Gold looks to NFP

Gold continues to trade below 1750 as investors await the US NFP report. Expectations are for 270k jobs to have been added in June, down from 390k in May. The unemployment rate is expected to hold steady at 3.6% and wage growth is to hold steady at 5.2%

This report is not expected to be a game-changer. The focus is significantly more on inflation than jobs right now. It would take an absolutely horrendous report for the market to change its Federal Reserve rate hike expectations. Next week’s inflation data is expected to be much more important.

A strong NFP could justify the Fed’s aggressive stance, which would lift the USD and could drag on the precious metal. Meanwhile, a slightly weaker report is unlikely to have a big impact.

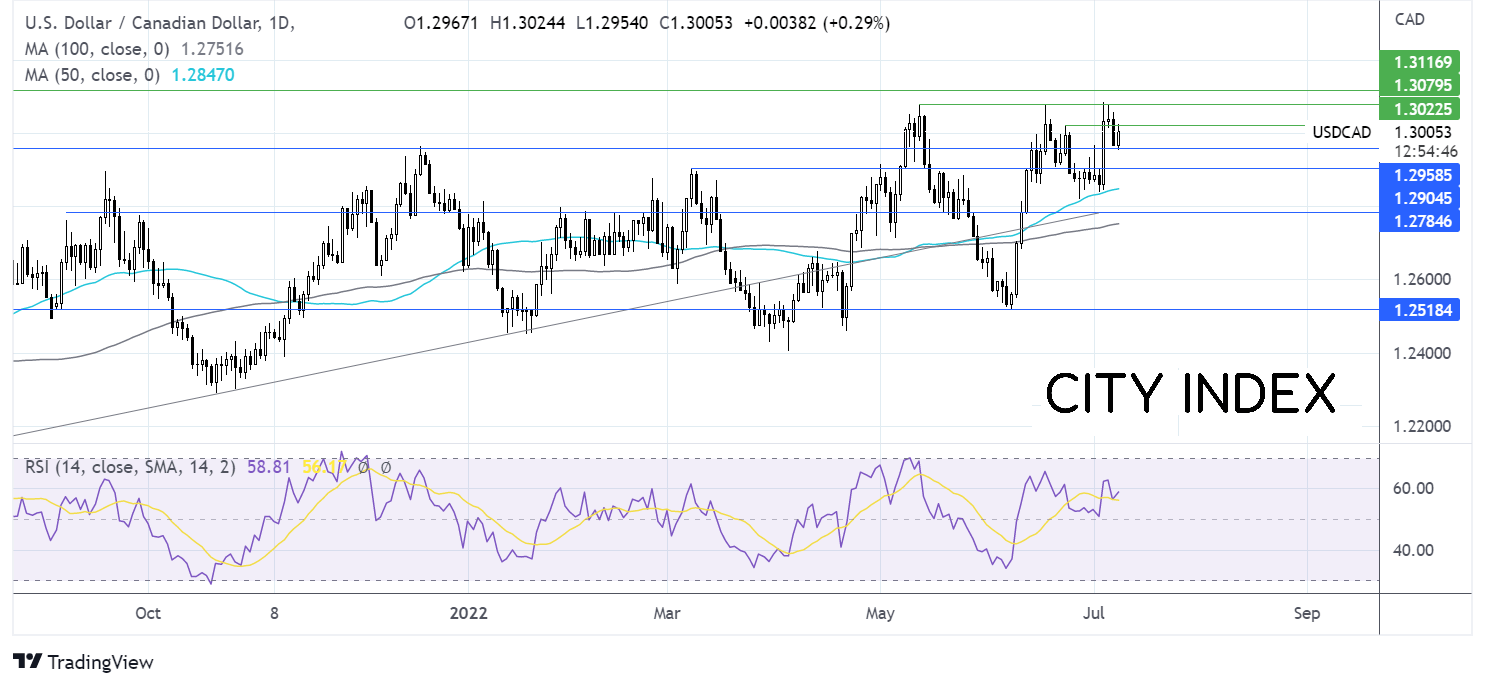

Where next for Gold?

The rebound in gold remains capped at 1750, with a daily close over this level needed to extend gains towards 1772, Tuesday’s high and a level that has shown significance at the end of last year.

However, the bearish MACD keeps sellers hopeful of further downside. Failure to retake 1750 could see a gold drop to 1731, the 2022 low, before bringing 1722, the October low, into play.

USDCAD rises with US & Canadian jobs in focus

USDCAD is rising after choppy trade across the week; the pair is set to end the week 1% higher.

The pair fell yesterday to a low of 1.2950 as the loonie tracked oil prices higher, and the USD was unimpressed by unsurprisingly hawkish FOMC minutes.

Today the pair is rising as the loonie tracks oil prices lower as recession fears once again weigh on demand for Canada’s main export. Meanwhile, the USD is surging higher ahead of today’s NFP report, which is expected to be a win-win for the USD.

Canadian jobs data will also be in focus, with the unemployment rate expected to hold steady at 5.1%.

Any strong divergence in the two reports could drive the currency pair.

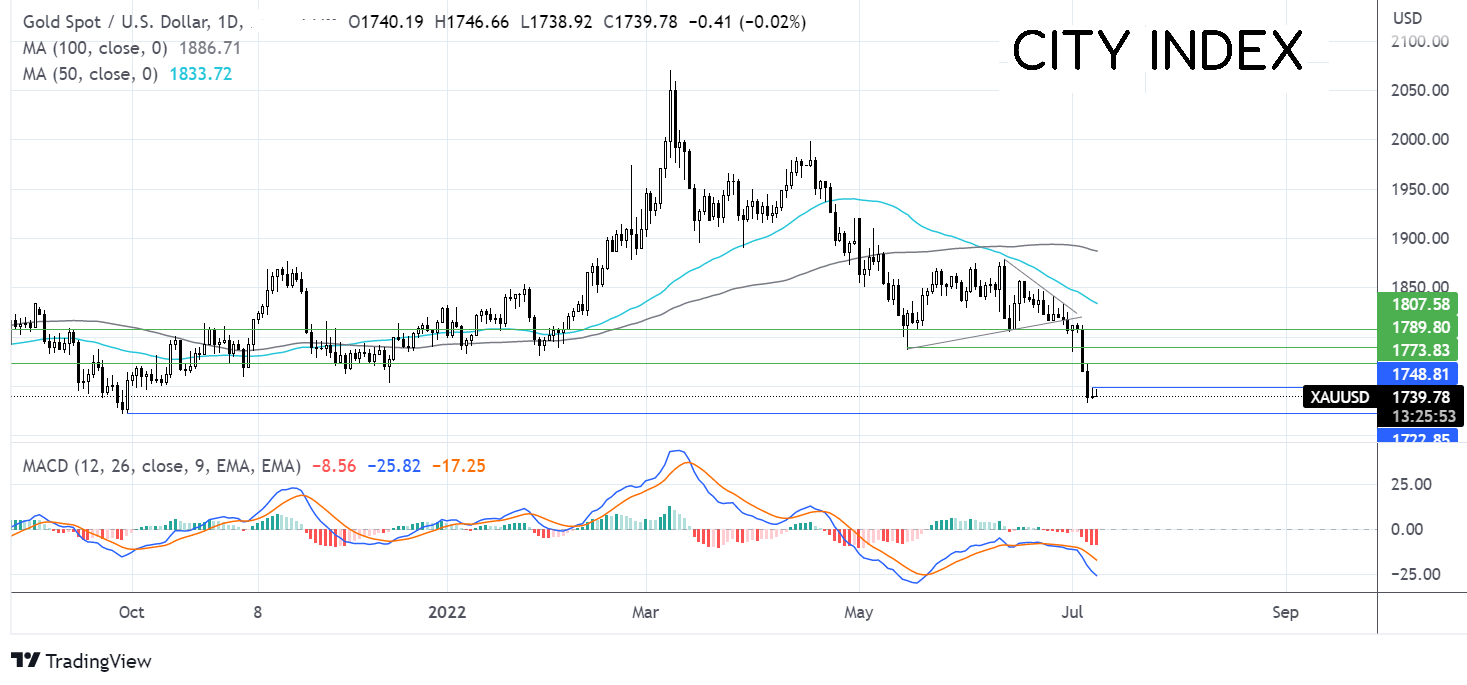

Where next for USDCAD?

After finding support at 1.2950, USDCAD has pushed higher, still trading above its rising 50& 100 sma, and the bullish RSI supports further upside.

Buyers will look to break above 1.3015, the June 245 high, on the way to 1.3083, the 2022 high. A break above here is needed to continue the bullish trend towards 1.31.

Support can be found at 1.2950, yesterday’s low, ahead of 1.2910, the March high. A break below the 50 sma and horizontal support at 1.2850 could create a lower low.