US jobless claims and Challenger cuts will be in focus ahead of tomorrow’s non-farm payroll. Jobless claims are expected to rise to 240k, from last week's 199k, the lowest level of claims since 1969!

Learn more about the Dow Jones

Where next for the Dow Jones?

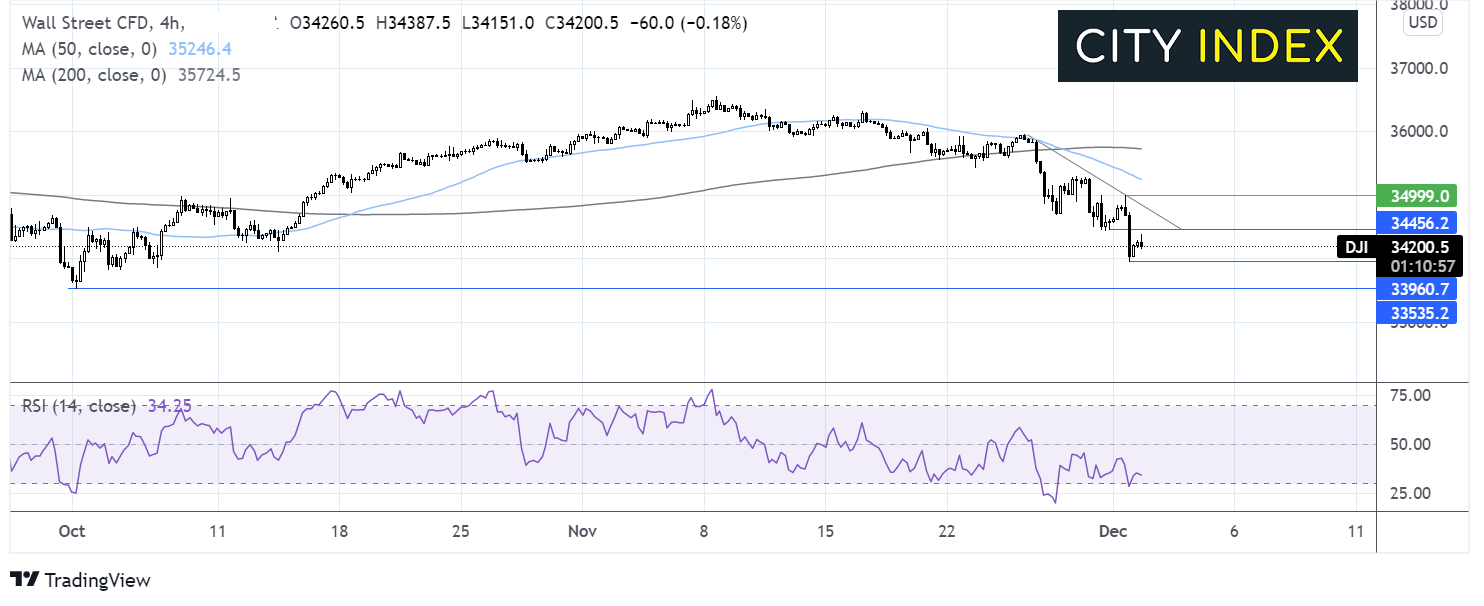

The Dow Jones has been declining since early November. The selloff gained traction from November 25. The index trades below its falling trendline from this date and below its 50 & 200 sma. The 50 sma crossed below the 50 sma in a bearish signal. The RSI suggests that there could be more downside whilst it remains out of oversold territory.

The Dow found a floor yesterday at 33950 and is attempting a rise. Buyers are looking for a rise over 34450, Tuesday’s low to negate the near-term downtrend and a move over 35000 yesterday’s high to expose the 50 sna at 35250.

Meanwhile sellers will be looking for a move below 33950 in order to pull 33510 the October low into play.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.