EUR/USD slips ahead of retail sales data & midterms

EUR/USD is falling away from parity as investors look ahead to eurozone retail sales and US mid-term elections.

Retail sales are expected to rise 0.3% MoM in September after falling -0.3% in August. Weak sales are expected to reflect higher interest rates and high inflation. On Monday, ECB President Christine Lagarde reiterated that inflation was too high and that the ECB will continue working to bring inflation down.

Yesterday EUR/USD briefly rose above parity supported by stronger-than-expected German industrial production and Eurozone investor confidence data, and a weaker USD.USD fell yesterday despite yields rising.

In addition to EZ retail sales and the US midterm elections and ECB speakers will be in focus.

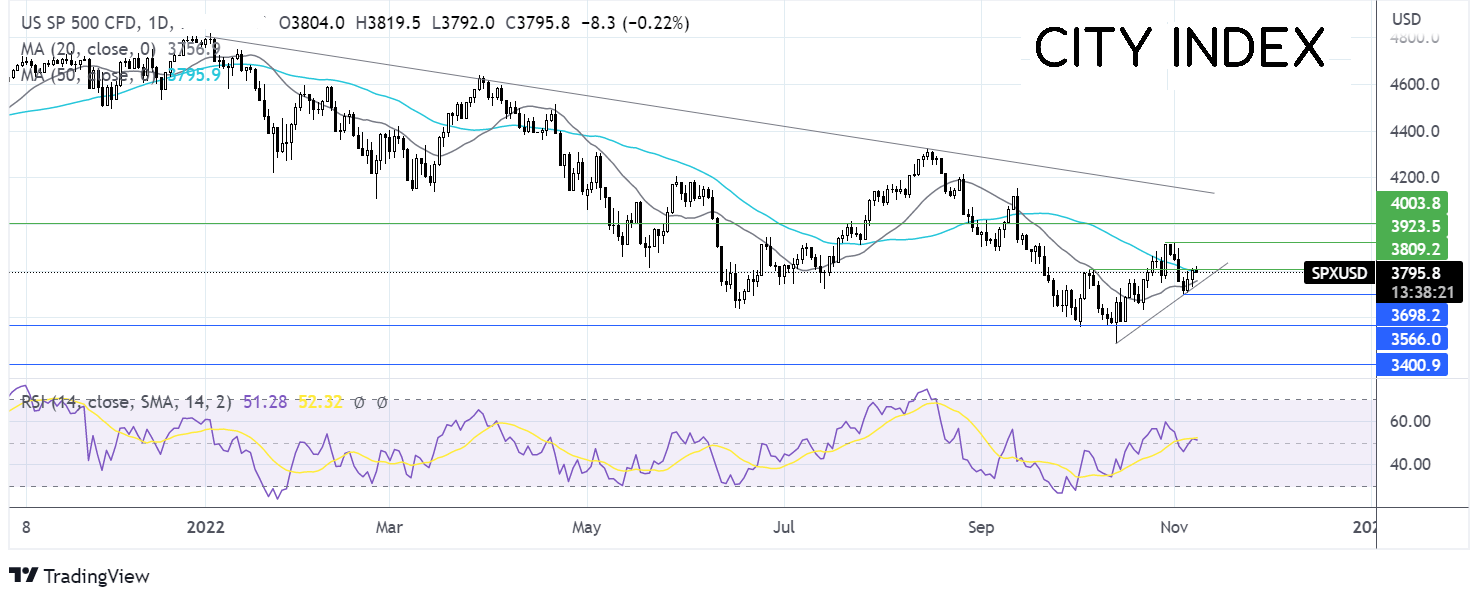

Where next for EUR/USD?

EUR/USD’s recovery from 0.9740 has stalled just shy of parity after having pushed over the 20 & 50 sma. The RSI is over 50 and the 20 sma is crossing above the 50 sma in a bullish signal.

Buyers could look for a move over 1.0090 the October high to bring 1.0980 the September high into focus.

On the flip side, sellers could look for a move below 0.9870 the 20 & 50 sma, ahead of 0.9730 the November low.

US government gridlock good for stocks?

The S&P500 finished yesterday higher for a second straight day, despite some signs of caution. The S’7P500 closed 0.96% higher above the key 3800 level.

Attention is now firmly on the midterm elections, where the Republicans are widely expected to perform well, as the hands of the Democrats. Recent polls point to the Republicans winning a majority in the House of Representatives. They could even do the double and win the Senate as well, given the level of content amid multi-decade high inflation and looming recession fears

So what does this mean? Effectively the result means gridlock in government, which will severely limit what Biden will be able to achieve in the final two years of his term.

Historically a gridlocked government is good news for stocks, with politicians given less room to meddle.

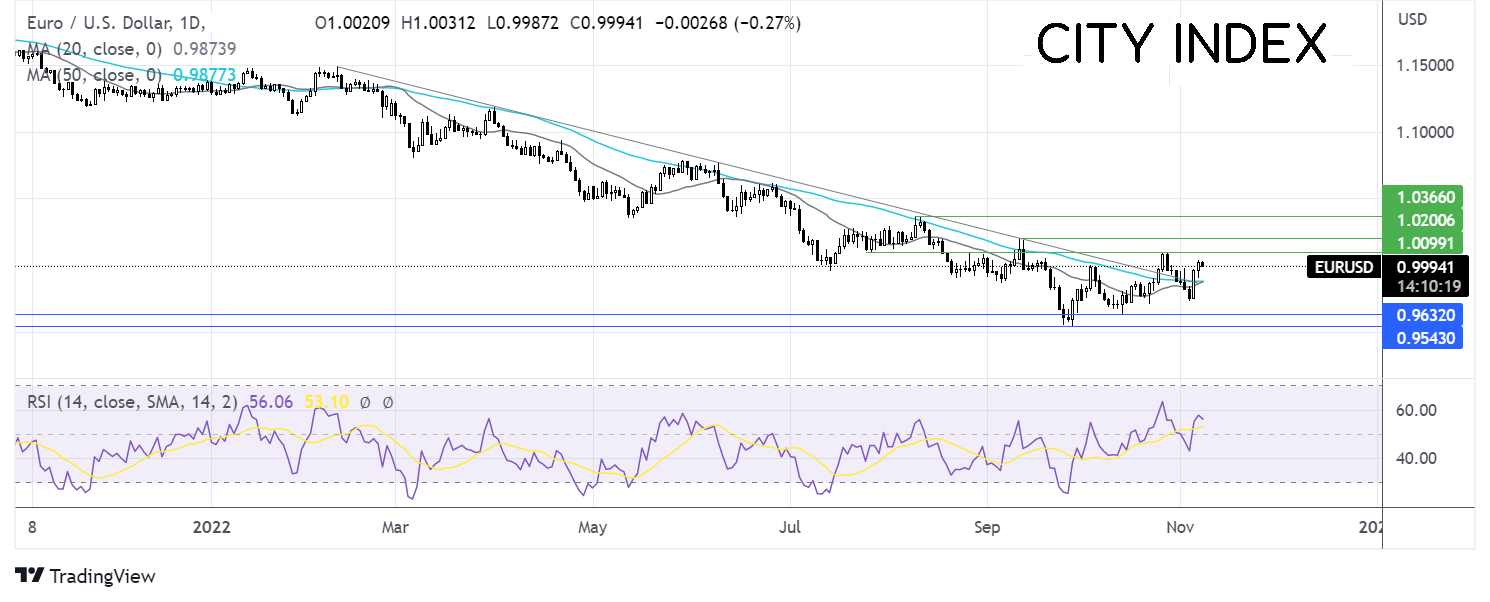

Where next for the S&P500?

The S&P500 has risen from its November low of 3770, retaking the 20 & 50 sma before running into resistance around 3800.

With the RSI supportive of further upside. Buyers will look to rise over 3800 ahead of 3920 the October high, to create a higher high.

Support can be seen at 3750 the 20 sma and rising support trendline, and 3700 the November low