- Markets are setting out on the front foot after strong gains on Wall Street and a push higher in Asia overnight.

- A new US stimulus bill and a Brexit deal are boosting sentiment as markets head towards the new year.

- Concerns over rapid growth in covid cases could keep the lid on optimism in Europe.

GBP/USD rebounds after steep losses

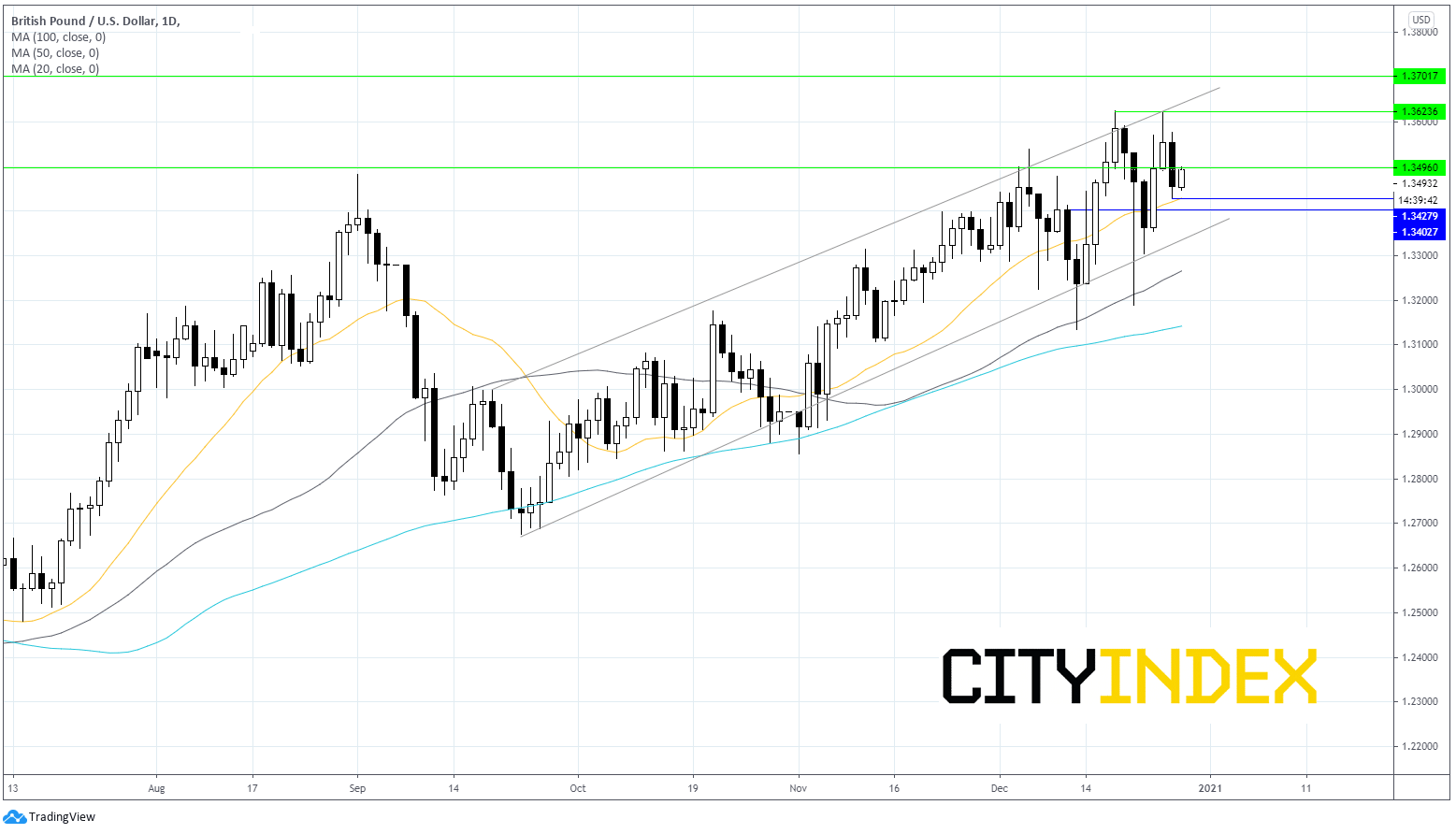

On the flip side, immediate support can be seen at 1.3430 (20 SMA &daily low) ahead of 1.34 round number and 1.3350 lower band of the ascending channel. A break below 1.3260 (50 sma) would be seen as a key move by the bears.

Learn more about trading forex

US stimulus agreement boosts WTI demand outlook

Oil is on the rise on expectations of rising oil demand as the US could expand covid relief payments and as Brexit finally offers some stability.

Whilst markets are trading range-bound owing to thin holiday volume, the prospect of larger stimulus aid is lifting sentiment and future demand expectations.

Near term concerns over the covid variant and tighter lockdown restrictions in the US and Europe could limit gains.

US crude inventory data is due later today. Crude stocks are expected to have fallen by 2.1 million barrels.

An OPEC+ meeting on 4th January also hangs over the market.

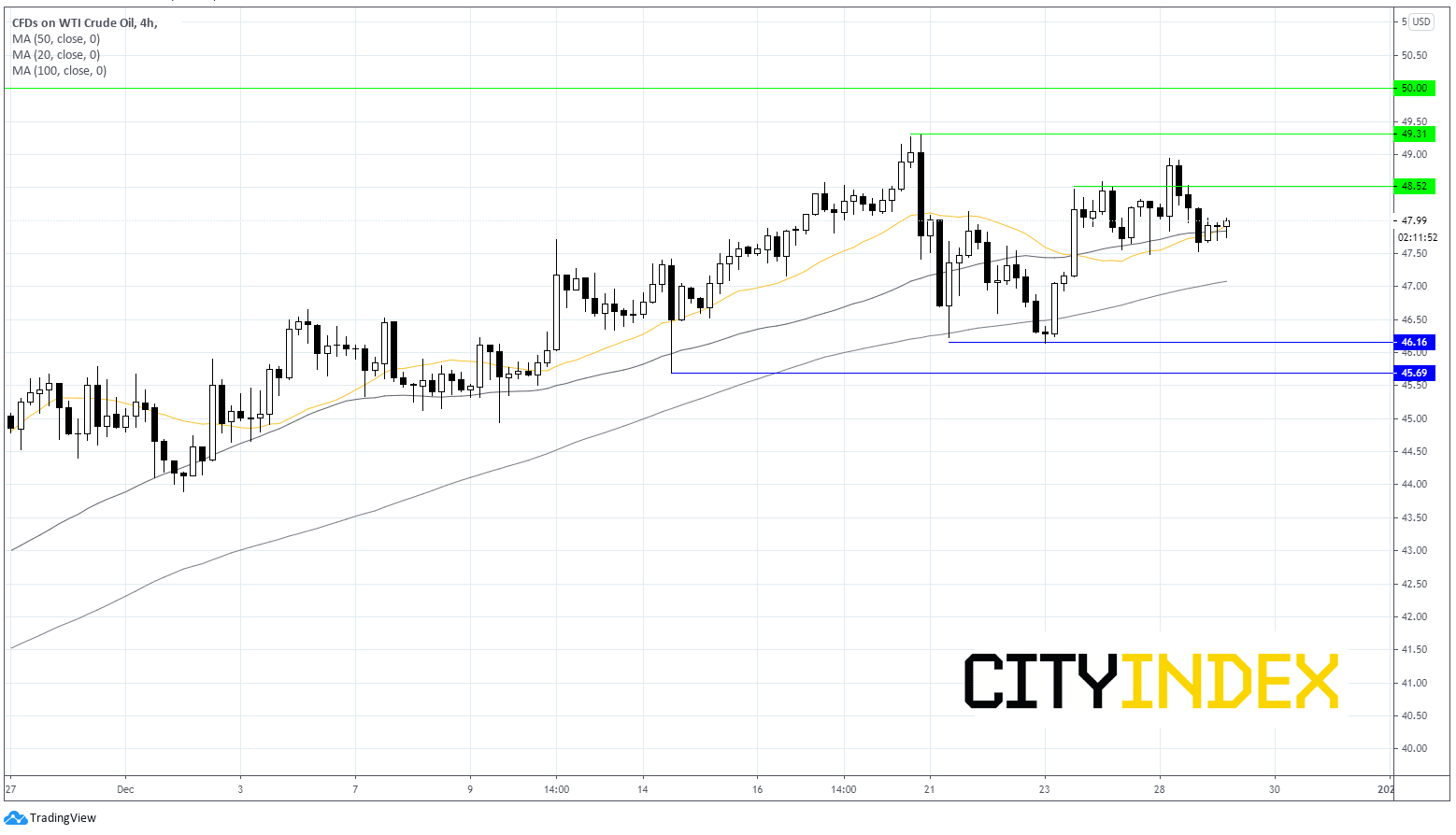

WTI shows mild gains and is hovering near session highs of $48 as it keeps the 20 and 50 sma on 4 hour chart as immediate support. Should this support hold a move towards $48.50 and $49 the monthly high could be on the cards, ahead of $50 round number and psychological level.

A break below the 20& 50 sma could open the door to $47, the 100 sma and $46.15 last week’s low, negating the bullish trend.

Learn more about trading commodities.