FTSE rises after upbeat Chinese services data

- Chinese services PMI hit 55 from 52.9

- UK composite to confirm 53, up from 48.6

- FTSE extends rebound from 7850

The FTSE along with its European peers is pushing higher at the end of the week boosted by upbeat comments from Bank of England chief economist Huw Pill and by upbeat China services PMI data.

Chinese services PMI jumped shut up play in February I've consumer demand was revived amid the removal of tough covered restrictions. The Caixin services PMI rose to 55 in February, up from 52.9 in January, showing the sector expanded at the fastest pace in 6 months. The data comes after the manufacturing PMI showed activity expanded at the fastest pace in over a decade.

Meanwhile, the outlook in the UK is also improving slightly, according to BoE’s Huw Pill. He said that data suggests that the current momentum in economic activity may be stronger than anticipated.

Attention will now turn to UK composite PMI data, which is expected to confirm that business activity returned to growth in February to 53, up from 48.5.

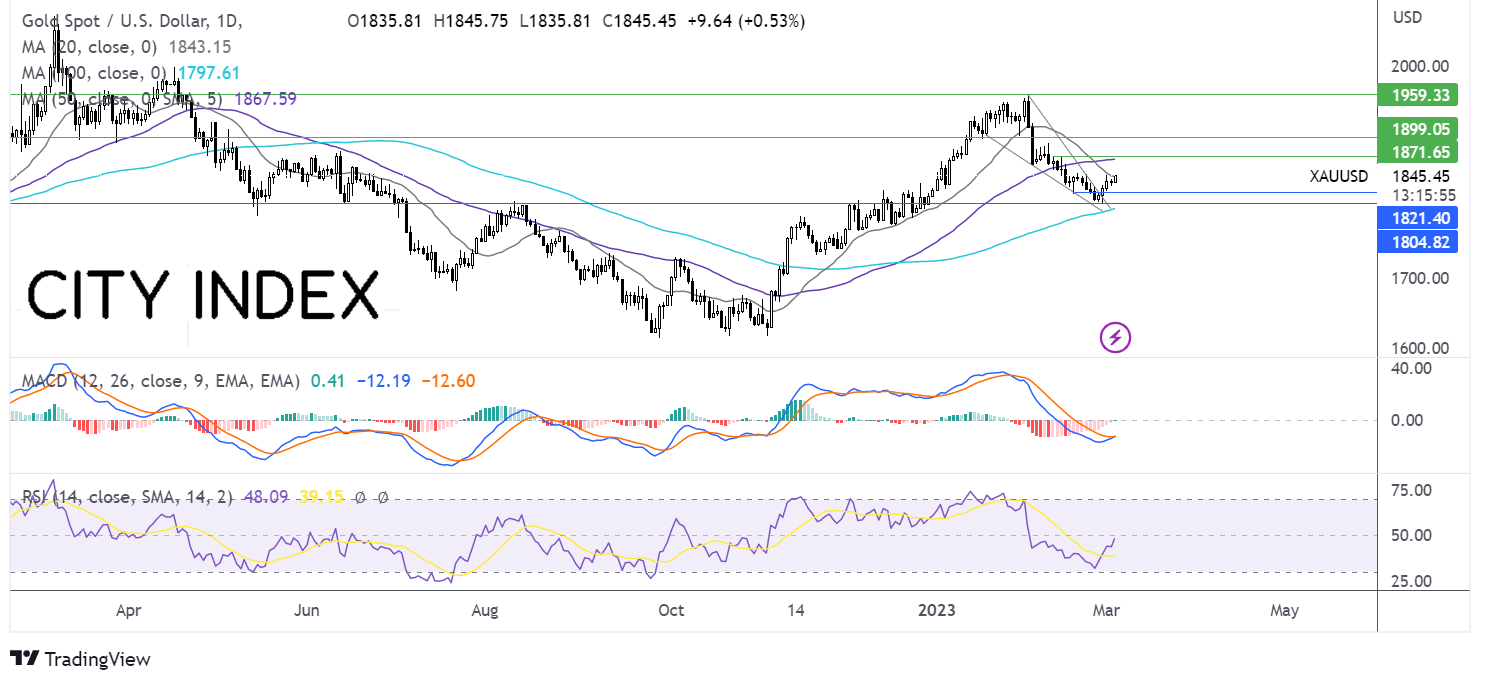

Where next for the FTSE?

After falling to 7850 earlier in the week the FTSE has rebounded and is attempting to retake the multi-month rising trendline resistance. The RSI supports further upside while it remains above 50 but below 70 overbought level.

Buyers could look for a rise above 8000, the psychological level to extend the bullish run to 8046, the all-time high.

Gold rises ahead of US ISM services PMI

- Gold rises across the week

- US ISM services forecast at 54.5 from 55.2

- Gold tests 20 DMA

Gold is heading higher on Friday and is set to book gains across this week even as the 10-year treasury yield pushed over 4%.

The latest leg higher comes after Atlanta Fed President Raphael Bostic said that the US central bank may need to raise interest rates higher but that they could be in a position to pause the tightening cycle in the summer.

Attention will now turn towards the US ISM services PMI which is expected to show that growth slowed slightly to 54.5 in February, down from 55.2 in January. Paid prices are forecast to drop sharply to 64.5 from 67.8.

Weaker data could help ease hawkish Fed jitters and send gold higher.

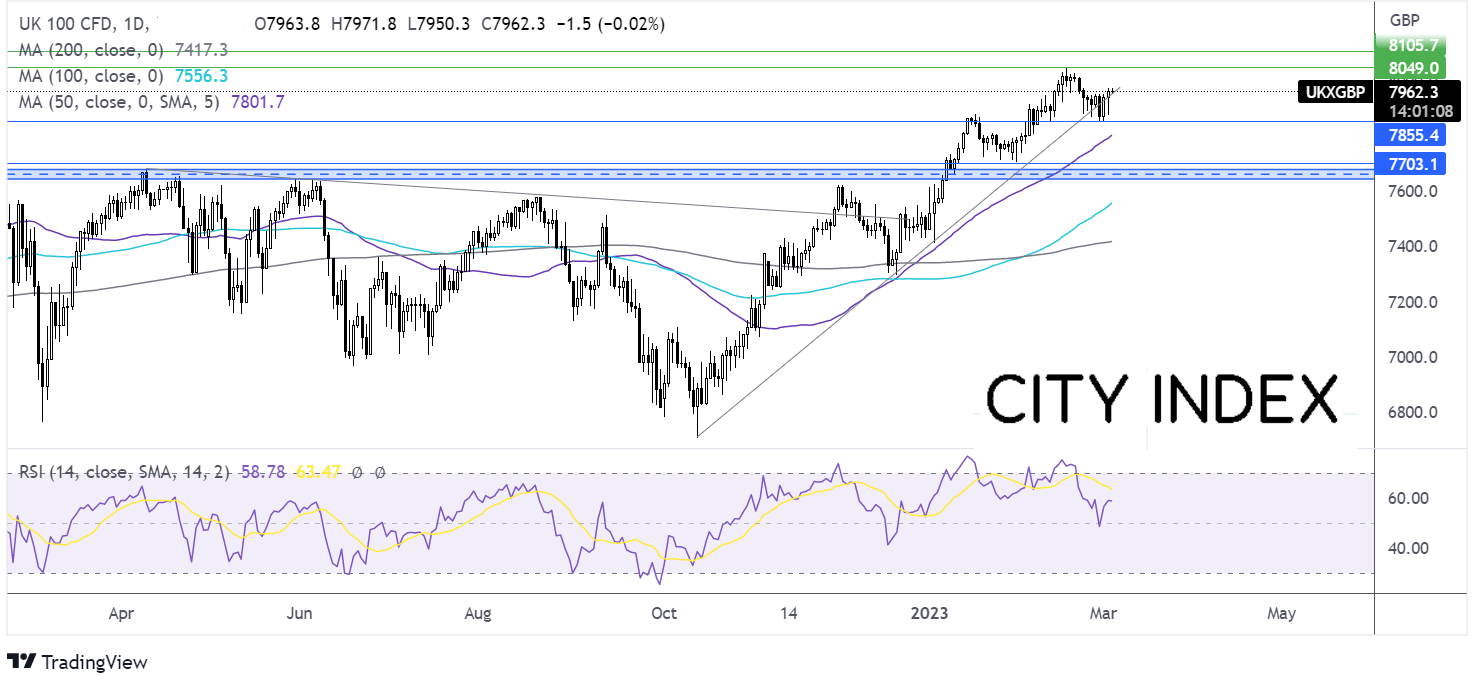

Where next for Gold?

Gold has broken out of the falling wedge, which, together with the bullish crossover on the MACD keeps buyers hopeful of further upside. Gold is testing resistance at 1845 the 20 sma a rise above here is needed to extend the runup towards the 50 sma at 1858.

Meanwhile, sellers could take note of the RSI which remains below 50. Should sellers successfully defend the 20 sma, bears could look for a break below 1830 yesterday’s low, before bringing 1820 the Friday 17th low into play. Beyond here bears could target 1804, the 2023 low.