EUR/GBP rises as UK COVID cases surge

is falling, paring gains from the previous week.

The pound trades under pressure as COVID cases continue to surge in the UK. New daily infections have risen 52% over the past 7 days and the government is refusing to rule out further restriction to stem the spread of the highly contagious Omicron.

Adding to the pound’s woes, Brexit secretary Lord Frost resigned over the weekend. Frost, who had been a key player in the UK Brexit strategy quit over disillusionment with the direction of the government.

Where next for EUR/GBP?

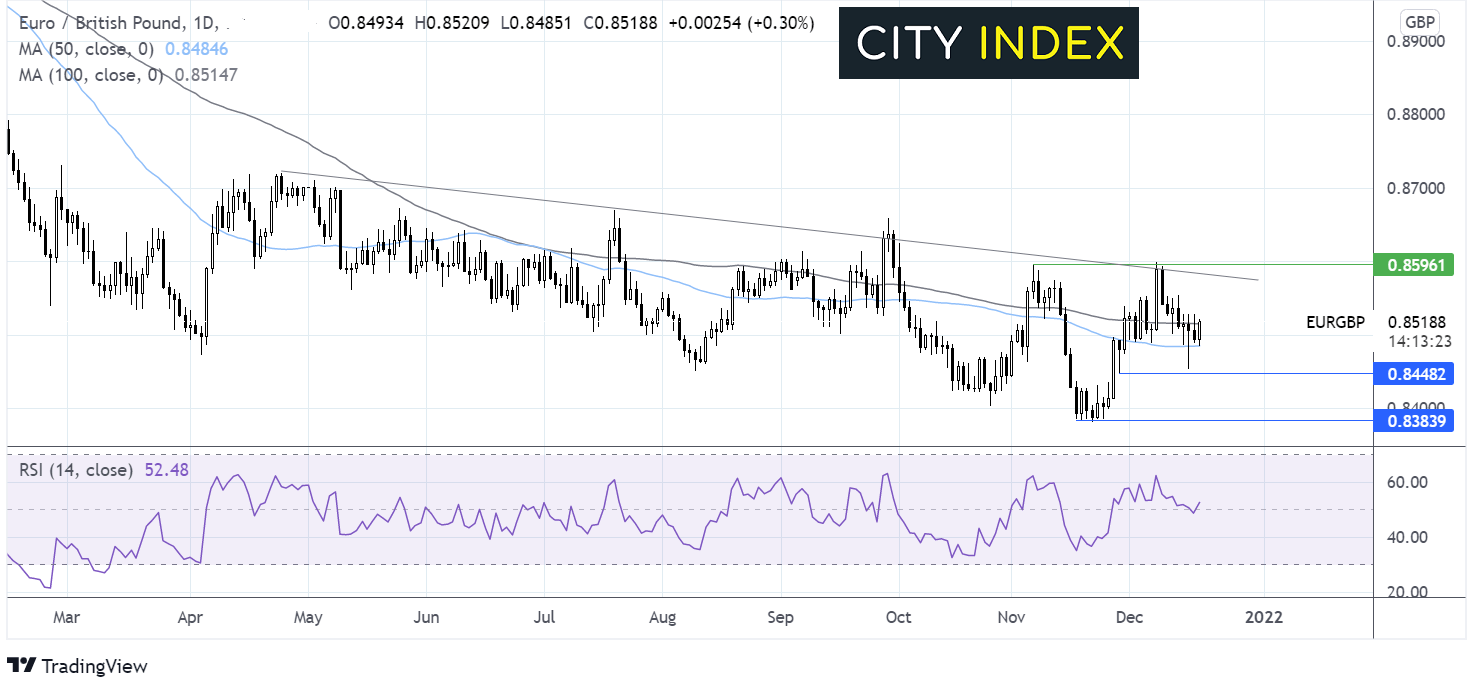

EUR/GBP trades below a multi-month falling trendline in a long term bearish trend.

After facing rejection at the multi-month falling trendline resistance, EUR/GBP moved lower, finding support at 0.8483 the 50 sma.

The price has pushed over the 100 sma and the RSI is edging into bullish territory keeping buyers hopeful of further upside.

Resistance can be seen at 0.8550 last weeks high. A move beyond here could see the falling trendline ne resistance at 0.8580 exposed.

Meanwhile, failure to hold above the 100 sma at 0.8515 could see the 50 sma tested at 0.8480 opening the door to 0.8450. A move beyond here could see the sellers gain traction towards 0.8384 the yearly low.

Oil slumps on Omicron concerns

Oil prices are sliding lower, extending losses from the previous week, as surging Omicron cases are clouding the demand outlook.

Surging cases in Europe have resulted in the Netherlands locking down over the weekend and the UK government refusing to rule out more restrictions.

More restrictions risk hurting global growth and oil demand which often go hand in hand. Investors will be keeping a close eye on Omicron cases in the US where the new strain is set to become the dominant strain.

Separately, the US rig count, which is considered an early indicator for future output rose by 3 to 579 in the week December 17.

Where next for WTI crude oil?

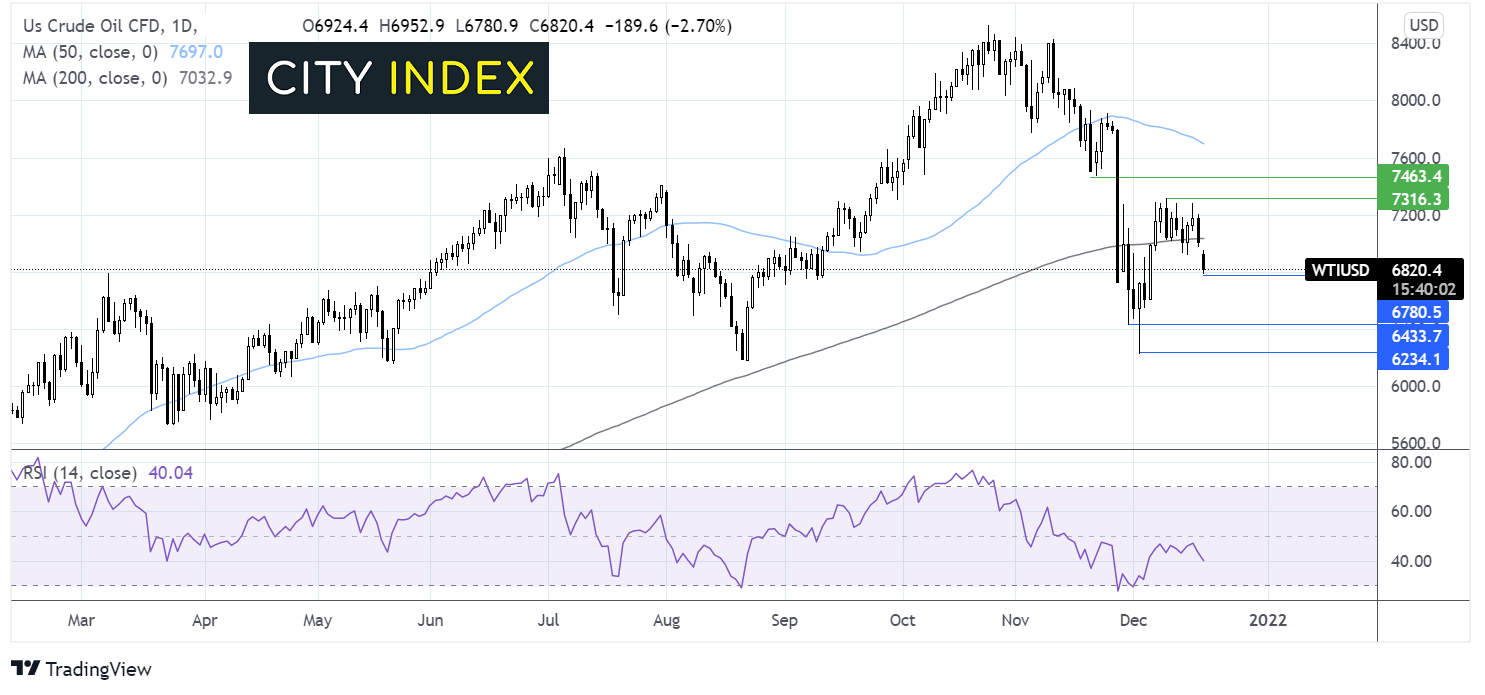

WTI has been trending lower since late October. The price falling below its 200 sma combined with a bearish RSI are keeping sellers optimistic of further downside.

Immediate support can be seen at 67.80 today’s low, with a move below here opening the door to 66.20 December 7 swing low and 64.28 the November low.

Meanwhile, buyers would look for a move back over the 200 sma at 70.22 to bring73.16 the December high into play.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.