EUR/USD trades at weekly high ahead of EZ inflation, US ADP

EUR/USD is edging higher for a third straight session. Easing Fed fears pulled the USD lower at the start of the week helping the euro shrug off mixed data.

Today attention turns to EU inflation. Expectations are for inflation to fall to 4.4% in January, down from 5%. This comes ahead to the ECB meeting tomorrow.

US ADP data is expected to show that private payrolls increased by 207k, down from the 807k in December. A strong number often drives expectations of a strong non-farm payroll number – although that wasn’t the case in December!

Learn more about how inflation impacts forexWhere next for EUR/USD?

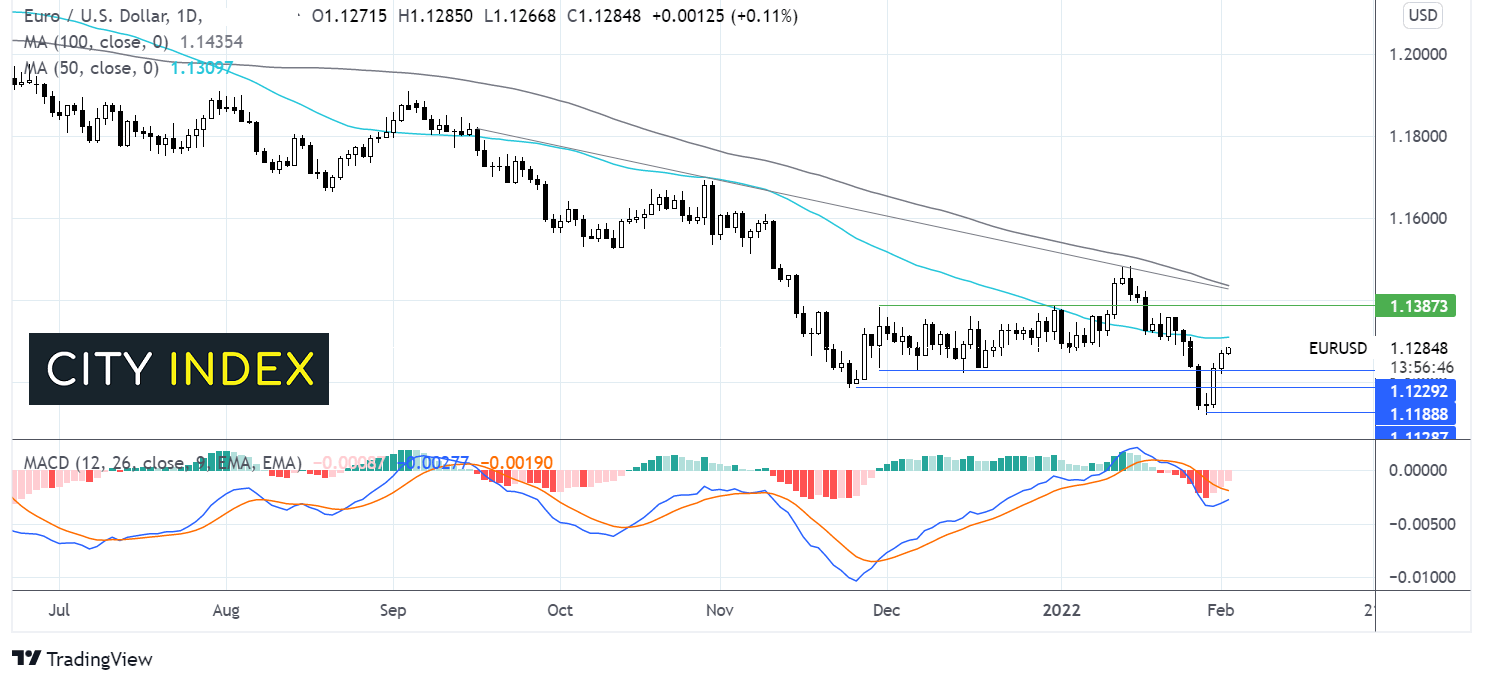

EUR/USD extends its recovery from 1.1120 the 2022 low and has risen up back into the horizontal channel within which the pair traded in across December. The channel is limited by a low band at 1.1225 and an upper band of 1.380. The current move higher is supported by a receding bearish bias on the MACD.

The 50 sma at 1.1310 could act as a key resistance, EUR/USD has traded below its 50 sma across most of the second half of the year. A move above here brings 1.1380 in focus before exposing the 100 sma at 1.1435.

On the downside, a move below 1.1225 could open the door to 1.1190 and 1.1120 the 2022 low.

Alphabet jumps 9% pre-market on record revenue

Alphabet reported a big beat on both top an bottom line sending the share price 9% higher. EPS $30.69 versus the $27.34 expected on revenue of $75.33 billion versus $72.17 billion.

Google cloud revenue came in at $5.54 billion ahead of the $5.47 billion forecast.

The stock also announced a 20 – 1 stock spit to open the share price up to the masses.

Revenue growth of 32% impressed Wall Street, proving that the business has been able to hold up against pressures from he pandemic and rising inflation. Advertising revenue grew 33% to $61.24 billion versus $46.2 billion for the same period a year earlier.

Everything that you need to know about earnings seasonWhere next for Alphabet share price?

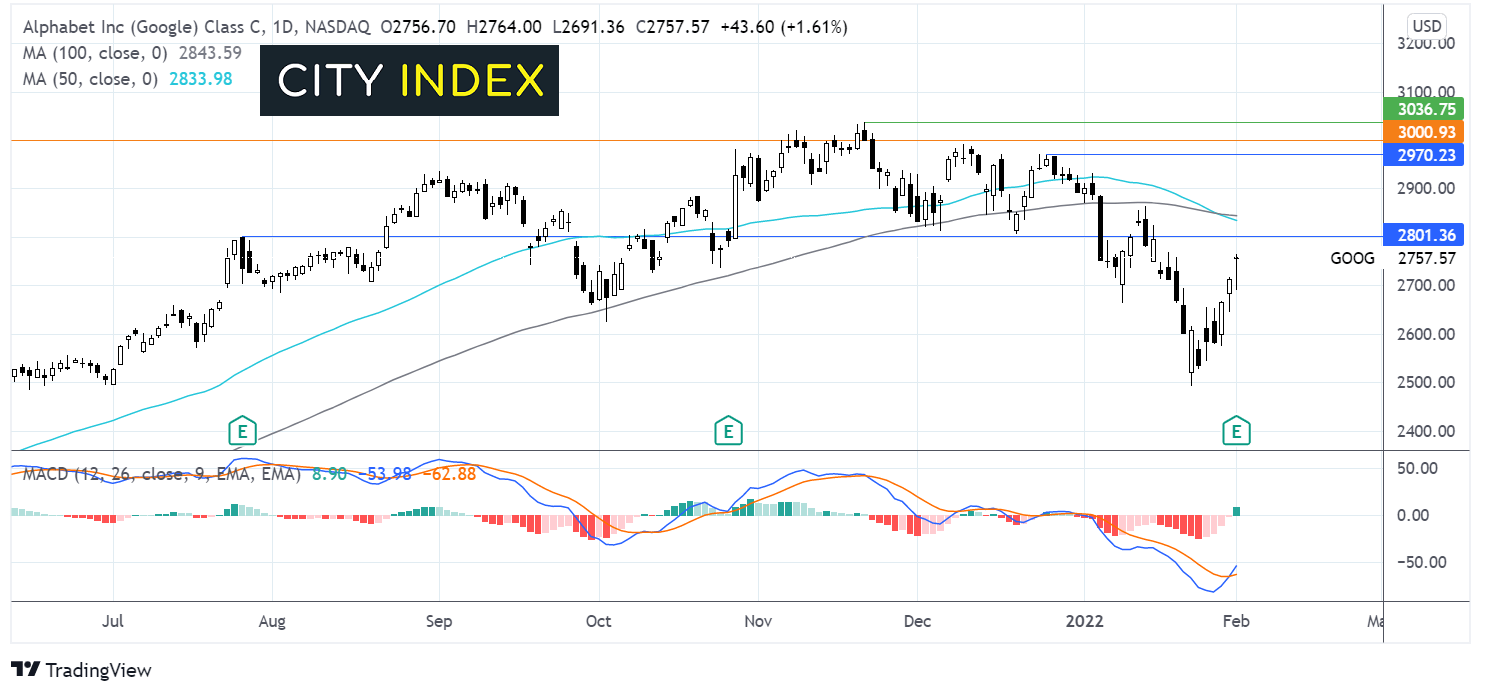

Alphabet has been extending its rise from 2492 low on January 24 with a bullish crossover on the MACD supporting further upside.

The 9% jump takes the price back up to $3000, rising back above the 50 & 100 sma and resistance at 2970 and bringing the all time high at $3037 back into target whilst $2970 will offer support ahead of $2806, a level which has been a key horizontal support and resistance.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.