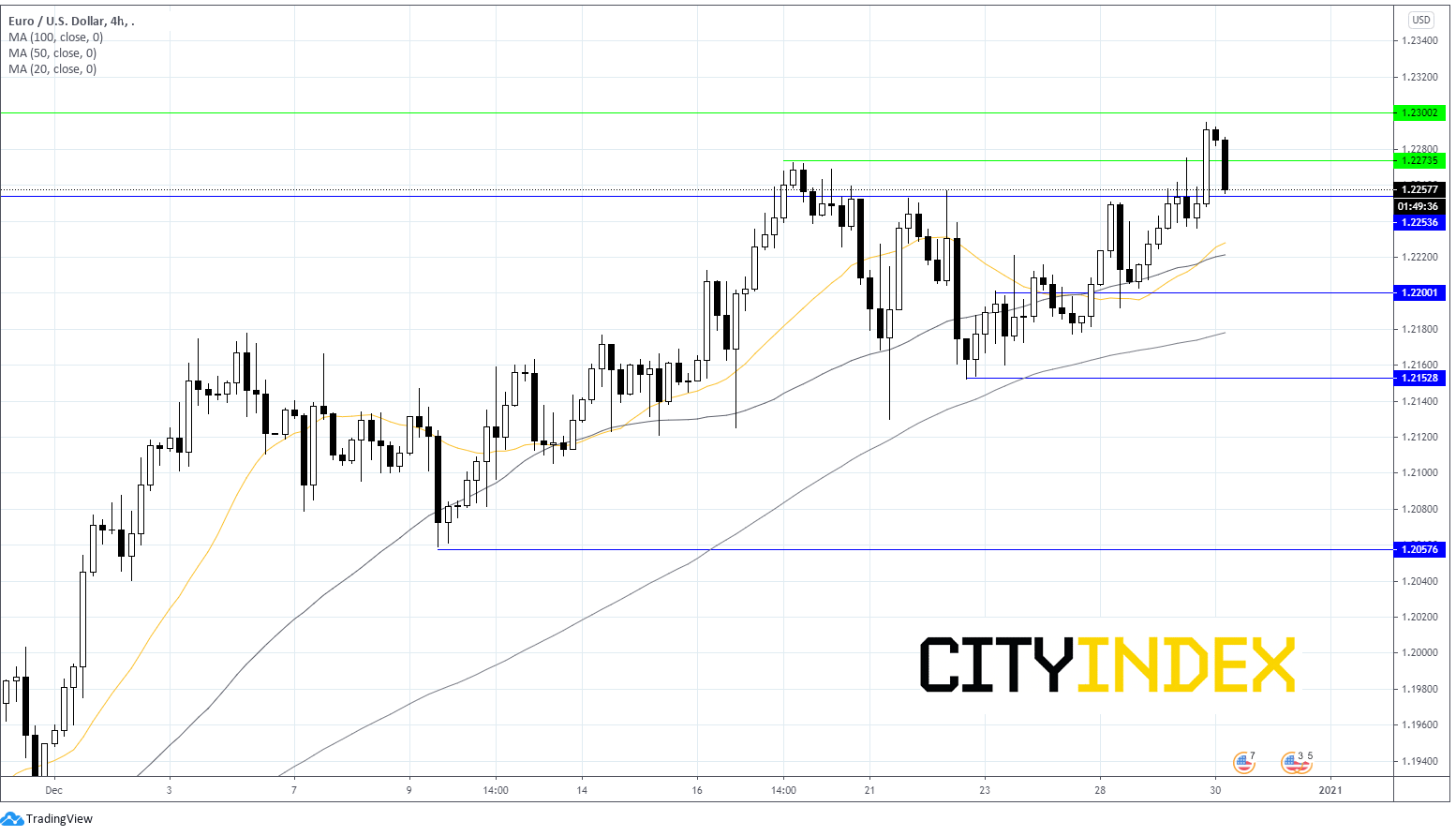

Technically, the pair trades comfortably over its 20,50 & 100 sma a bullish chart suggesting that more upside could be on the cards. Furthermore, the 20 sma has crossed above the 50 sma in another bullish signal.

On the upside, a move towards the round number 1.23 could be eyed prior to 1.245

Learn more about trading forex.

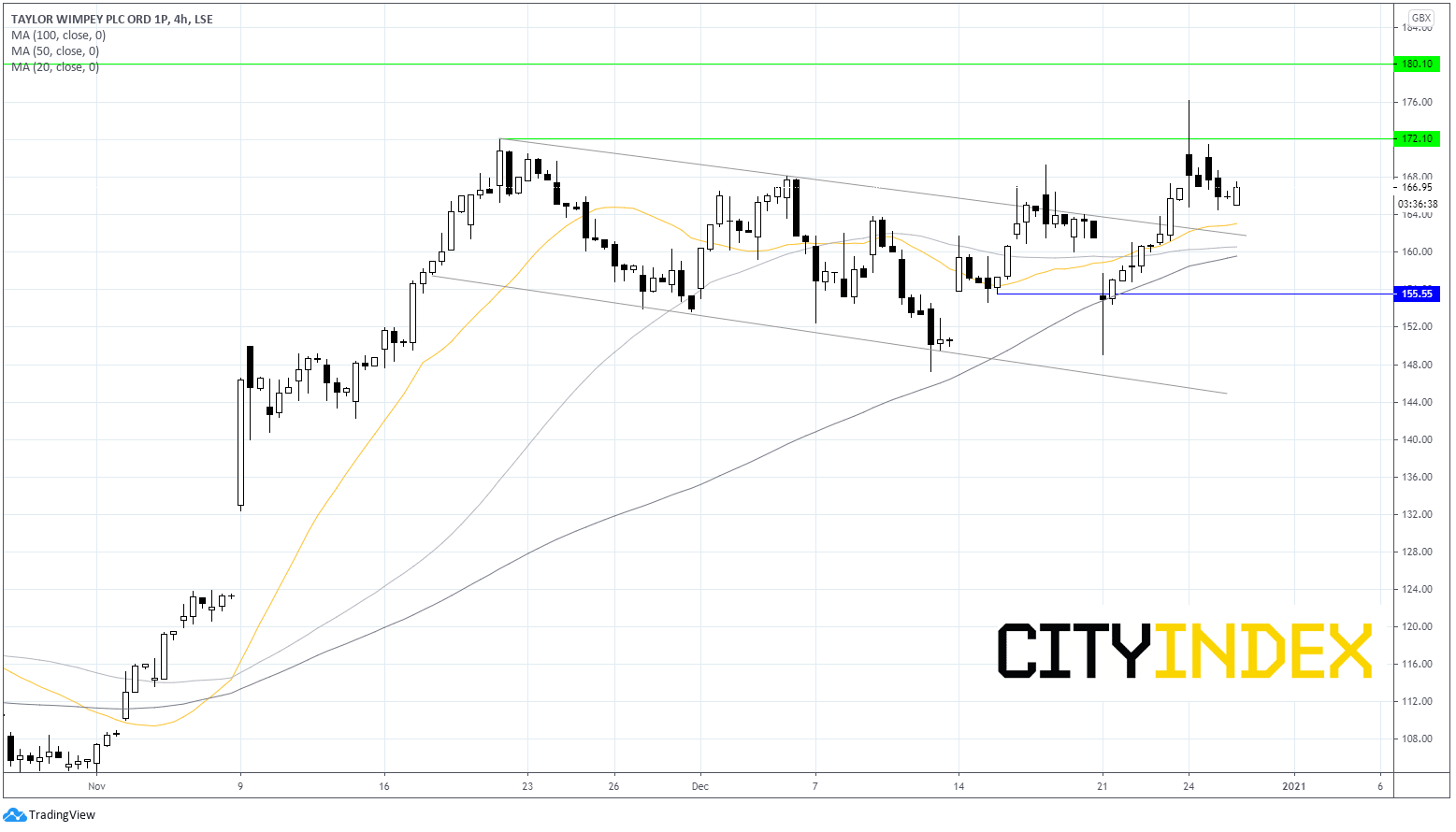

Where next for Taylor Wimpey as house price rise?

According to Nationwide, UK house prices climbed 7.5% in 2020 the highest growth rate in 6 years after demand was buoyed by the Chancellor’s stamp duty holiday, furlough scheme and changing preferences amid the pandemic.

However, the outlook is much more uncertain, depending on how the pandemic evolves and the economic scaring suffered. Whilst the stamp duty holiday continuing until March means prices could continue to increase in Q1, rising unemployment is the obvious risk.

Technical outlook

Taylor Wimpey rallied hard in early November on vaccine optimism hitting a high of 172 before trending lower from mid November to 23rd December. The stock broke out of its descending channel scaling to 176 on 24th December after the Brexit deal announcement.

The pair trades above its 20, 50 & 100 sma in a bullish sign although has failed to find acceptance above 172 which acts as the immediate resistance prior to 176 and the 9 month high of 180p.

163/1 offers important support with 20 sma and upper band of the descending channel. A break through there sees more support at 160/59 50 & 100 sma, prior to horizontal support at 155.

Learn more about trading equities