Gold looks to FOMC minutes

Gold prices briefly pierced 1800 on Tuesday, benefitting from falling US treasury yields, which slipped to 1.35%.

The precious metal struggled to maintain the key psychological level of 1800 despite US Dollar strength and settled on Tuesday below this level.

Gold looks to FOMC minutes for further clues. The minutes relate to the mid-June meeting when the Fed adopted a hawkish shift seeing two rate rises in 2023. Fed Powell also advised that the Fed had started to talk about talking about tapering. Non-yielding gold dropped steeply after the meeting losing 6% that week.

Today’s minutes could draw attention again to the Fed’s hawkish shift pressurizing gold. That said, the minutes are now almost 3 weeks old making them dated.

Following the tick higher in unemployment and the weaker than forecast ISM services data, market fears of the Fed acting sooner are easing.

Where next for Gold prices?

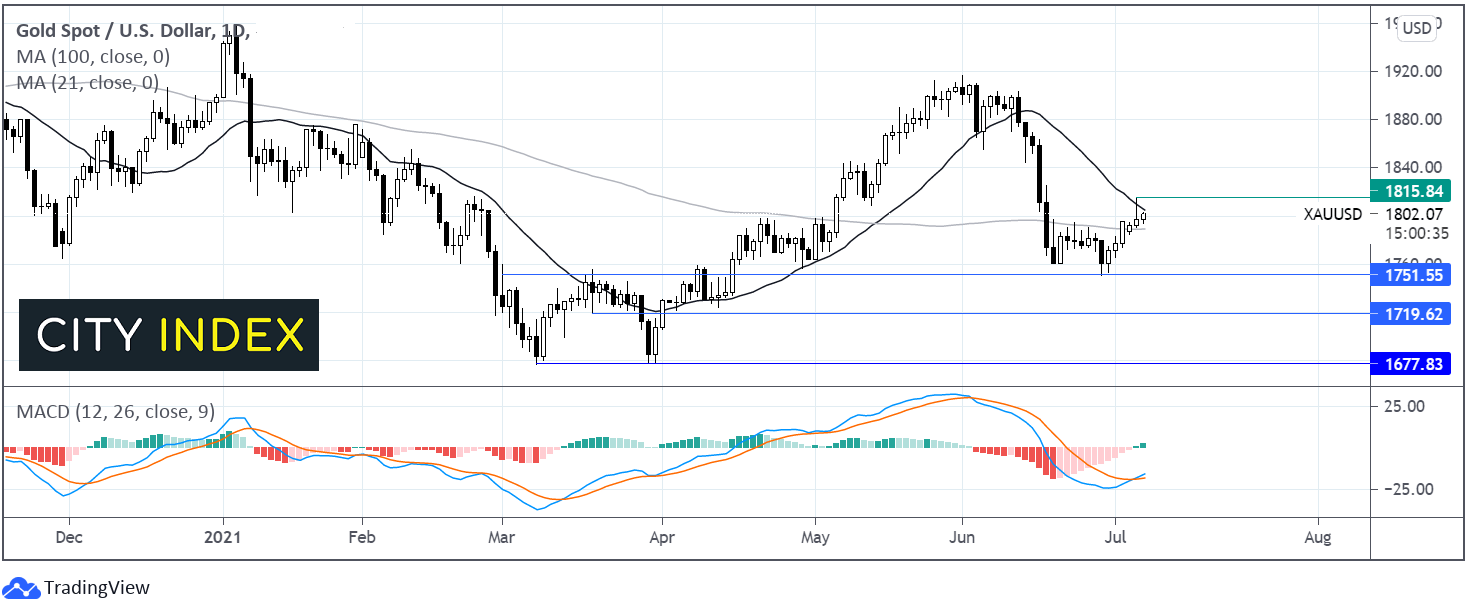

After falling steeply across June, Gold found a floor at 1751. It rebounded off this level hitting a 3 week high of 1815 yesterday before closing below 1800.

The price is attempting to retake 1800 the key psychological level in early trade. A close over this level is needed to confirm the reversal.

The MACD has formed a bullish crossover suggesting more upside could be on the cards.

Beyond 1800, buyers will look to retake the 21 day ma at 1805 ahead of 1815 yesterday’s high and the 50 sma at 1830.

On the flip side the 100 day ma offers support at 1789. A break below this level could open the door to 1751 the recent 10 week low. A move below this level could see the sellers gain momentum.

Eurostoxx 50 rebounds with EC growth forecasts in focus

European indices are rebounding on Wednesday, despite weakness on Wall Street overnight following softer than expected USM services data.

The mood remains upbeat despite weak data from Germany. German industrial production unexpectedly fell -0.3% MoM in May, after falling -1% in April. Expectations had been for 0.5% increase.

News that the UK could drop quarantine rules for double jabbed Brits returning from amber list countries is boosting sentiment.

The European commission is due to release economic growth forecasts.

Where next for Eurostoxx 50?

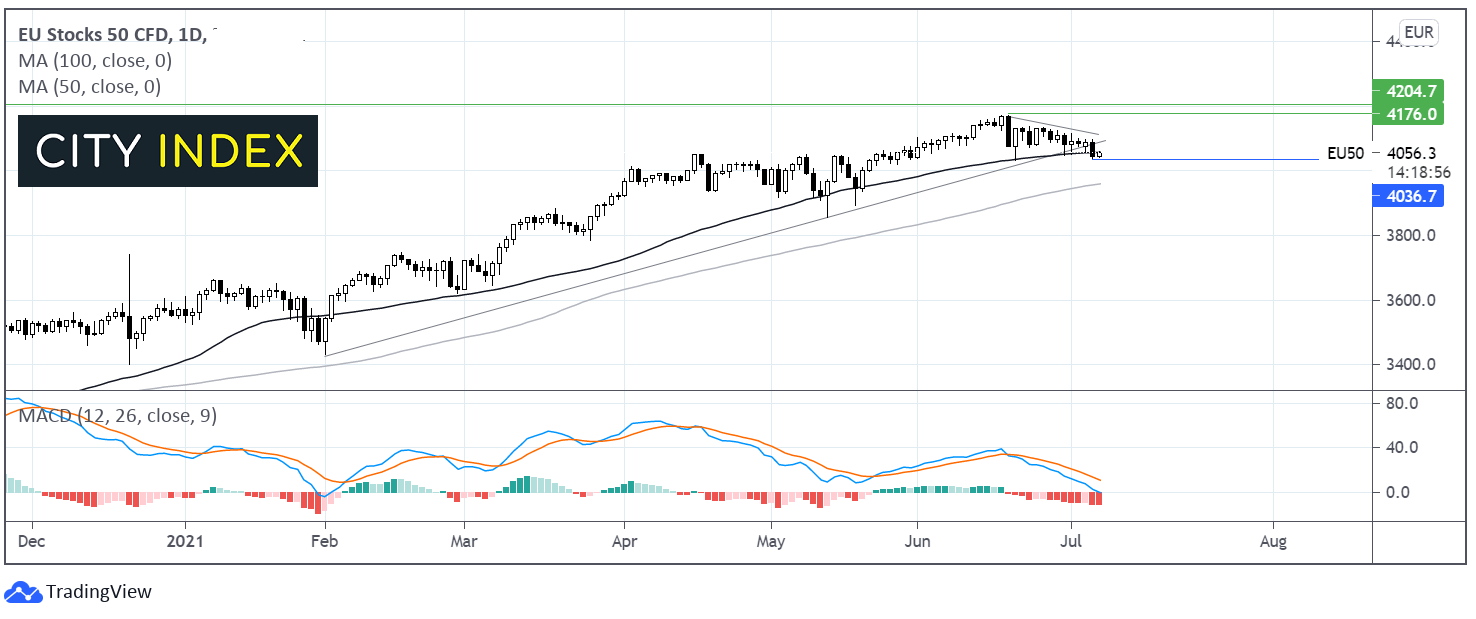

Eurostoxxs 50 has been trending firmly higher across the year, hitting an all time high of 4171 mid June before easing lower.

The index formed a symmetrical triangle before breaking out to the downside yesterday hitting a low of 4037.

The MACD favours further downside. However, buyers are trying to reverse their fortunes finding support at the 50 sma at 4050.

Any meaningful recovery would need to break above the ascending trend line dating back to early February at 4080 ahead of the 4130 the descending trendline support from mid-June. Above this level the buyers could gain traction towards 4171 and a fresh all time high.

Should the 50 sma fail to hold, sellers could look to make a fresh assault on 4037 yesterday’s low. A break below here and 4000 the key psychological level could see the 100 sma at 3950 come into play.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.