GBP/USD edges lower services PMI & US ADP data in focus

GBP/USD is edging lower in early trade amid a rise in covid cases due to the Indian variant unnerves investors. Questions over whether the UK will continue to along its set re-opening path remain.

The PM could announce an update to the UK’s green list for traveling.

Market’s final UK services PMI is due to show 61.8 in May, up from 61 in April.

US Dollar is rising after Fed Harker calls for tapering asset purchases

ADP private sector jobs reports and US ISM Services PMI are due.

Where next for GBP/USD?

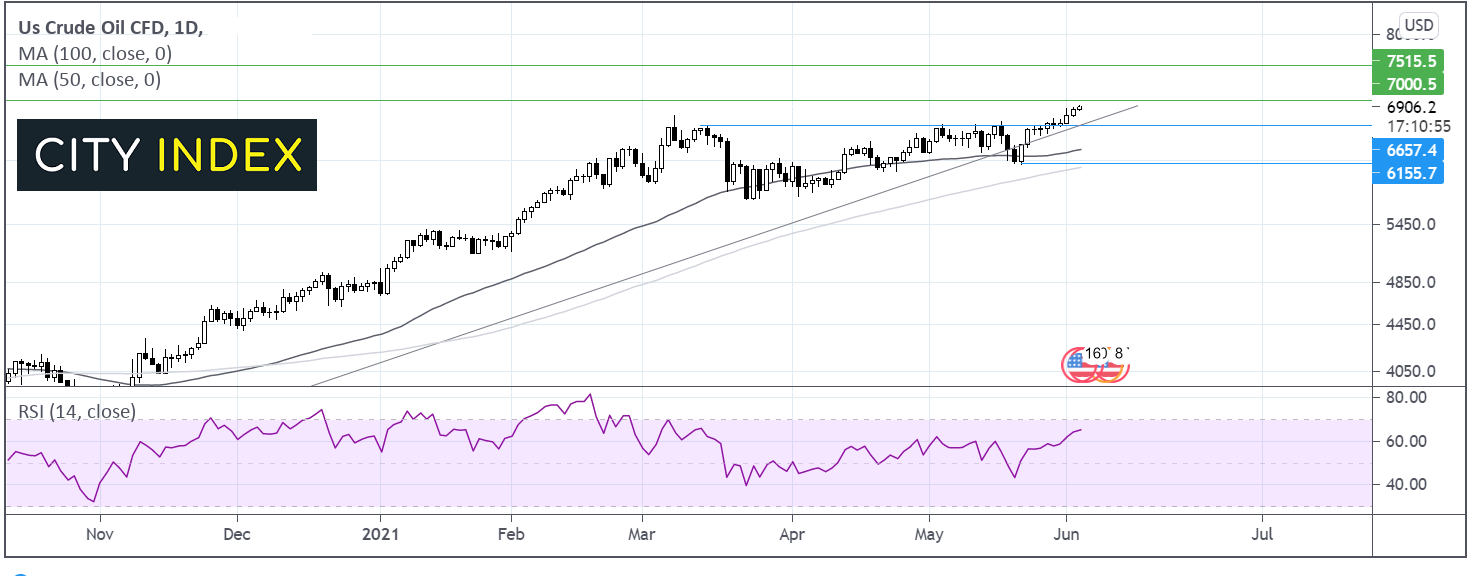

GBP/USD continues to trade within a familiar range. It has slipped below its 50 sma on the 4 hour chart, however, just remains above its 100 sma. The RSI suggests that more downside could be on the cards as it points lower within bearish territory.

Immediate support can be seen at 1.4150 the 100 sma and the daily low. A break below here could see support at 1.41 tested, yesterday’s low. 1.4090 offers critical support – a double bottom with a break through here opening the door to 1.4050.

On the upside, the 50 sma offers some resistance at 1.4165, whilst a break above 1.4220 could see buyers gain traction.

Learn more about trading forex

WTI oil hits fresh yearly high post OPEC, EIA data due

Oil prices rallied to a fresh yearly high on Wednesday after the OPEC+ announcement.

OPEC+ agreed to stick to plans to gradually ease back on production cuts by boosting output in July in line with April’s decision.

The group’s cautious approach combined with expectations of faster growing demand boosted the oil price to

The move comes thanks to a solid demand recovery in US and China with the rapid pace of vaccine rollouts also helping to re-balance the oil market.

After an initial knee-jerk reaction, Iran nuclear talks have turned into a slow burner

EIA inventory data is due later today and is expected to show a decline in stock piles.

Where next for WTI crude oil?

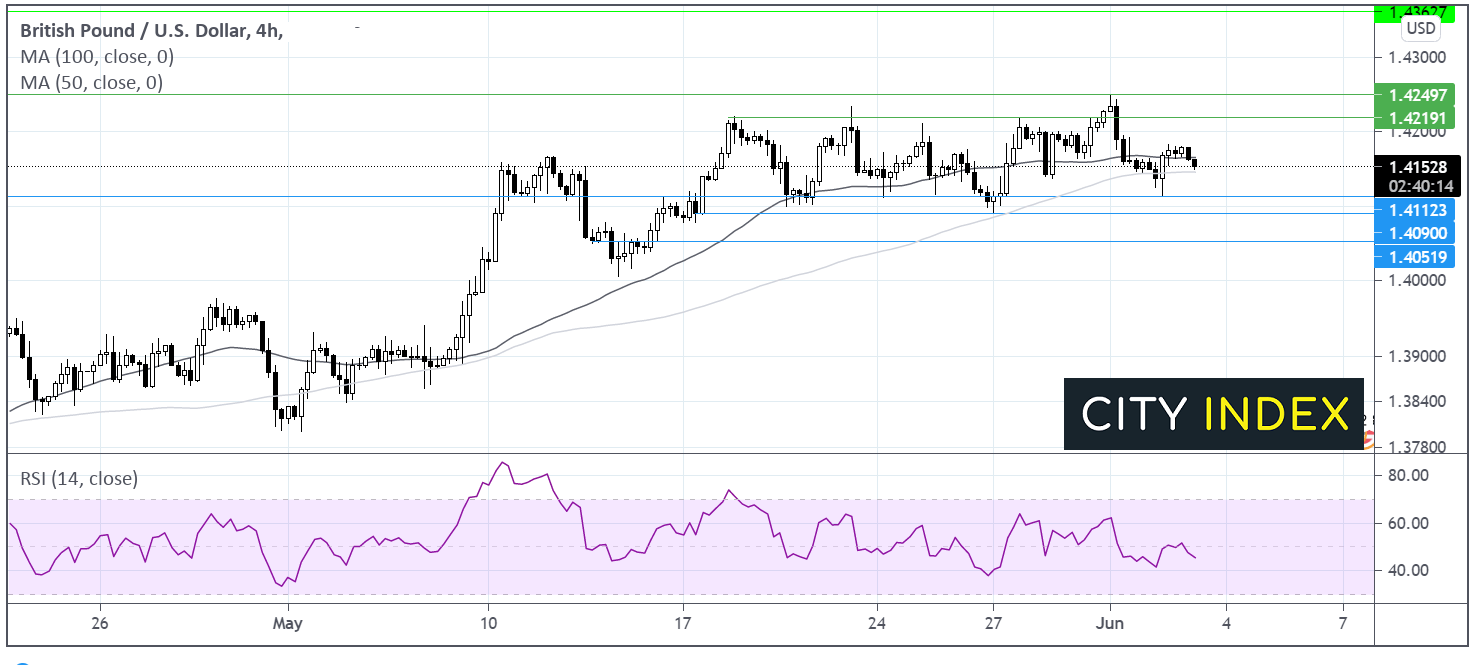

WTI trades above its ascending trendline dating back to November. It trades above its 50 & 100 sma on the daily chart in an established bullish trend. The RSI is supportive of further gains whilst it remains out of overbought conditions.

Immediate resistance is at $70 the psychological level, before $75.00 draws into a focus a level last seen in 2018.

It would take a move below $66.80 to negate the near term uptrend. Support can be seen at the 50 sma at $63.30 and $61.50 May’s low.