FTSE cautiously climbs

Russia, Ukraine peace talks make little progress which combined with fears over a global recession mean any recovery in sentiment will remain cautious.

Oil prices are once again climbing as the US could still press ahead with a ban on Russian imports, despite Europe not agreeing. Meanwhile, Russia threatens that oil prices could rise to $300 if gas supply to Europe is slowed.

Commodity prices across the board are rising, adding to fears of stagflation, slowing economic growth and surging inflation.

There is no UK economic data due today leaving risk sentiment in the driving seat.

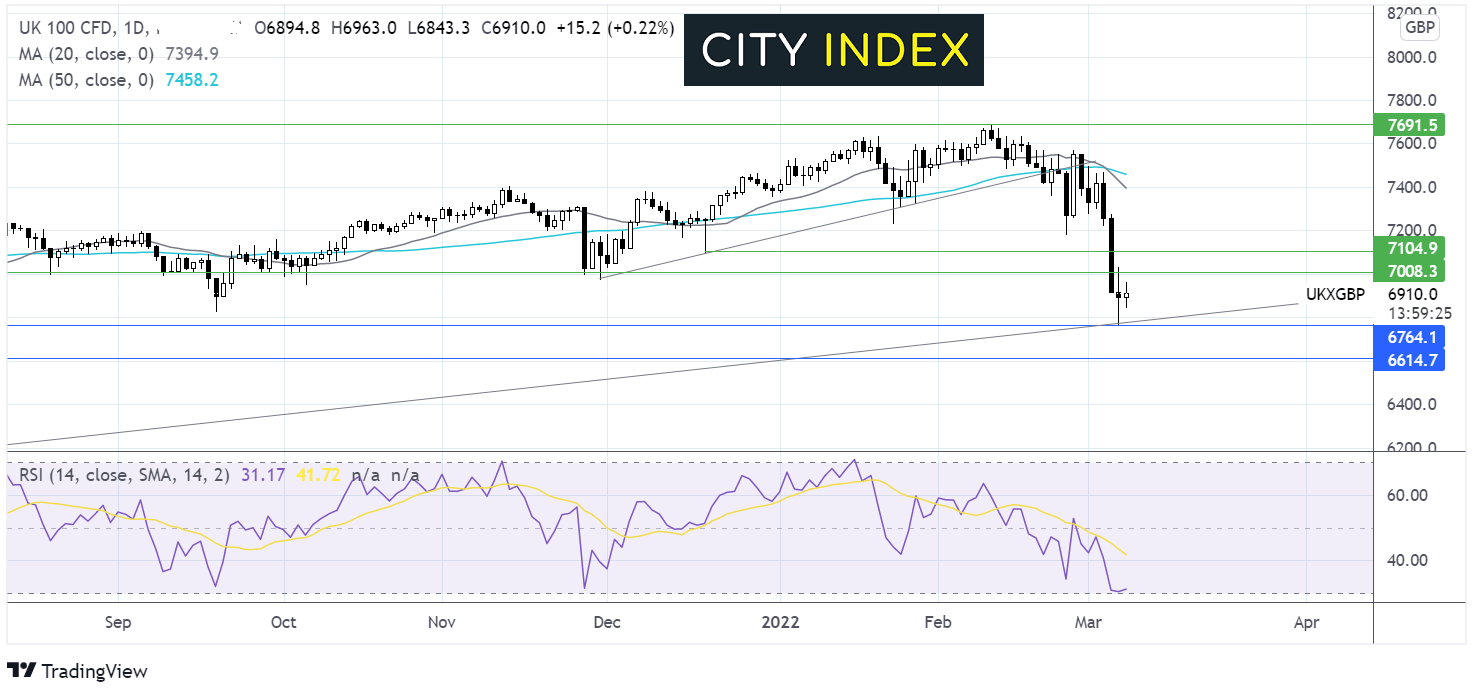

Where next for FTSE?

The FTSE fell to a low of 6800, the rising trendline support dating back to March 2020, but failed to find acceptance at these levels, with buyers quickly coming back in a pushing the price back up above 6950.

Today the price is looking towards 7000 as the RSI teeters on the edge of oversold a bounce was likely on the cards, or at least some consolidation.

Any recovery would need to retake 7000 the key psychological level ahead of 7100 the December 20 low.

Meanwhile, sellers will be encouraged by the 20 sma crossing below the 50 sma. Bears will look for a move below 6800 in order to target 6620 the March 2021 low.

EUR/GBP rises from 5 year low ahead of EZ GDP

EUR/GBP is extending gains for a second session after steep falls across the previous week.

The Euro is finding support after spiking to a 5 year low as the Eurozone is more exposed to developments in Ukraine, given its geographical location and its dependence on Russian energy.

Recent data from Germany has been encouraging, retail sales jumped 2% MoM in January, recovering firmly from Omicron. German factory orders also rebounded strongly at the start of the year sand industrial production in the eurozone’s largest economy rose 1.8% MoM, beating forecasts of 0.5%.

However, the more recent Eurozone Investor sentiment data revealed that confidence plunged to a 16 month low in March as Russia invaded Ukraine.

Looking ahead Russian headlines will drive the pair, Eurozone Q4 GDP is also due to confirm 0.3% growth QoQ in line with the previous estimate.

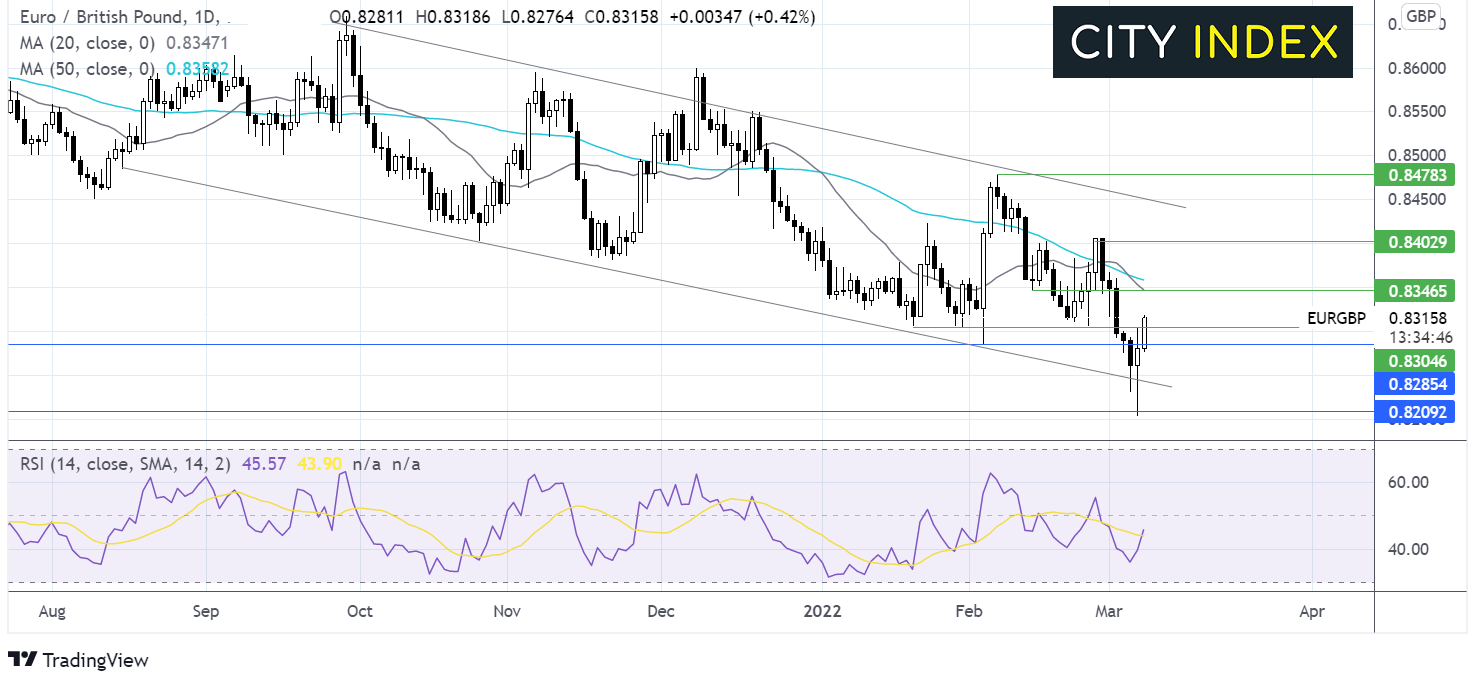

Where next for EUR/GBP?

EUR/GBP reversed the drop to 0.82 yesterday and has re-entered the falling channel within which it has traded since early September. The RSI is attempting to push back towards 50 which is giving buyers reason to be hopeful. Although a meaningful mover over support at 0.83 is needed to expose the 20 sma at 0.8350.

Meanwhile, the 20 sma is crossing below the 50 sma could be considered a sell signal. Bears could look for a move below 0.8280 in order to bring 0.8230 the Friday low into play ahead of 0.82.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.