GBP/USD rises as BoE to kick off QT

GBP/USD is pushing higher, boosted by risk on trade and as investors look ahead to a rate decision by the Fed and the BoE this week, both of which are expected to hike rates by 75 basis points.

GBP/USD is now extending its rally into a third straight week, helped higher by Rishi Sunak’s appointment as Prime Minister and rising expectations that the Fed could adopt a less hawkish approach to rate hikes after tomorrow’s meeting.

The pound is extending gains even as the economic reality of the UK’s dire position becomes more apparent. Sunak’s government is set to cut spending and raise taxes to the tune of £50 billion to fill an eye-watering hole in public finance and re-establish economic credibility.

Meanwhile, the BoE is set to become the first major central bank to sell off bonds accumulated during its 13-year stimulus programme. This is very quick turnaround that we are seeing from the BoE as it goes from buying gilts just a few weeks ago to selling them today. The hope is that QT will help tighten conditions leaving the focus firmly on rate hikes. However, this is unchartered territory, so there is clearly risk associated with that.

Looking ahead, UK manufacturing PMI is due to be released and confirm contraction in October at 45.7, as output shrank with foreign demand.

Meanwhile, US ISM manufacturing and JOLTS job openings will also be in focus. US ISM manufacturing is expected to show that activity slowed to 50 in October, down from 50.9. Meanwhile, Jolts job openings are expected to remain over 10 million.

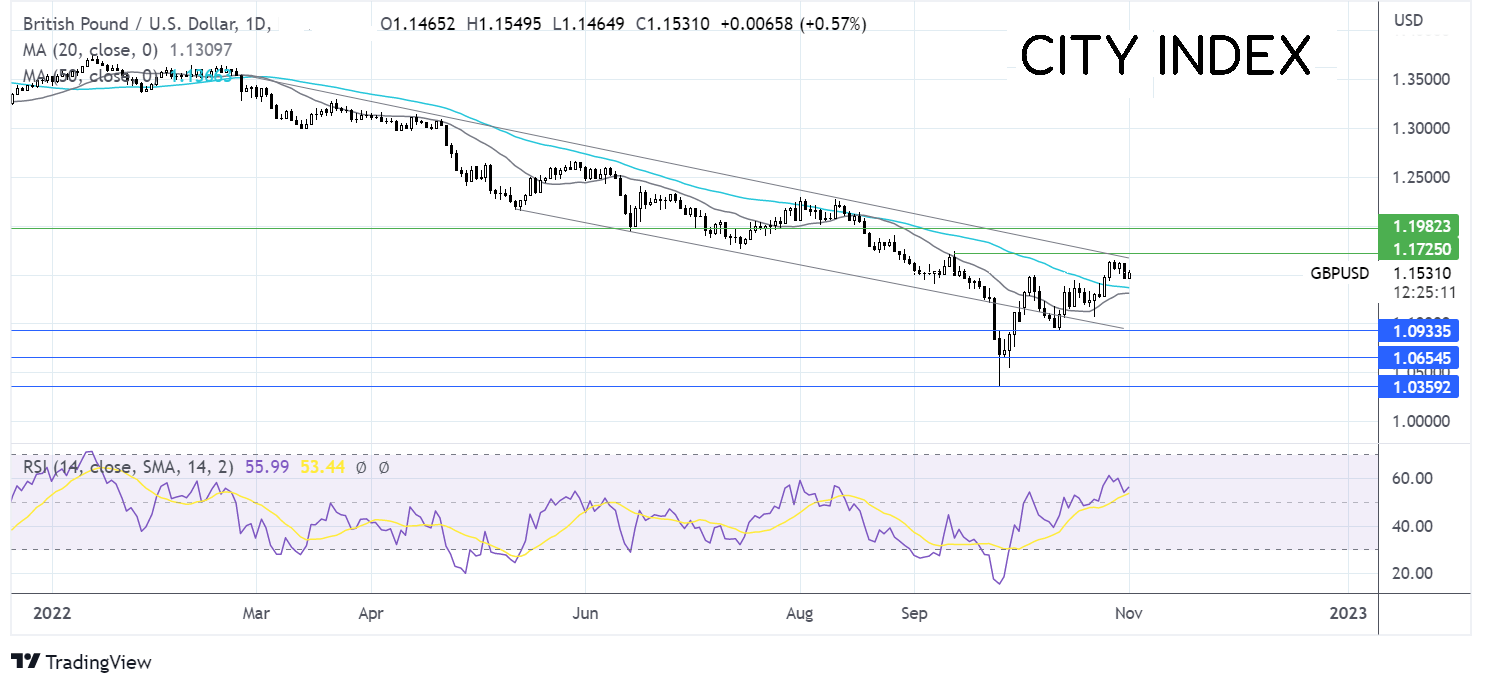

Where next for GBP/USD?

GBP/USD trades within a multi-month descending channel. The price has recovered from the October low of 1.0930 and recaptured the 20 & 50 sma. This, along with a bullish RSI are keeping buyers hopeful of further upside.

Buyers could look for a move over 1.1720 to extend the bullish run-up and break out of the falling channel. This could then bring 1.20 the psychological level into focus.

On the flip side, sellers could look for a move below the 50 sma at 1.1380 and the 20 sma at 1.13, to bring 1.10 the psychological level and 1.0930 back into focus.

FTSE outperforms on China COVID rumors

The FTSE has jumped higher on the open, boosted by commodity stocks on reports that China is looking to put together a committee to consider how to exit the zero-COVID strategy.

COVID lockdowns have continued to drag on the Chinese economy, the evidence of which was seen in the weaker-than-forecast PMI data at the start of the week. Therefore, any possibility of these restrictions coming to an end is good news for growth in China and commodity demand.

Miners are dominating the upper reaches of the FTSE, with the likes of Anglo-American and Glencore trading almost 4% higher.

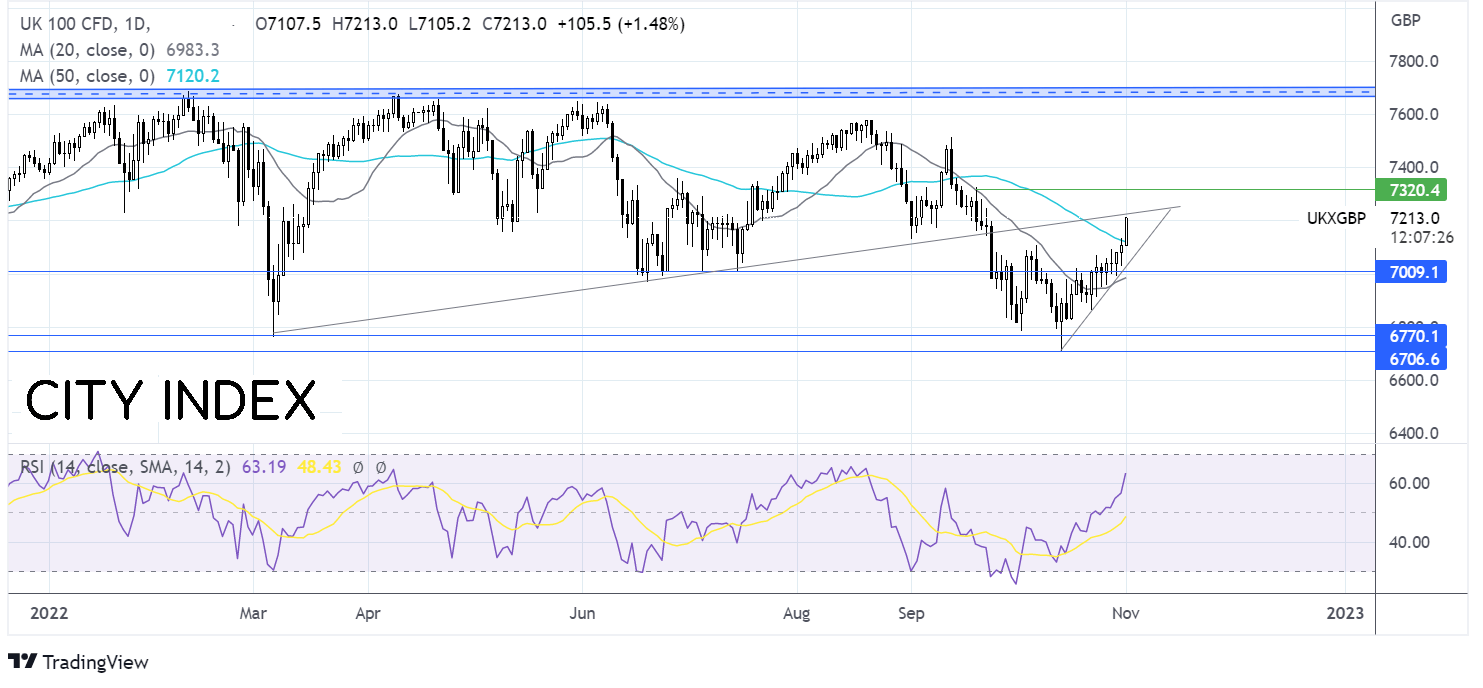

Where next for the FTSE?

The FTSE is extending its recovery from the 2022 low of 6706, rising above the 20 & 50 sma, which along with the RSI over 50 keeps buyers hopeful of further upside.

Buyers will look for a rise over 7230 the rising trendline resistance dating back to March, with a rise above here bringing 7320 the September 20 high into focus.

Meanwhile, sellers will look for a fall below the 50 sma at 7120 to expose 7000 the psychological level,