Gold rises with Fed speakers & US data in focus

After falling 1% yesterday, gold is on the rise today as treasury yields soared. The 2-year treasury yield jumped to 4.351%, its highest level in 15 years, while the 10-year rose to 3.83%

Fears over central banks aggressively raising interest rates have hurt demand for non-yielding Gold, which is set to decline 4% across September, its sixth straight month of declines. Yesterday the BoE warned that it would step in to hike rates further if needed, and ECB’s Lagarde also sang from the hawkish hymn sheet.

Today the precious metal is finding support from the pause in the US dollar rally. Attention will turn to another speech from ECB’s Lagarde and several Fed officials.

US durable goods are expected to decline. US consumer confidence is expected to rise to 14.3, up from 103.5. Improving consumer confidence could raise concerns about more Fed hikes and pull Gold lower.

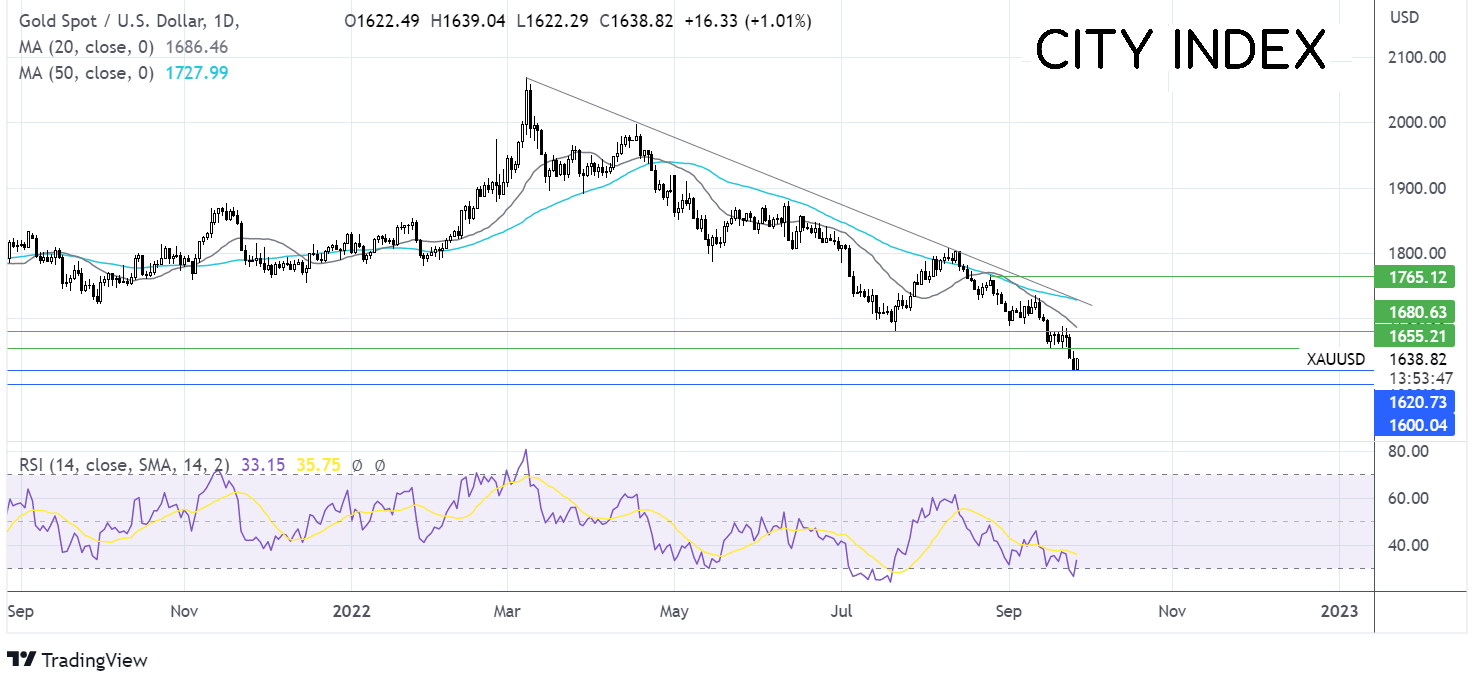

Where next for the Gold price?

Gold trades below its multi-month falling trendline, its 20 & 50 sma. The price fell below support at 1655, dropping to a 2022 low of 1621. The price has ticked higher to current levels of 1637, bringing the RSI out of oversold territory.

Sellers will look for a move below 1621 to extend the bearish move towards 1600.

Buyers will look for a move back above 1655, ahead of 1680, the July 21 low, a rise above here could negate the near-term downtrend.

GBP/USD bounces from record lows

The pound is on the rise, snapping a 6-day losing streak, thanks partly to the weaker USD.

The pound plunged to a record low in the previous session as investors continued digesting the Chancellor’s tax cuts, the largest in 50 years, and fretted at the prospect of borrowing to fund them.

Gilts and the pound got hammered. Today the pound is rising as investors take in comments from BoE Governor Andrew Bailey, who said that the central bank would step in if necessary. Kwarteng also said he would bring a plan to reduce debt in November.

These comments appear to be helping the pound for now. The markets are giving the sterling the benefit of the doubt, but GBP remains vulnerable.

Meanwhile, the USD rally pauses for breath after rising to a 20-year high on hawkish Fed bets.

Looking ahead, there is no high impacting UK data. US durable goods are expected to fall, and US consumer confidence is expected to rise, which could lift the USD.

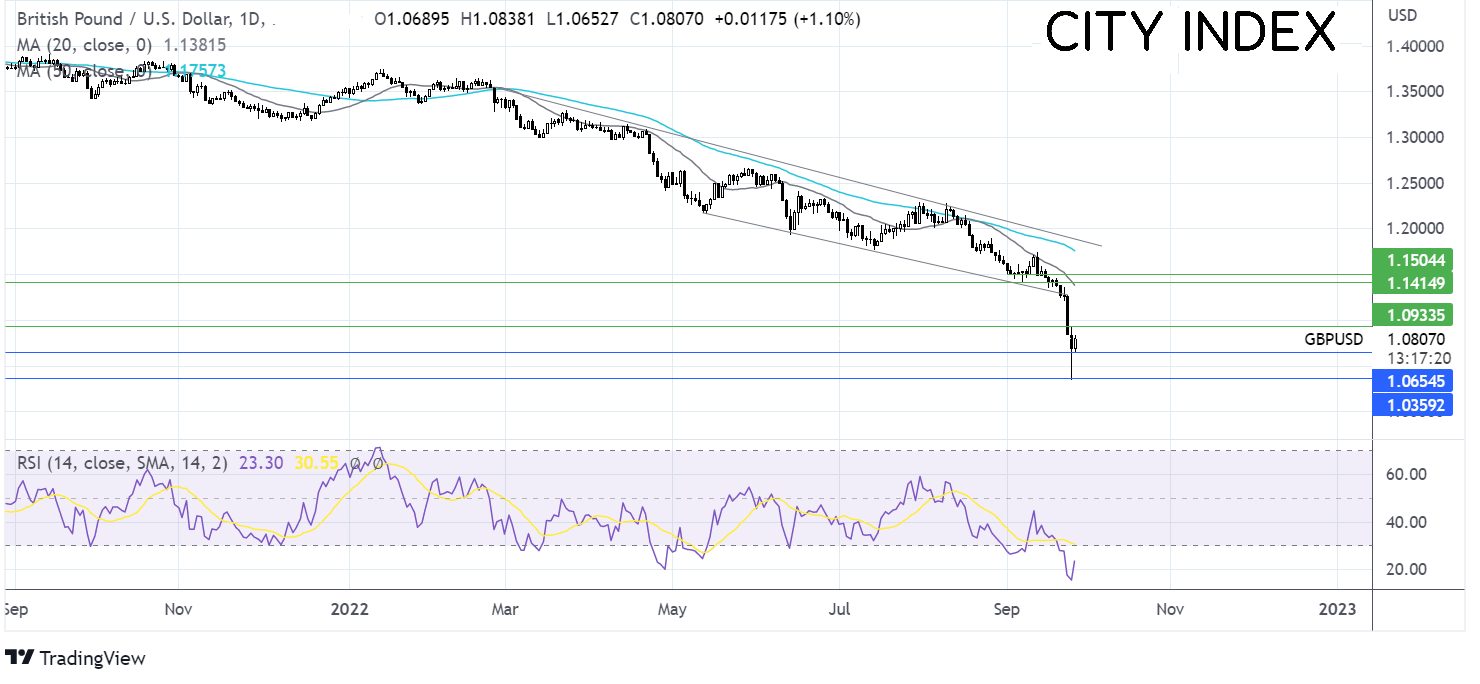

Where next for GBP/USD?

GBP/USD has bounced from the record low of 1.0350. However, the RSI remains firmly in oversold territory, so there could be some more corrective gains to be had. The long lower wick on yesterday’s candle suggests there wasn’t much appetite to sell further at the lower levels.

Buyers will look for a move over 1.0930, yesterday’s high, to bring the 1.10 the psychological level into focus.

Meanwhile, sellers will look for a move below 1.0690, the daily low, to bring 1.0350 back into focus.