FTSE steady as investors digest BP & HSBC results

FTSE futures are trading cautiously ahead of the open, the broad mood in the market is wobbling ahead of tomorrow’s Fed decision.

BP share price and HSBC share price movement will be in focus after both heavyweights beat forecasts.

Earnings are also out from Whitbread, Aveva, and PZ Cussons

A slightly weaker pound owing to the strengthening US Dollar underpins the UK index.

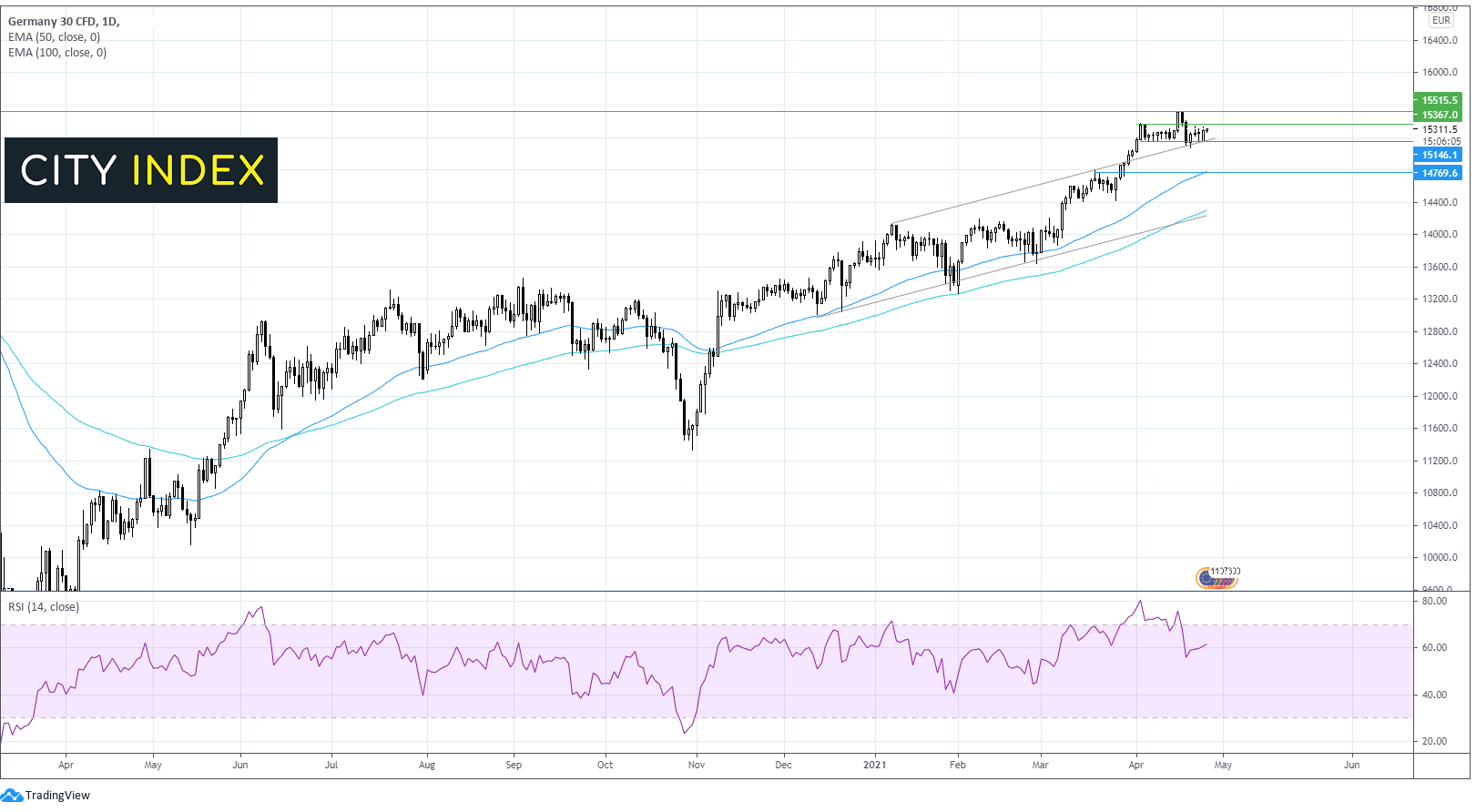

Where next for the FTSE?

After falling steeply last week, the FTSE is clawing higher as it looks towards 7050.

Trading above its 50 & 100 EMA and within the multi-month ascending channel the established bull trend remains intact. The RSI is also supportive of further upside.

Bulls will look towards resistance at 7050, the post pandemic high. Strong resistance can be seen at 7120.

On the down side, support can be seen at 6850, last week’s low, ahead of 6800, the 50 EMA and a level which provided resistance across February. A break below here could negate the current up-trend.

Learn more about trading indices

Dax trades cautiously ahead of Fed

After record highs were achieved on Wall Street the European open is looking lacklustre.

Cautious trade dominates ahead of a busy week for earnings both in Europe and the US.

Earnings so far have been strong and are likely to help the Dax keep its bullish bias.

Risk remain regarding covid

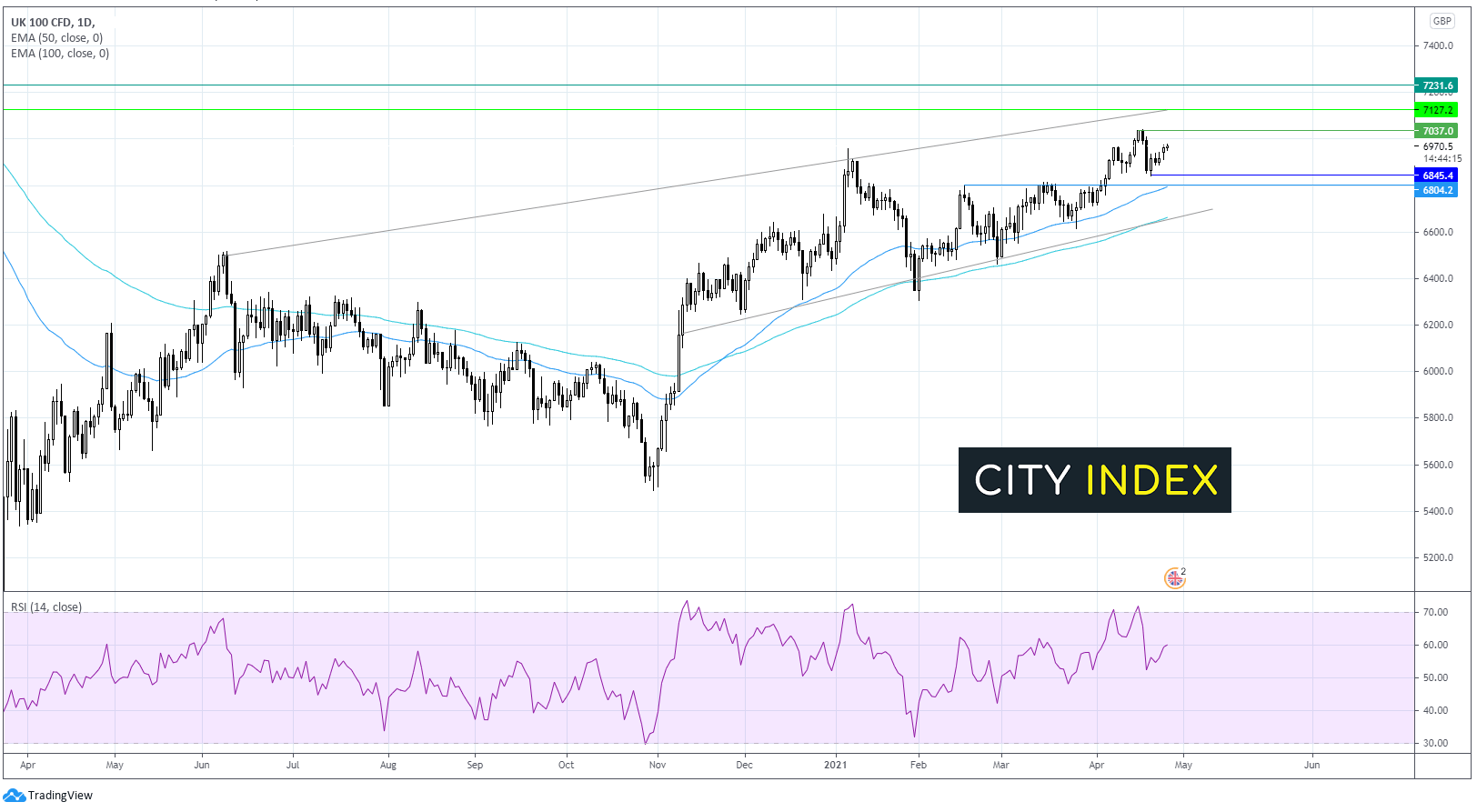

Where next for the Dax?

The Dax edged higher on Monday and is see extending that recovery , although it still trades below its all time high hit earlier in the month.

The continues to trade above its 50 & 100 EMA and above the upper band of its ascending channel. In an established bull trend.

The RSI has moved out of overbought territory and is supportive of more upside.

Support at 15100 is holding which offering a base from which to extend towards resistance at 16365 and on to 15500 the all time high.

On the downside support is seen at 15100, but a move below 15000 April’s low is needed in order to negate the current uptrend.