GBP/USD rises ahead of manufacturing PMI data

GBP/USD has rallied 130 pipis overnight and trades close to 1.3750.

An improved market mood amid easing EU-UK vaccine tensions as the EU refrains from adding the UK to the vaccine export restrictions list

UK reaches 600,000 vaccine a day and easing virus numbers in Britain have added to the upbeat mood

US President Biden’s push for US stimulus is also lifting sentiment pulling on USD.

Final UK manufacturing PMI & US ISM manufacturing PMIs in focus

Where next for GBP/USD?

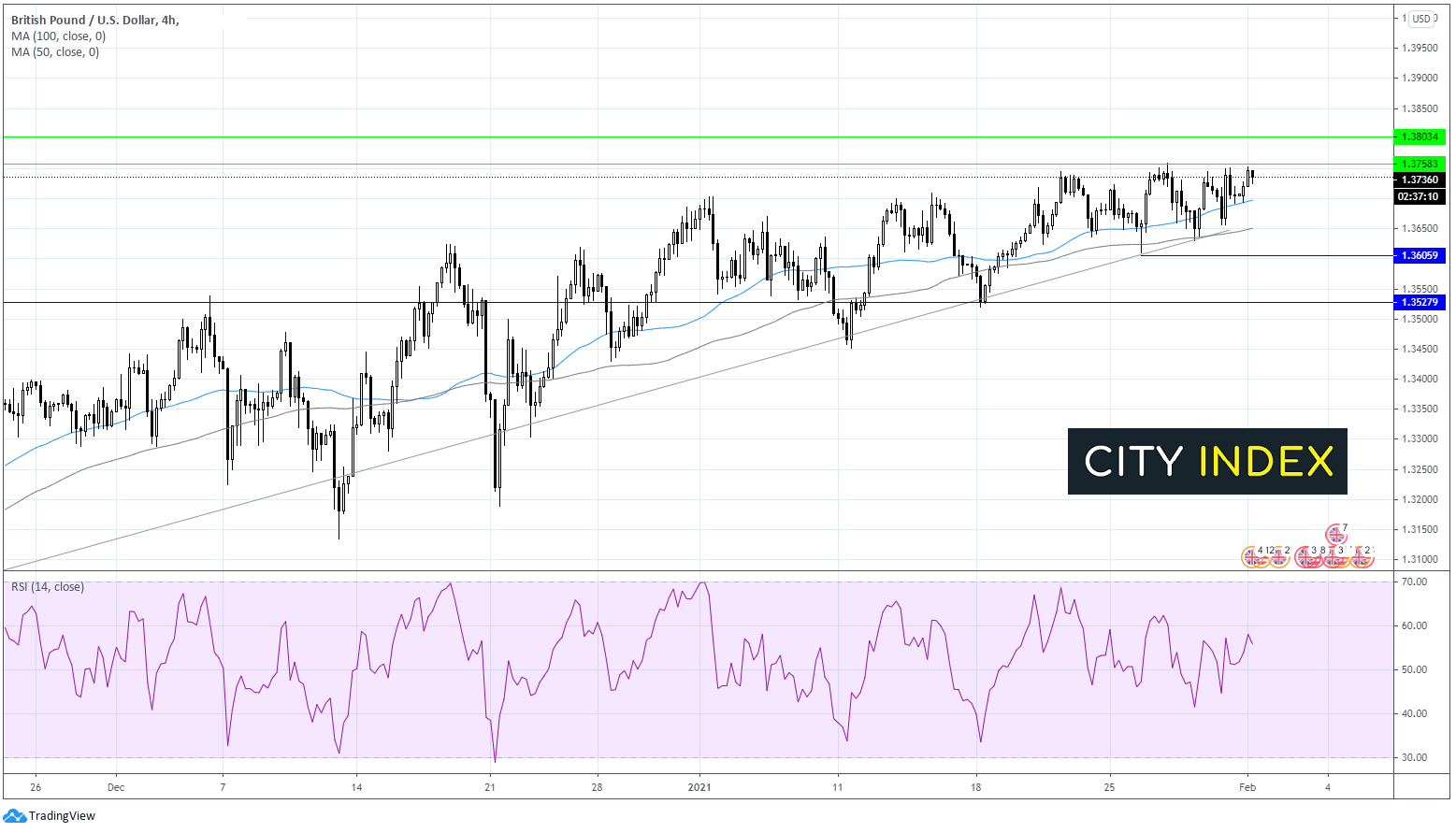

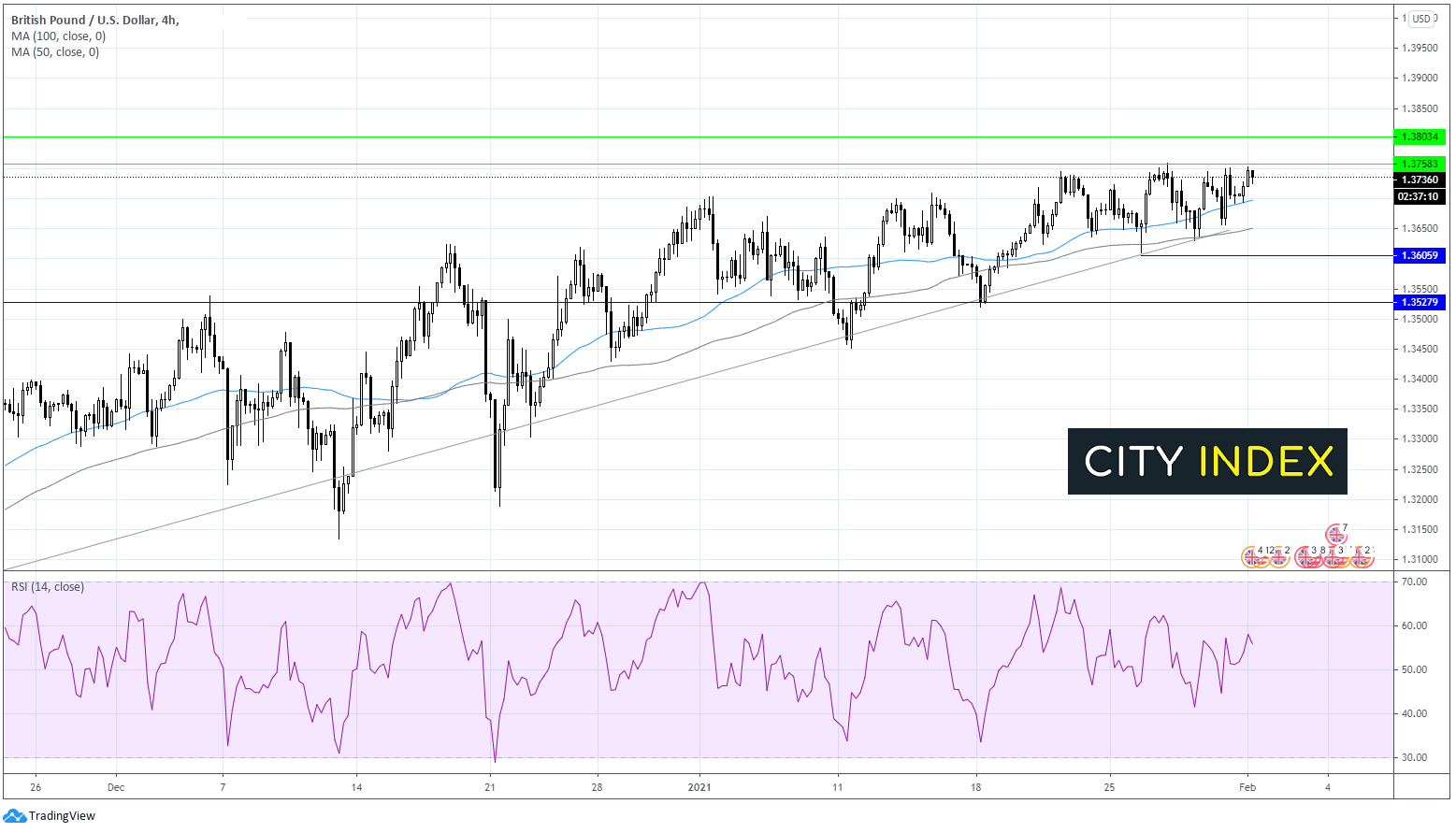

GBP/USD trades above its 50 & 100 sma and is supported by an ascending trendline presenting a bullish bias on the 4 hour chart.

However, momentum has slowed as 1.3750 continues to act as an immediate hurdle. A move beyond this strong resistance level could bring 1.38 into target.

Immediate support can be seen at 1.37 round number and 50 sma, prior to 1.3650 the confluence of the 100 sma and the ascending trend line. This level is key for the sellers and a deep move southwards to 1.3650.

Learn more about trading forex

Silver spikes 8% higher but risks remain high

Silver is roaring higher on the open amid surging demand from social media users.

Plans to short squeeze silver to never before seen levels are circulating on Reddit in a similar way that they did for GameStop and AMC Entertainment among others last week.

Can silver continue higher without any logic? If last week’s short squeeze stocks are anything to go by then the answer for now appears to be yes. However, beware these can come crashing lower as fast as they go up.

Learn more about what a short squeeze is here

Silver technical analysis

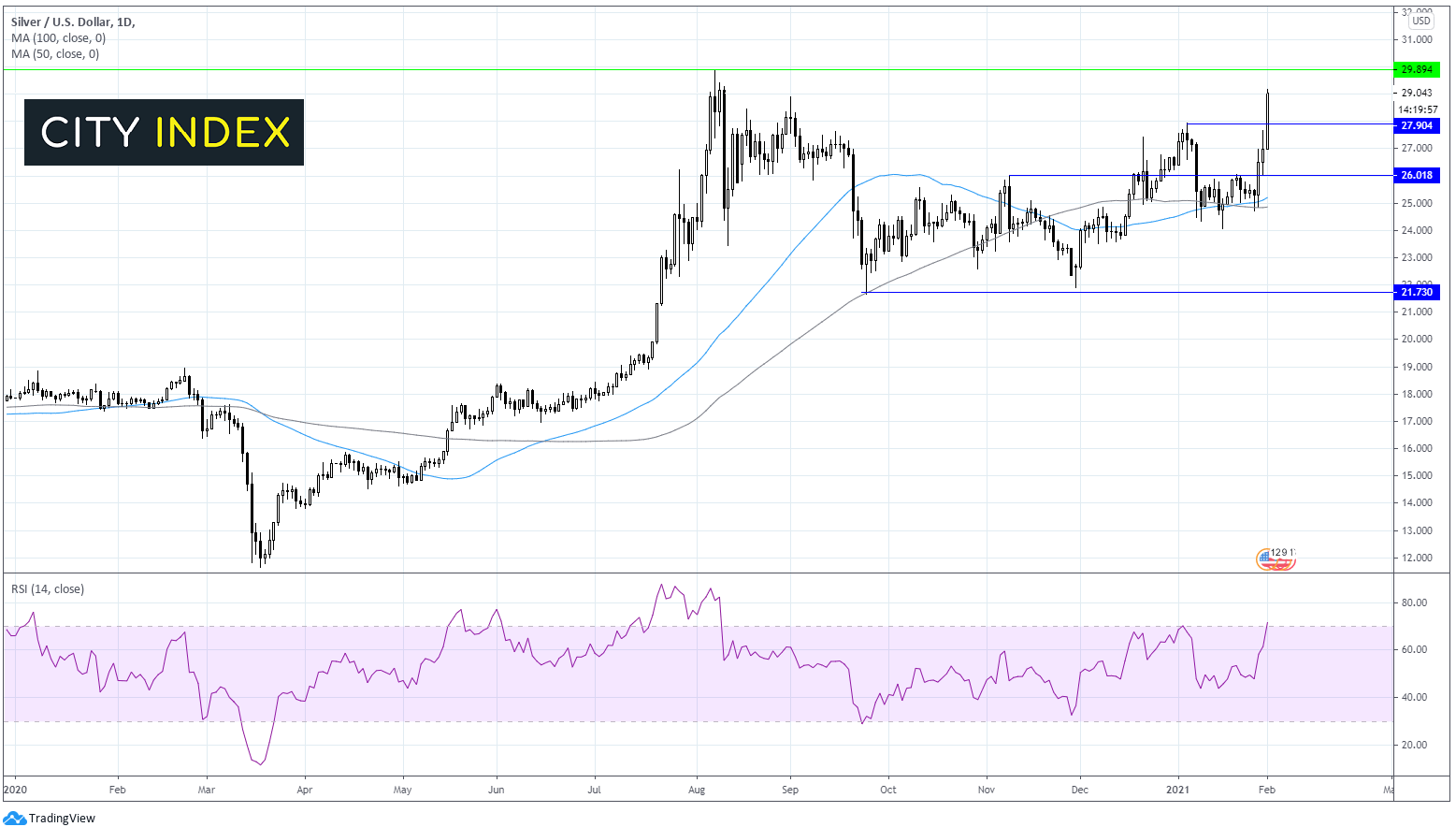

The price of silver has been in consolidation mode since late September. Resistance was previously seen at $27.90. However, today’s jump has seen that resistance taken out.

Silver trades above its 50 & 100 sma on the daily chart and the 50 sma has formed a golden cross pattern above the 100 sma in a bullish signal.

Although it is worth noting that the RSI is in overbought territory above the key 70 level so caution should be applied before placing any aggressive bullish bets. Although these are unprecedented time.

A drop below resistance turned support at $27.90 could invalidate attempts on $29.85 and open the door to support at $26.00.