GBP/USD falls despite retail sales rebounding

- Sales rise 1.2% MoM

- UK PMI data to ease to 52.9 from 53.1

- GBP/USD tests support at 1.2280

GBP/USD is falling after strong gains yesterday as investors continue to digest the BoE rate decision as well as stronger than expected UK retail sales.

Sales jumped 1.2% MoM in February, not from a 0.9% rise in January, suggesting that the consumer is resilient despite double digit inflation.

The data comes after the Bank of England raised interest rates by 25 basis points yesterday as it battles inflation I'm playing for consent the central bank left the door open for the height significance airy the spending remains strong there is a good chance that that may be necessary.

Meanwhile the US dollar has steadied after falling to a seven week low as investors remained convinced that the Fed will start to cut interest rates this year, despite Fed chair Powell insisting otherwise. Less hawkish fed bets overshadowed stronger the expected jobless claims yesterday.

Attention will well now turns UK and US PMI data which are expected to show modest expansion.

The composite UK PMI is expected to be 52.9 down from 53.1, where the level 50 separates expansion from contraction.

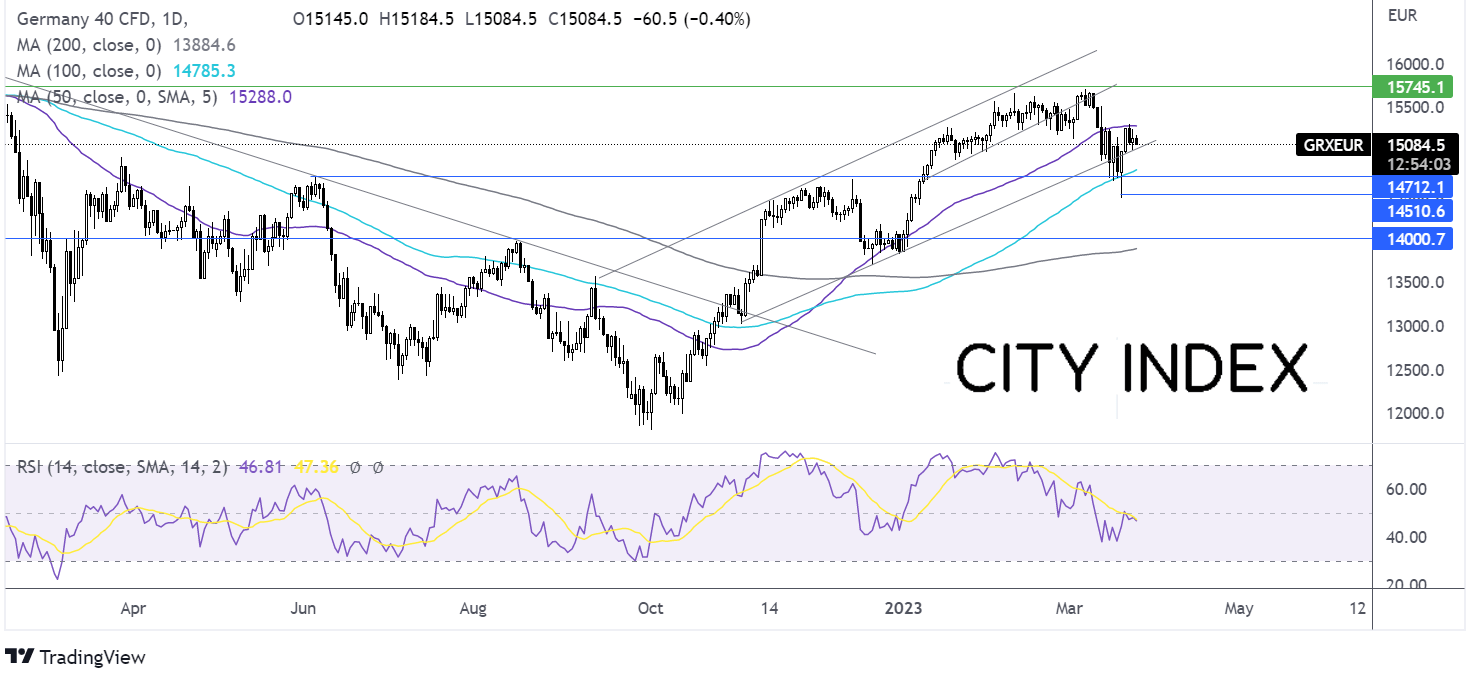

Where next for GBP/USD?

After rising to a high of 1.2350 yesterday, the pair has eased back slightly to support at 1.2280, the February 14 high. The pair holds above the 50, 100 & 200 sma and the RSI is above 50 keeping suggesting that momentum is to the upside.

Buyers could look for a rise over 1.2350 to create a higher high and aim towards 1.2450 the 2023 high.

Sellers could look for a fall below 1.2170 the 50 sma to negate the near term uptrend. A break below here exposes the 100 sma at 1.2070 before brining 1.2010 the March 15 low into focus.

DAX edges lower ahead of PMI data

- DAX falls as growth concerns linger

- German composite PMI to ease to 51.5

- DAX supported by rising trendline, capped by 50 sma

The DAX is pointing to a softer start at the end of week although it is still on track to book solid gain of over 2.5% across the week, as the mood improved as a line appeared to be drawn under the banking crisis.

Today German PMI data will be in focus and is expected to rise to 51 in March up from 50.9. While the service sector PMI is expected to be 51, up from 50.9, the manufacturing PMI is expected to show that the sector contracted at a slower pace of 47, down from 46.3.

Stronger than expected PMI data will help to ease recession fears. Recent volatility in the banking system could shift investors attention to recession risks.

ECB President Christine Lagarde will speak before the European Council later today.

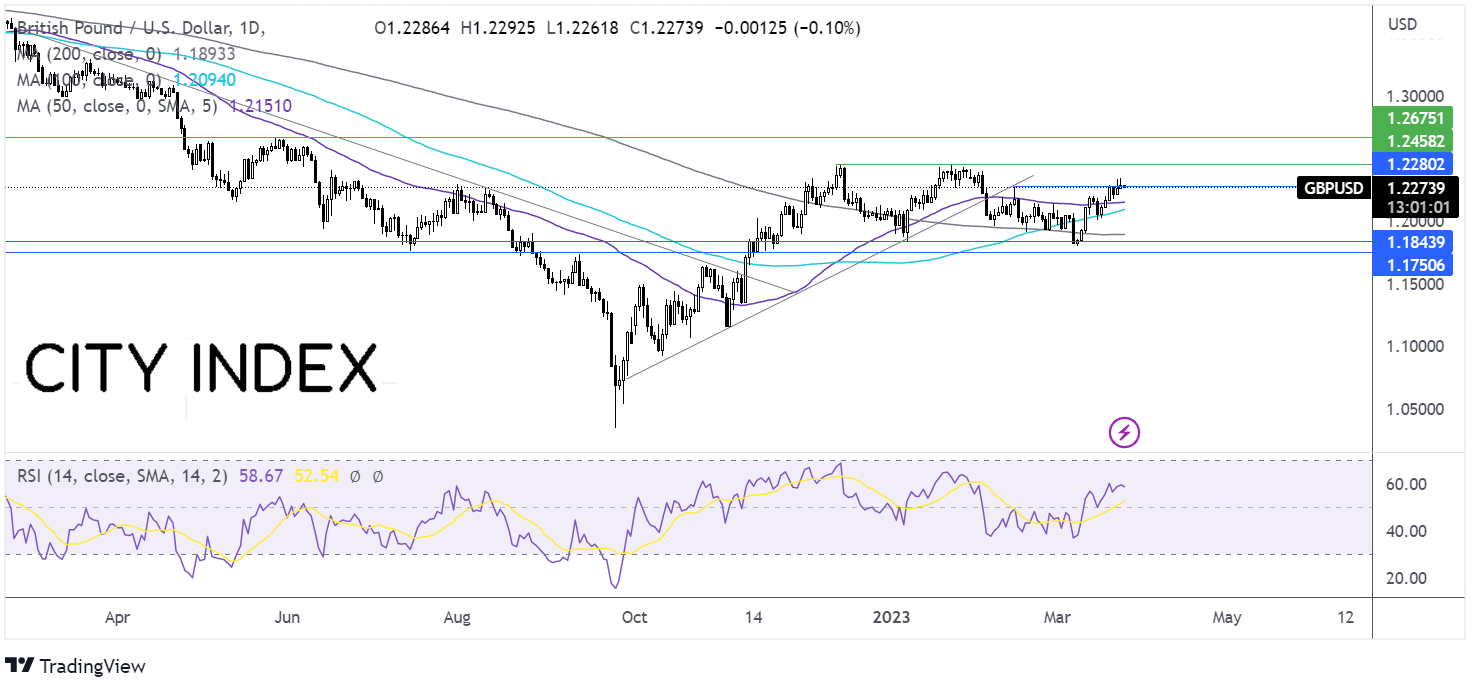

Where next for the DAX price?

The DAX once again found support on the rising trendline support yesterday, remaining within the ascending channel. Recent gains have been capped below the 50 sma. The RSI is neutral.

Buyers could look for a rise over the 50 sma at 15300, the weekly high to extend gains and create a higher high. Beyond here 15700, the 2023 high comes back into focus.

Sellers could look for a break below 15040 the rising trendline support and 15010 the weekly low to extend the selloff towards 14790 the 100 sma.