Gold looks to jobless claims & Fed speakers

Gold fell 1.4% yesterday as treasury yields, and the USD rose. Fed speakers continued to sing from the hawkish song sheet.

Federal Reserve President Neel Kashkari, a habitual dove, hammered home the hawkish message saying that the Fed couldn’t consider pausing rate hikes while core inflation continued to rise.

Today yields continue to rise, exerting pressure on gold. However, the USD is easing lower, which is supporting the precious metal.

Looking ahead, US jobless claims are expected to tick modestly higher to 230k, up from 228k in the previous week.

Federal Reserve speakers will also be in focus, with the Fed’s Jefferson, Bowman, and Cook due to hit the airwaves. More hawkish rhetoric could pull Gold back towards 1600.

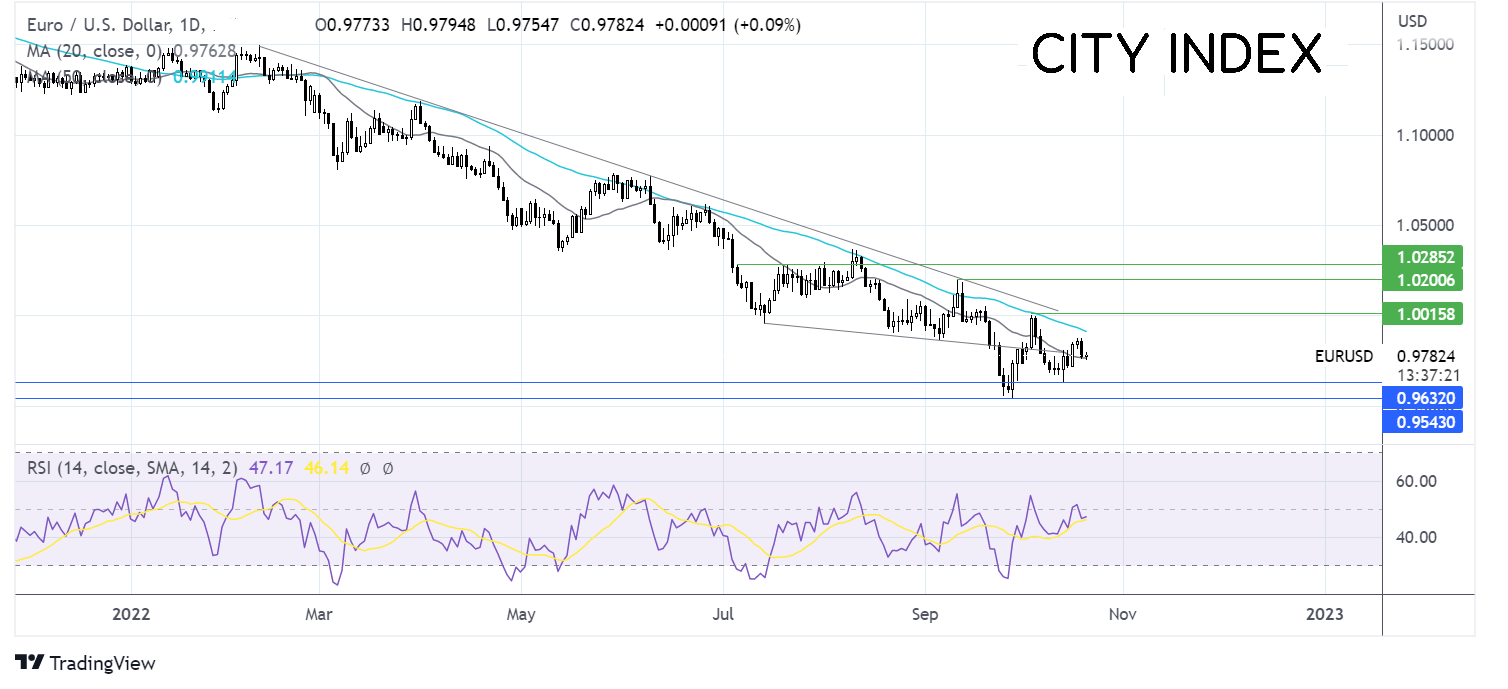

Where next for Gold price?

Gold has rebounded lower from the 50 sma at 1727 at the start of October, falling below the 20 sma. This, combined with the RSI below 50 keeps sellers hopeful of further downside.

Sellers will look to break below 1614 the 2022 low to create a lower low and bring 1600 into target.

On the flip side, buyers could look for a move over 1654, the mid-September low. A rise above 1667, the 20 sma to open the door to 1680, the July low.

EUR/USD edges higher after German PPI

EUR/USD is rising, recouping losses from the previous session as USD bulls pause for breath.

Headline eurozone inflation rose to 9.9% YoY in September. This was below the 10% initially forecast but is sufficiently high to keep pressure on the ECB to raise interest rates by 75 basis points at next week’s meeting.

German PPI remained stubbornly high at 45.8% YoY in September, in line with August but above forecasts of 44.7%. PPI is considered a lead indicator for consumer prices, suggesting that consumer prices will continue to rise.

Meanwhile, the USD is broadly supported by the hawkish Federal Reserve, and safe haven flows as global recession fears rise.

Looking ahead, US jobless claims and several Fed speakers could lift the USD.

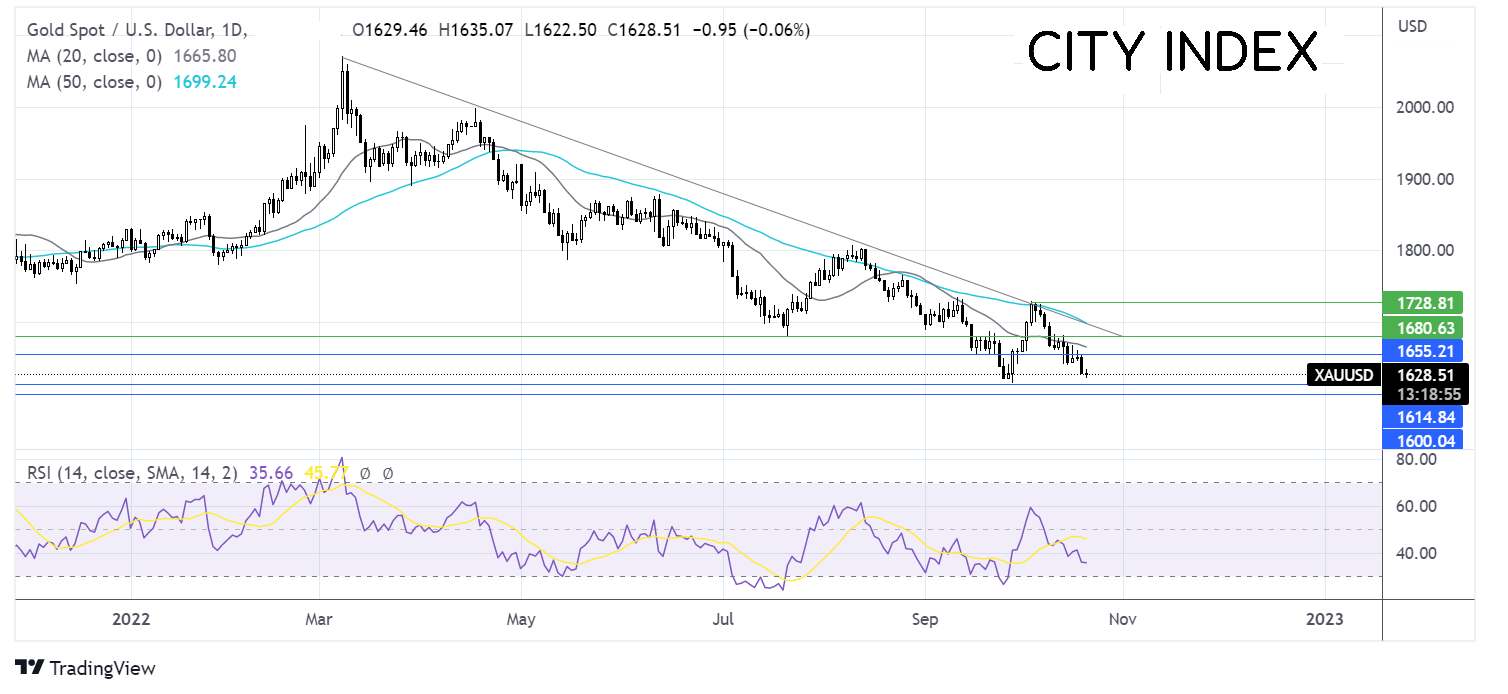

Where next for EUR/USD?

EUR/USD has formed a series of lower lows and lower since February. The pair ran into resistance this week at 0.9865 and is edging lower. The RSI is just below 50, which suggests that momentum supports the downside.

Sellers are looking for a break below support at 0.9750 the 20 sma and the multi-week falling trendline. A break below here opens the door to 0.9650, the October 13 low, and 0.9535, the 2022 low.

Buyers will rise above 0.9870 the weekly high, exposing the 50 sma at 0.9920 and 1.00 the October high.