EUR/USD ahead of EZ CPI & FOMC minutes

EUR/USD trades at a 3 month high above 1.22, and is seen extending gains from the previous session.

A weak US Dollar on dovish Fed talk boosted the pair yesterday. Continued weakness in the greenback today suggests that market participants are not concerned that the Fed will start tapering soon.

Several European countries have started to ease covid lockdown restrictions as numbers slow and the vaccine programme ramps up.

Eurozone CPI is expected to show 0.6% MoM rise in April, down from 0.9% in March.

US FOMC minutes are due later and investors will be watching closely for any clues of the Fed’s next move.

Where next for EUR/USD?

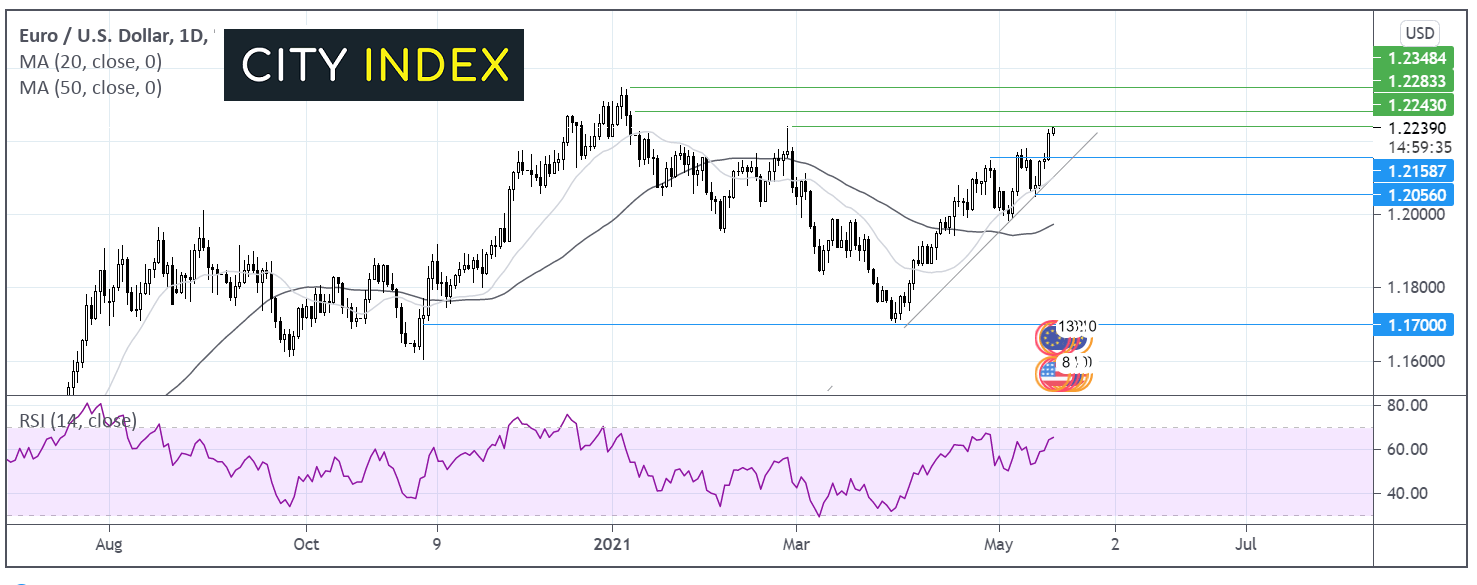

EUR/USD has been trending higher since late March. It trades above its ascending trendline and its 20 and 50 sma on the daily chart. The 20 sma recently crossed above the 50 sma in a bullish signal and the RSI is supportive of further gains whilst it remains out of overbought territory.

A break above resistance at 1.2235 high February 25th is needed for the buyers to be able to move ahead to 1.2280 high January 8, before 1.2350 the yearly high comes in play.

It would take a move below 1.2150 to negate the near term uptrend.

Learn more about trading forex

WTI looks to EIA data after progress in Vienna

WTI crude oil remains under pressure but has picked up off session lows. The price reversed from a two month high on Tuesday at 67.00 falling to 64.15.

Significant progress towards Iran rejoining the nuclear deal in talks in Vienna weighed on the price whilst a build in stock piles reported by API added to the bearish picture.

US Dollar weakness is failing to lift WTI

EIA data is expected to show 1.68M versus -0.427M which could add downside pressure.

FOMC minutes will also be key.

Learn more about what moves oil prices

Where next for WTI crude oil prices?

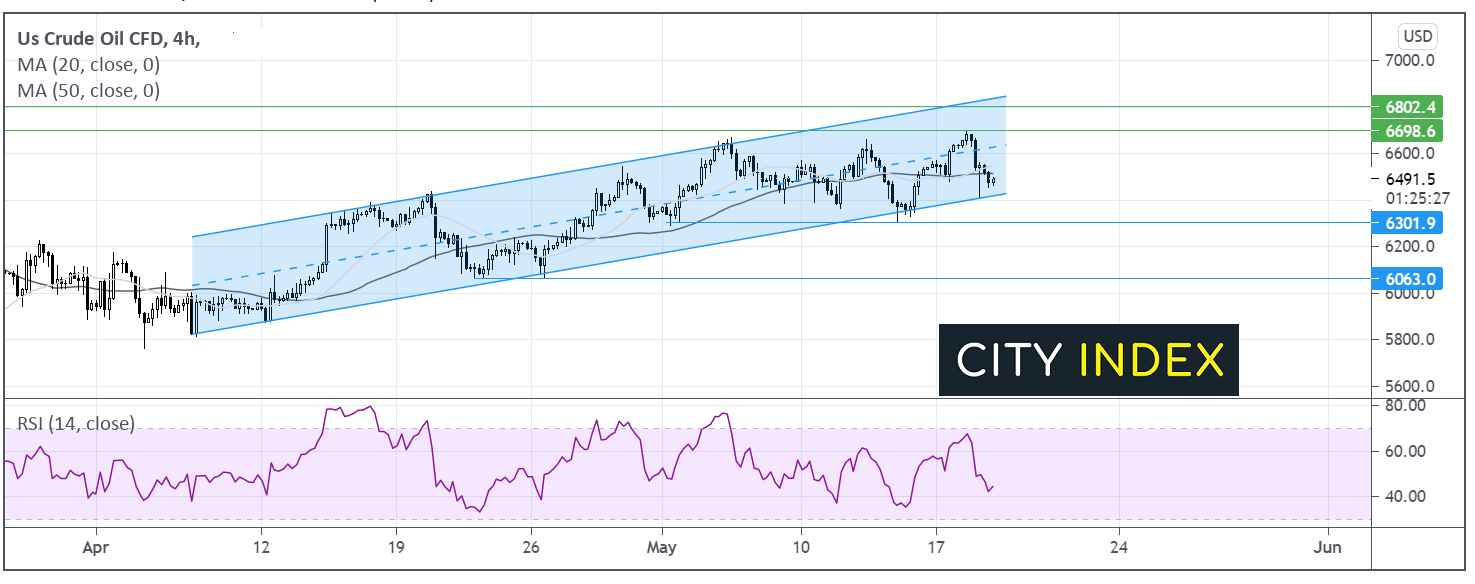

Despite yesterday’s selloff and some follow through weakness today, WTI continues to trade within its ascending channel dating back to early April, suggesting that the bullish trend remains intact.

The price has fallen through the 20 & 50 sma on the 4 hour chart and the RSI is in bearish territory suggesting further downside could be possible.

Sellers could be looking for a move below 6420 below the lower band of the ascending channel for a deeper selloff towards 63.00.

Any recovery would need to retake the 50 & 20 sma at 65 and 64.50 respectively. A move above 65.50- could see the bulls gain momentum and look back towards 67.00 yesterday’s high.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.