FTSE heads higher on quiet data day

The FTSE, along with its European peers is heading higher on Monday after a solid end to trading on Wall Street on Friday.

News flow over the weekend was light and both the earnings calendar and economic calendar are bare today.

There is bank holiday in parts of Europe.

Where next for the FTSE?

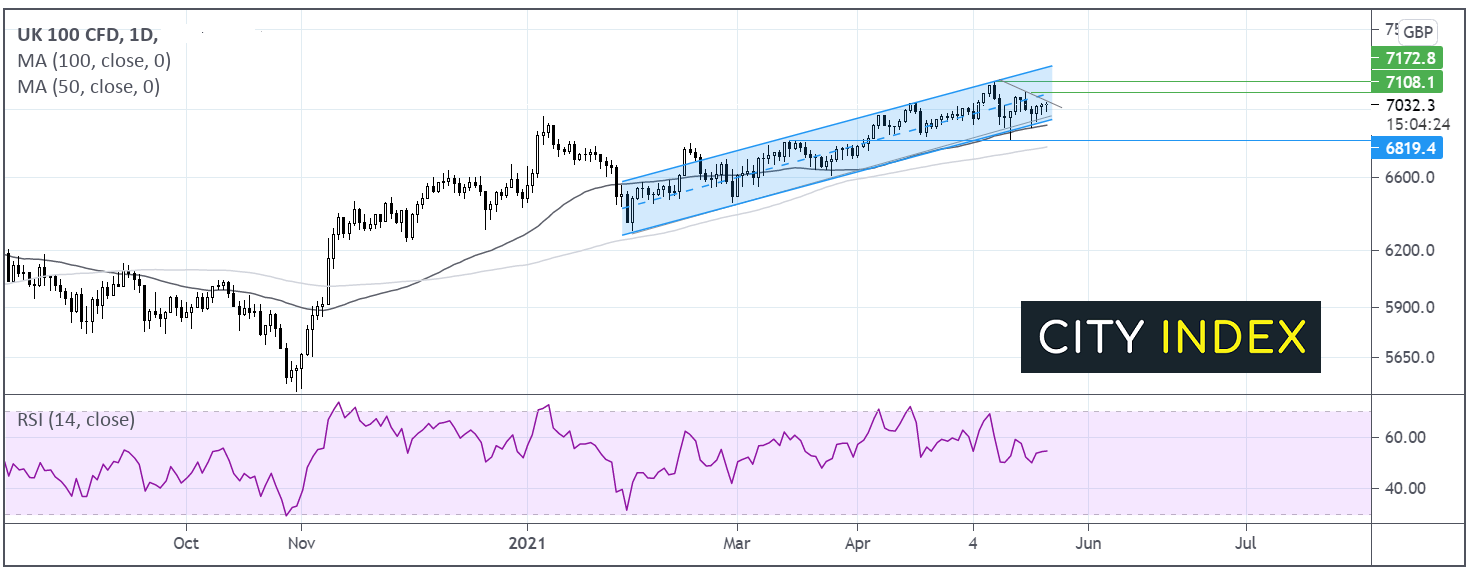

The FTSE continues to trade within an ascending trendline dating back to late January.

Last week the FTSE probed the lower band of the ascending channel. However, repeated moved to this support have not resulted in a deeper pullback.

The fact that the lower band support also coincides with the 50 sma means that it is proving to be a tough nut to crack which could help the index remain within the channel and provide a base for a possible move higher.

A move above the descending trendline dated back to early May could see the FTSE advance towards 7100 high May 18 and 7150.

It would take a move below 6910 the 50 sma and the lower band of the ascending channel for the sellers to gain traction.

WTI crude oil prices move higher as Iran nuclear talks hit problems

Oil prices are recouping some of last week’s losses as potentials hitches start to emerge in reviving the Iran 2015 nuclear deal, which would have added more oil supply to the market.

The US Secretary of State Blinken stated that there was no sign that Iran is willing to comply with nuclear commitments. This is a further blow to progress rumours as Iran prepares to end UN watchdog’s access to nuclear sites

Meanwhile rising covid cases in Japan, the world’s fourth largest importer of oil, where just 4% of the population is vaccinated, is acting as a drag.

Where next for WTI crude oil?

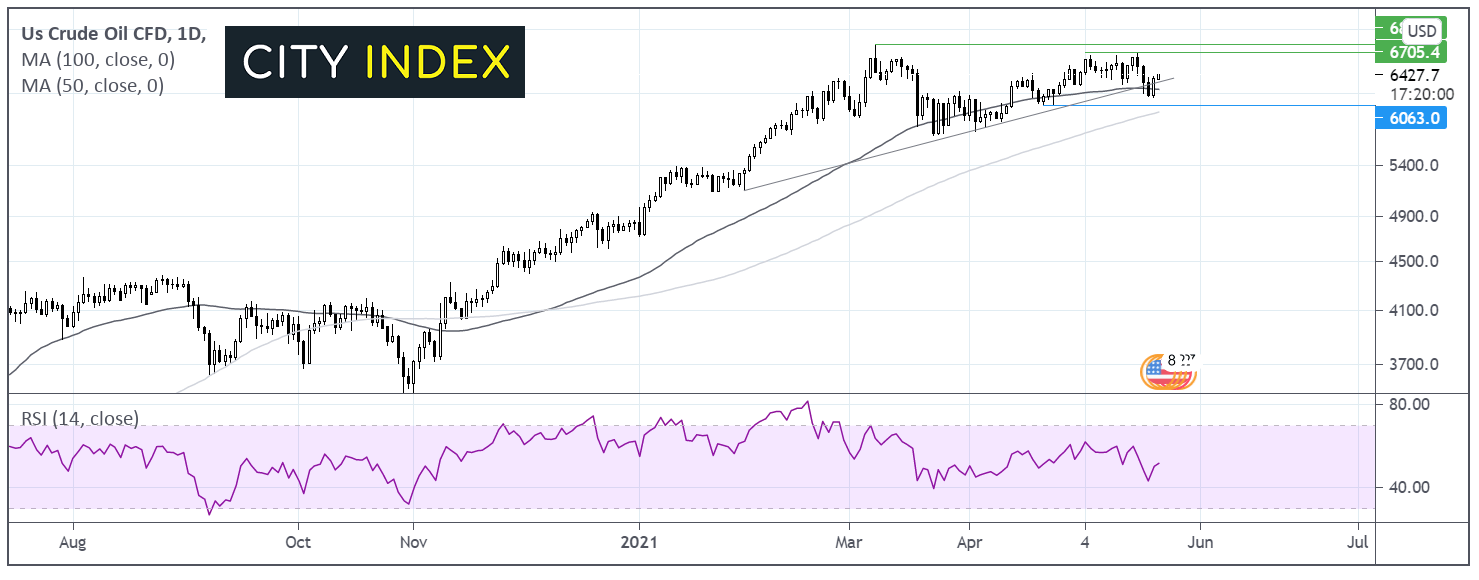

WTI crude oil managed to rise back above its 50 sma on the daily chart and ascending trendline dating back to late January, which it briefly moved below last week.

Whilst the trendline holds, buyers could remain optimistic of a move back towards 6700 the May high.

A move back below the ascending trend line at 63.50 and the 50 sma at 62.50 could prompt a deeper sell off towards 60.00 the 100 sma.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.