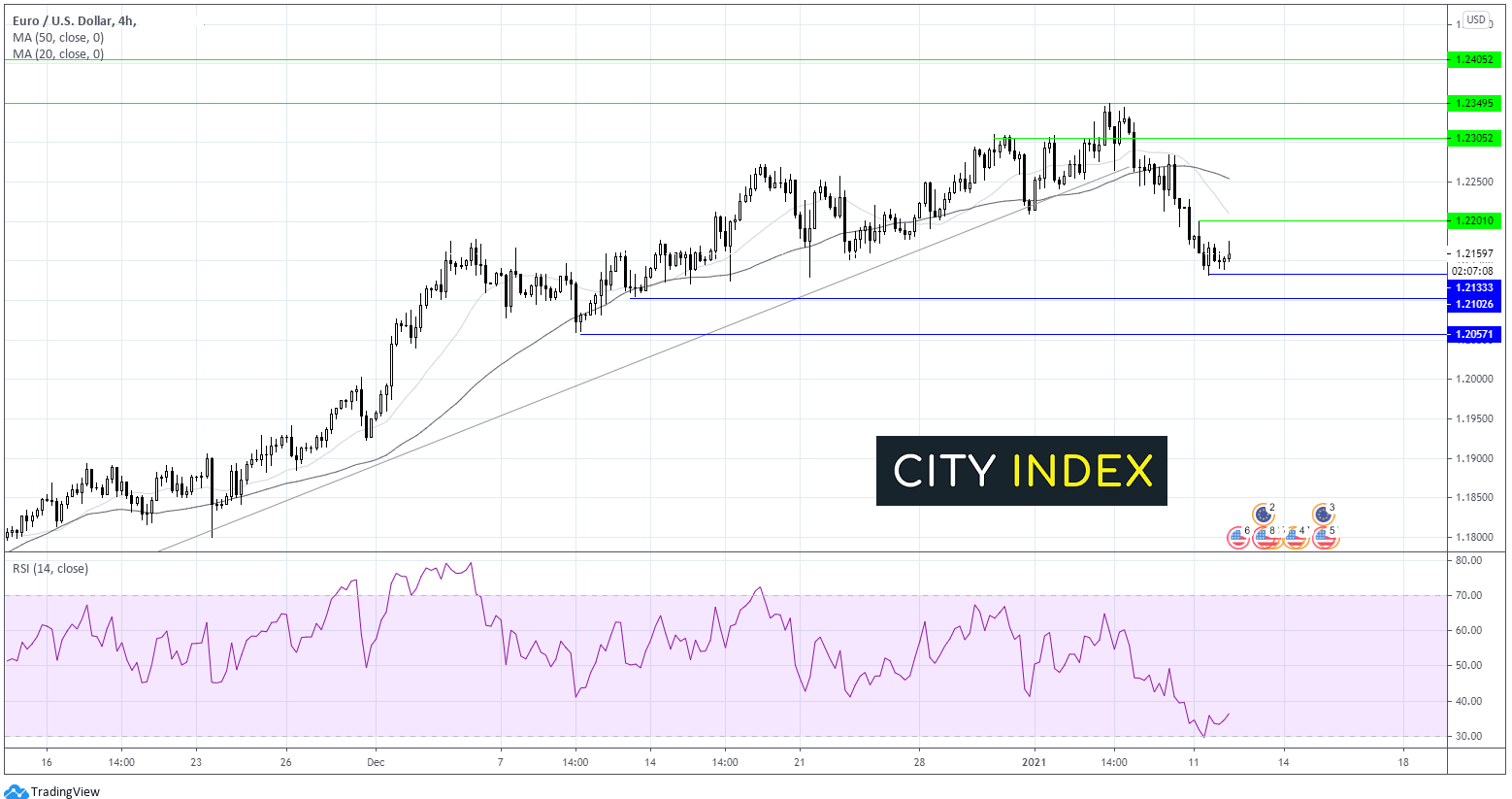

EUR/USD rebounds above 1.2150

• Cautious optimism along with the USD taking a breather as treasury yields stabilize at 1.15% is helping EUR/USD pick up from session lows and retake 1.2150.

• Surging covid cases, vaccine rollout and US politics remain in focus.

• There is no high impacting economic data leaving sentiment & covid developments in the driving seat

EUR/USD technical analysis

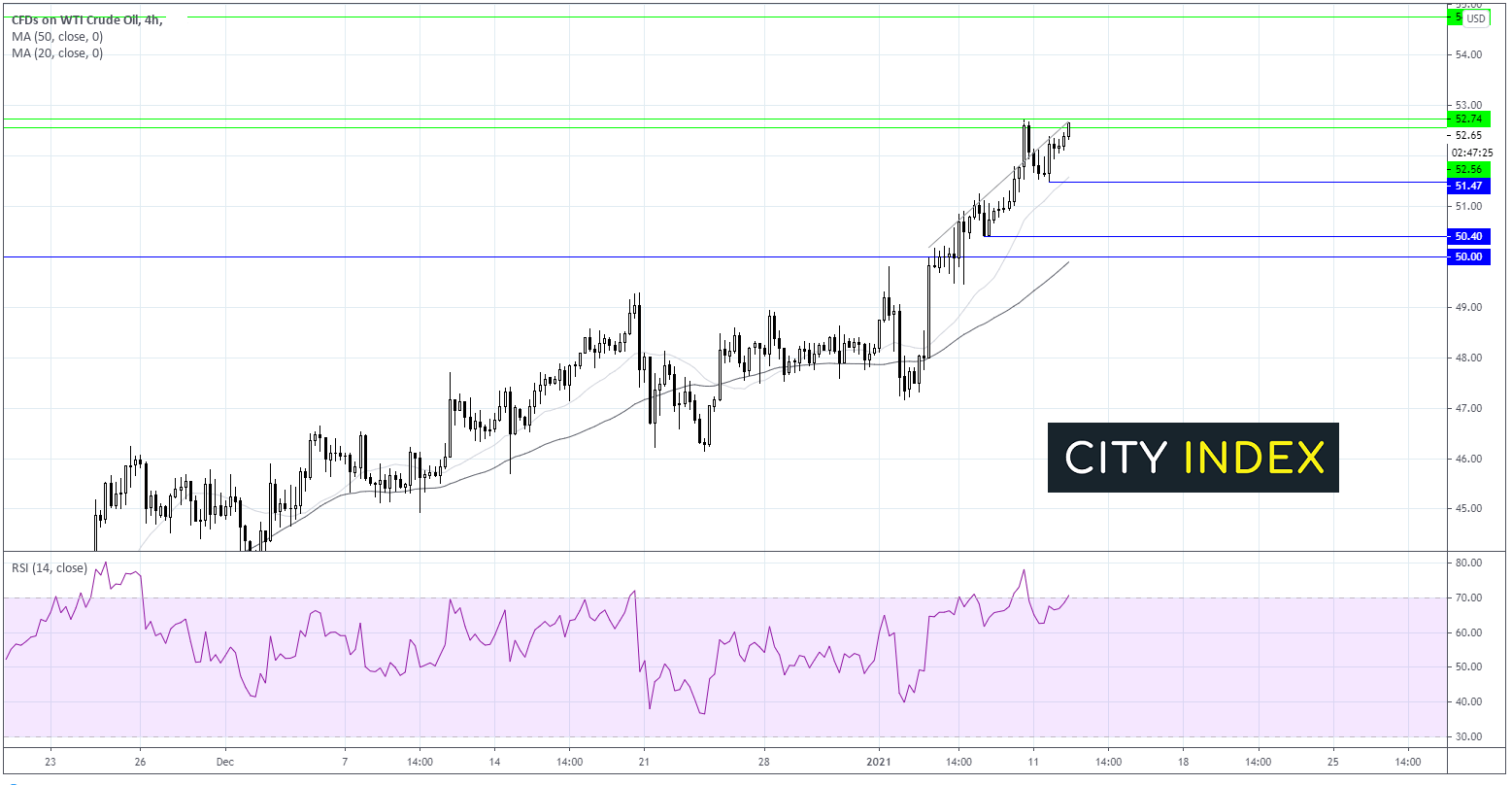

• WTI continues its impressive bullish run advancing for 6 of the past 7 sessions and pushing over $52.

• Helping the case for oil, Goldman Sachs made a bullish call that Brent (currently at $55.50 bp) will rise to $65 by mid-2021 amid a sharp rebound in demand. It expects to see the Saudi output cut and global vaccine rollout to result in a fast tightening of the market.

• Meanwhile rising covid cases and tighter lockdowns conditions are strong headwinds for oil.

• API crude oil inventory data due later is expected to show a drawdown in inventory for the 5th straight week.

Oil also appears to be considering a move above its week old ascending resistance line and its 11 month high at $52.70. Should the bulls refresh this multi month top $54.70 could come into play.

Failure to extend gains beyond $52.70 could see WTI revisit yesterday’s low and the 20 sma of $51.50 prior to $50.40 swing low 7th Jan and key psychological support at $50 which is also the 50 sma.