EUR/USD rises ahead of EZ consumer confidence on hawkish ECB chatter

EUR/USD is rising, building on gains from the previous week and pushing to a 9-month high,

The euro has found support from hawkish ECB comments, pointing to further rate hikes. ECB Governing Council member Klaas Knot said that the ECB would raise interest rates by 50 basis points in February and March and will continue to raise rates after.

His comments come after hawkish comments from ECB President Christine Lagarde last week.

Meanwhile, expectations are growing of a less aggressive Federal Reserve, as investors brush off last week’s hawkish Fed comments and instead consider that slowing inflation and growth will see 25 basis points hikes from the Fed in February and March before a 50 basis point rate cut by the ed of the year.

The Fed is now in the blackout period ahead of the February announcement.

Today the economic calendar is relatively quiet, with just Eurozone consumer confidence in focus, which is expected to improve to -20 in January, up from -22 in December.

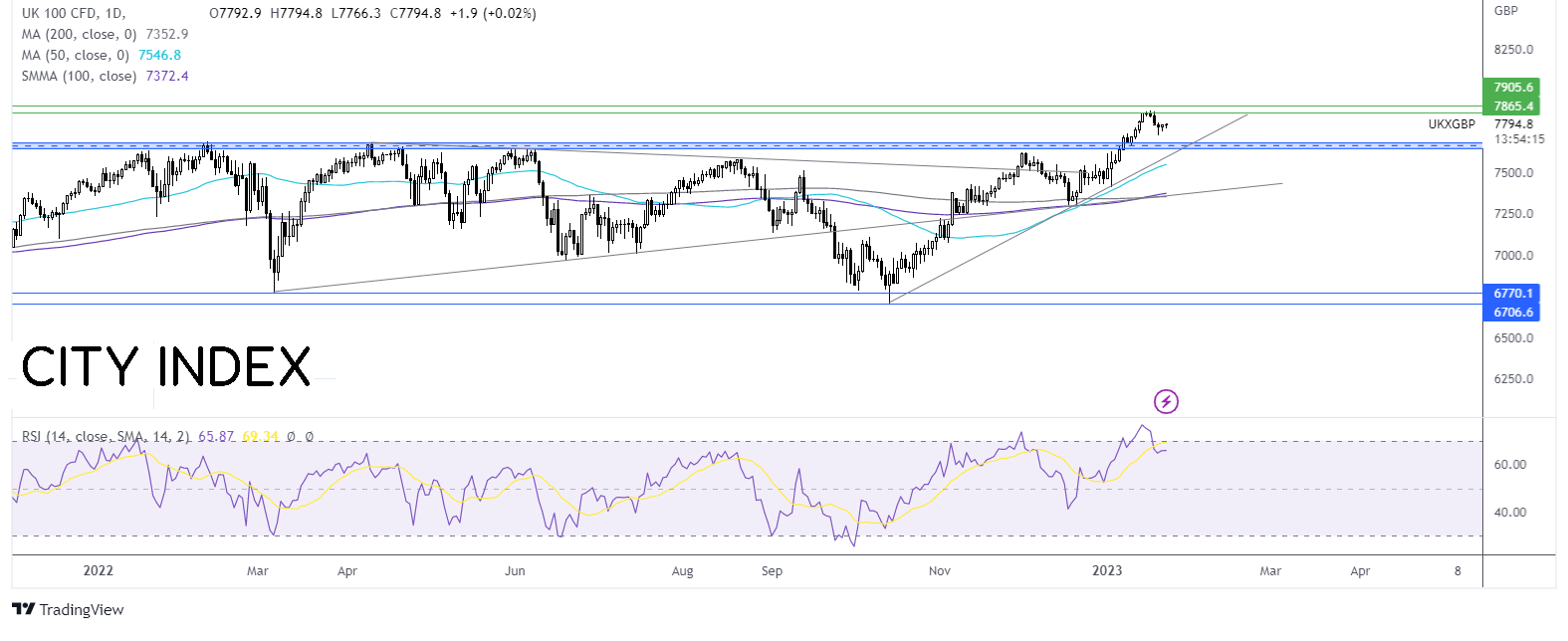

Where next for EUR/USD?

EUR/USD trades within a rising channel dating back to early October. More recently, the pair is consolidating within the channel, suggesting indecision.

Buyers need to rise meaningfully above 1.09, last week’s high, to attack 1.0935, the late April hig,h and bring 1.10 into focus. However, its worth noting that the RSI is teetering on the brink of overbought territory, which could hinder a bullish move.

Meanwhile, support can be seen at 1.0,8 the May high, with a break below here opening the door to 1.074,0 the December high.

FTSE rises cautiously at the start of the week

The UK index is set to open higher, rebounding after losses last week. The index fell 1% in the previous week, marking its third straight week of losses.

Today, the FTSE is being helped higher by a strong close on Wall Street on Friday and an upbeat session in Asia.

Investors appear to be increasingly convinced that the Fed and other major central banks are on the brink of a dovish pivot in policy later this year.

While China is closed for the Lunar New Year, base metals are pushing higher on optimism surrounding the reopening of the Chinese economy.

Today, BAE systems will update the market. Looking ahead, PMI data will be in focus tomorrow.

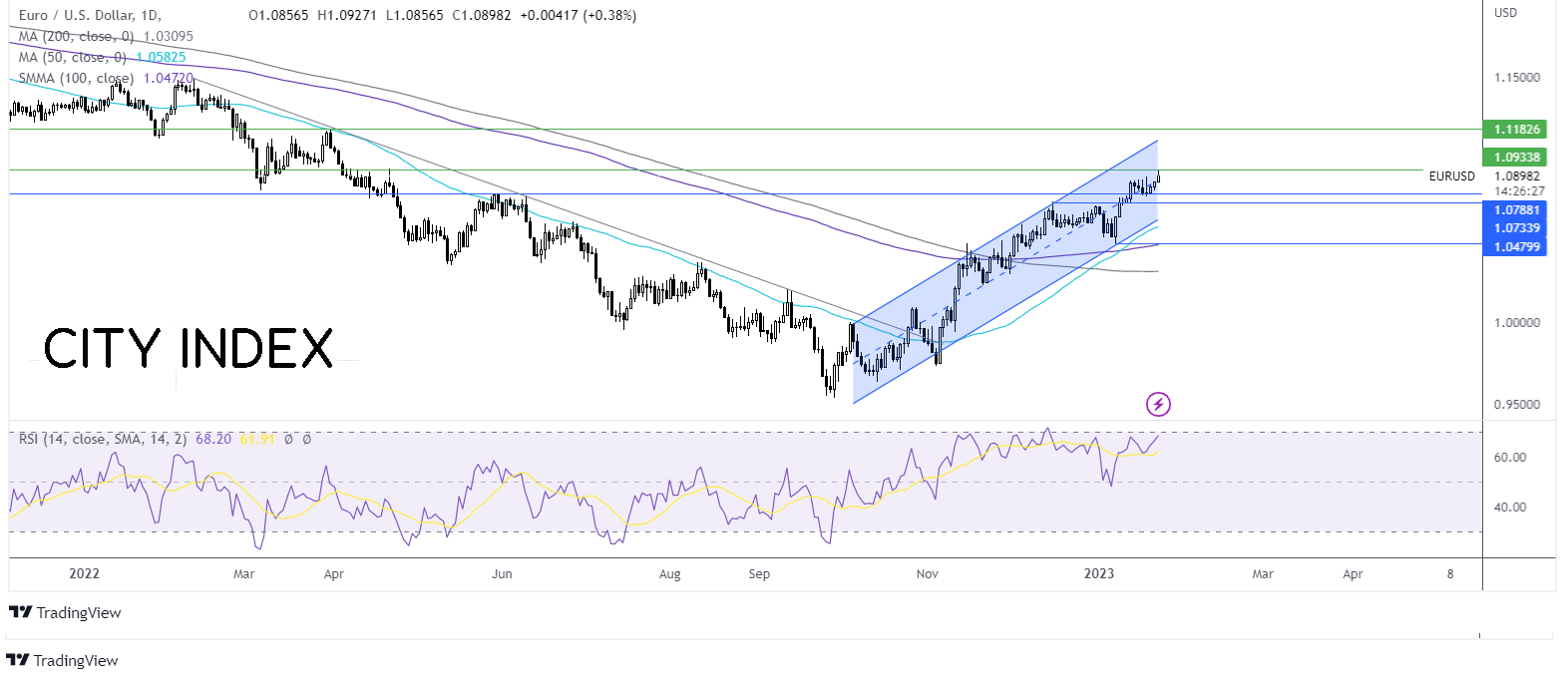

Where next for the FTSE?

The FTSE ran into resistance at 7830 and is consolidating off this level, bringing the RSI out of overbought territory. The price continues to trade above the 50, 100 & 200 sma, and the multi-month rising trendline.

Buyers could look for a rise over 7840 to bring 7905 into view and fresh all-time highs.

On the flip side, sellers could look for a fall below 7725, last week’s low, and 7680, a level that has offered resistance several times across the past year.