Brexit trade talks continued overnight between the EU and the UK and an agreement is expected to be unveiled today. The deal document, which is being finalised in the early hours of this morning is expected to be around 2000 pages long. If agreed, both sides will have until 31st December to approve the deal.

FTSE points to stronger start

• FTSE rallied 0.6% on Tuesday as Brexit rumors swirled and on news that a deal could be imminent.

• FTSE set for a positive start again today, markets close half day.

• Brexit stocks which are closely tied to the performance of the UK economy such as banks, house builders, retailers and airlines rallied hard in the previous session and will remain in focus.

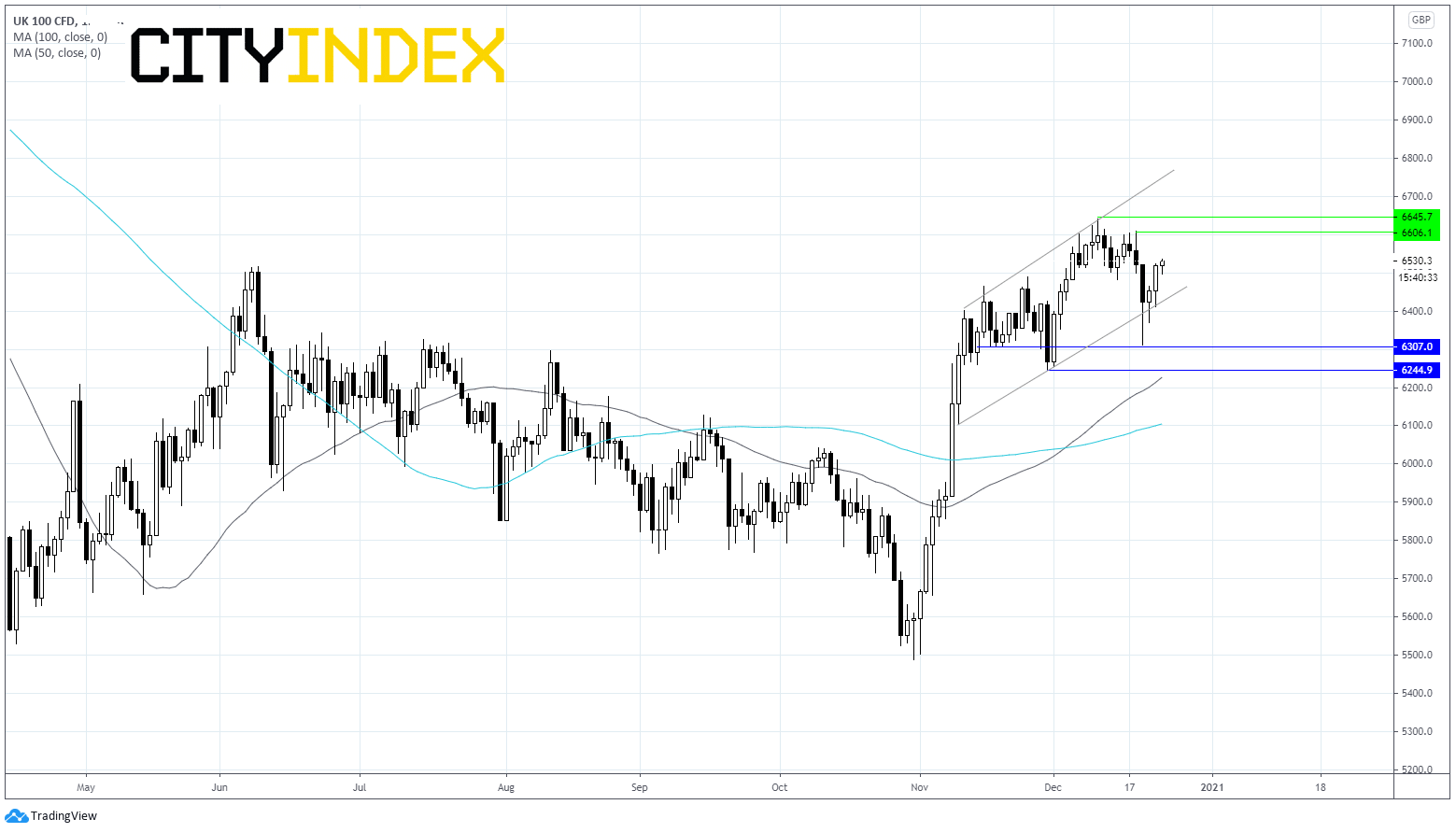

The FTSE continues to trade within and ascending channel dating back to early November. The index also trades above its 50 and 100 sma suggesting that there is more upside on the cards. The 50 sma also crossed above the 100 sma again, another bullish indication.

Immediate resistance can be seen as 6600 (high 18th Dec) before 6645 (December high) prior to 6850 (March high).

It would take a move below the lower band of the ascending channel at 6435 to open the door to 6300 horizontal support which has offered support since early November and then 6245 December low and 50 sma.

Learn more about trading indices.

Where next for GBP/USD on Brexit news?

• GBP/USD rallied to fresh weekly highs on expectations of a Brexit deal

• Hopes of an imminent deal are boosting sterling, whilst falling safe haven demand is dragging on the US Dollar

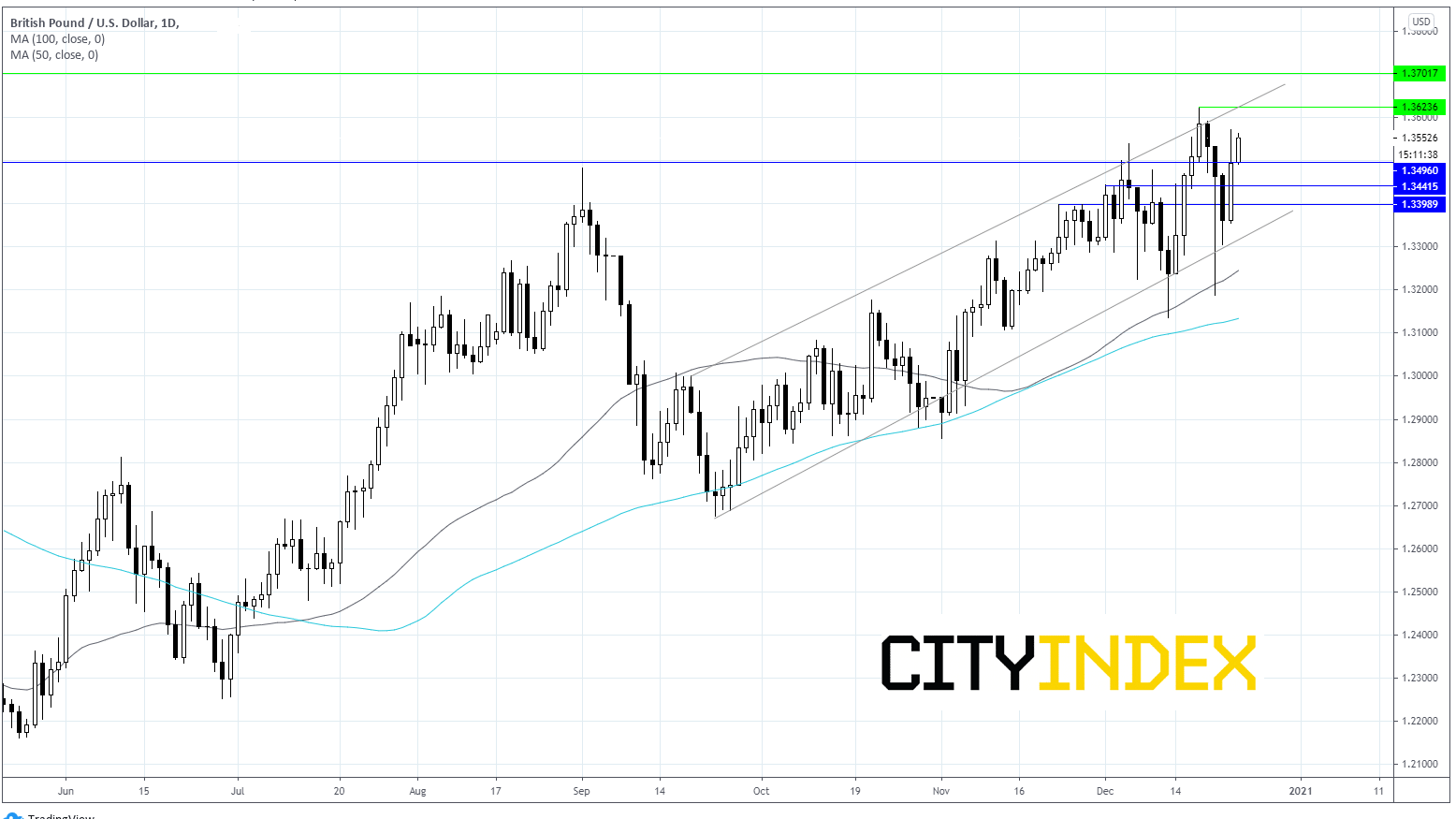

GBP/USD rallied to an intraday high of 1.3570 overnight and has eased back slightly to 1.3550. The pair continues to trade in its ascending channel dating back to mid September and also trades above its 50 & 100 sma – a bullish trend.

Immediate resistance can be seen at 1.3625 last week’s swing high and the upper band of the ascending channel. A break through here could clear the way for a move towards 1.37 a level not seen since early 2018.

On the flipside, immediate support sits at 1.35 psychological number, prior to horizontal support at 1.3440 and 1.34. It would take a break below 1.3330 the lower band of the ascending channel to negate the bullish trend.

Learn more about trading forex