EUR/GBP falls after post-Brexit deal agreed & with inflation in focus

- GBP supported by NI Brexit trade deal

- EUR could rise on hot France, Spain inflation

- EUR/GBP breaks unconvincingly below rising channel

EUR/GBP is falling, extending losses from the previous session after a post-Brexit trades deal was agreed upon and as investors look ahead to the release of French and Spanish inflation data.

UK Prime Minister Rishi Sunk announced yesterday that a deal had been agreed upon with the European Union on post-Brexit trade rules for Northern Ireland. The deal hopes to resolve tensions caused by the Northern Ireland protocol, one of the most content parts of the Brexit deal.

The deal, which must now be agreed upon by the UK parliament, could pave the way for improved relations between the UK and Brussels. The removal of uncertainty is expected to improve business confidence and investment, helping growth, which has been pressurized since the Brexit deal in 2016.

There it's no high-impacting UK economic data today however, investors will be looking at speeches from BoE policymakers, including Huw Pill, Catherine Man, and John Cunliffe.

Meanwhile, the euro is finding some support from hawkish ECB comments from Philip Lane, who said that the case for a 50 basis point rate hike in March remains solid. His comments come after eurozone core inflation unexpectedly rise last week.

Today inflation data from Spain and France is expected. While Spain is set to see inflation cool, France’s CPI is expected to rise to 6.1% YoY, up from 6%.

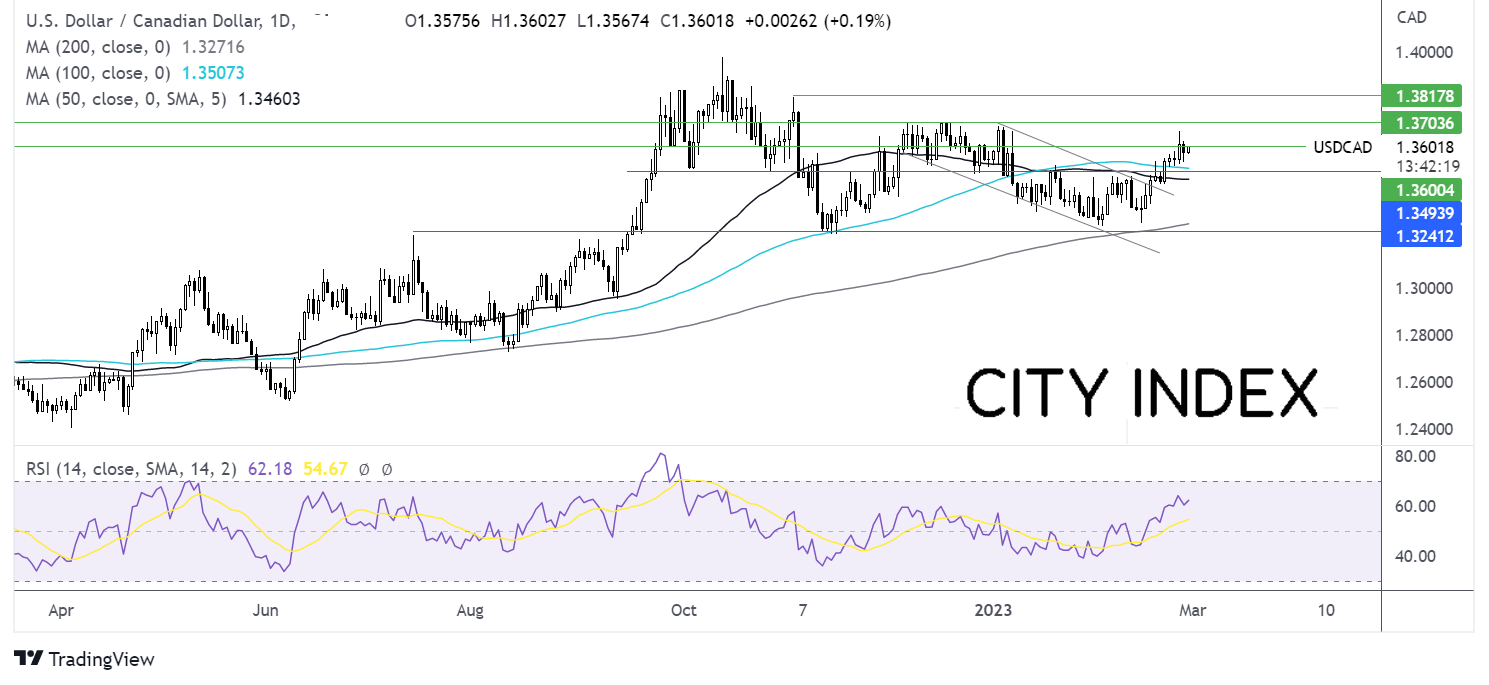

Where next for EUR/GBP?

EURGBP has fallen out of the rising channel dating back to early October. However, the long lower wick means that the breakout looks unconvincing.

Sellers will need to take out today’s low of 0.8780 to extend the bearish trend towards 0.8750 the 100 sma.

Meanwhile, buyers will look for a rise above 0.88 back into the rising channel and towards the 50 sma at 0.8835. A rise above here brings 0.89 into focus, the January high.

USD/CAD rises ahead of US consumer confidence & Canada GDP

- CAD GDP to stall at 0% MoM December

- US consumer confidence to rise again to 108.5

- USD/CAD heads towards 1.36

USD/CAD is rising, reversing losses from yesterday as investors look ahead to the economic calendar and despite oil prices pushing higher.

While oil is advancing on hopes of a solid economic recovery in China, the loonie isn’t tracking the price higher.

Instead, CAD looks towards GDP data which is expected to show that the economy stalled in December at GDP 0%.

Meanwhile, the USD is rising across the board as investors price in a more hawkish Federal Reserve, with rates rising higher for longer. Bets are rising that the Fed could lift rates to a peak of 6%.

Today attention will be on YS consumer confidence data which is expected to rise again in February to 108.5, up from 107.1. Stronger than forecast consumer confidence could lift the USD higher.

The US house price index and goods trade balance is also due.

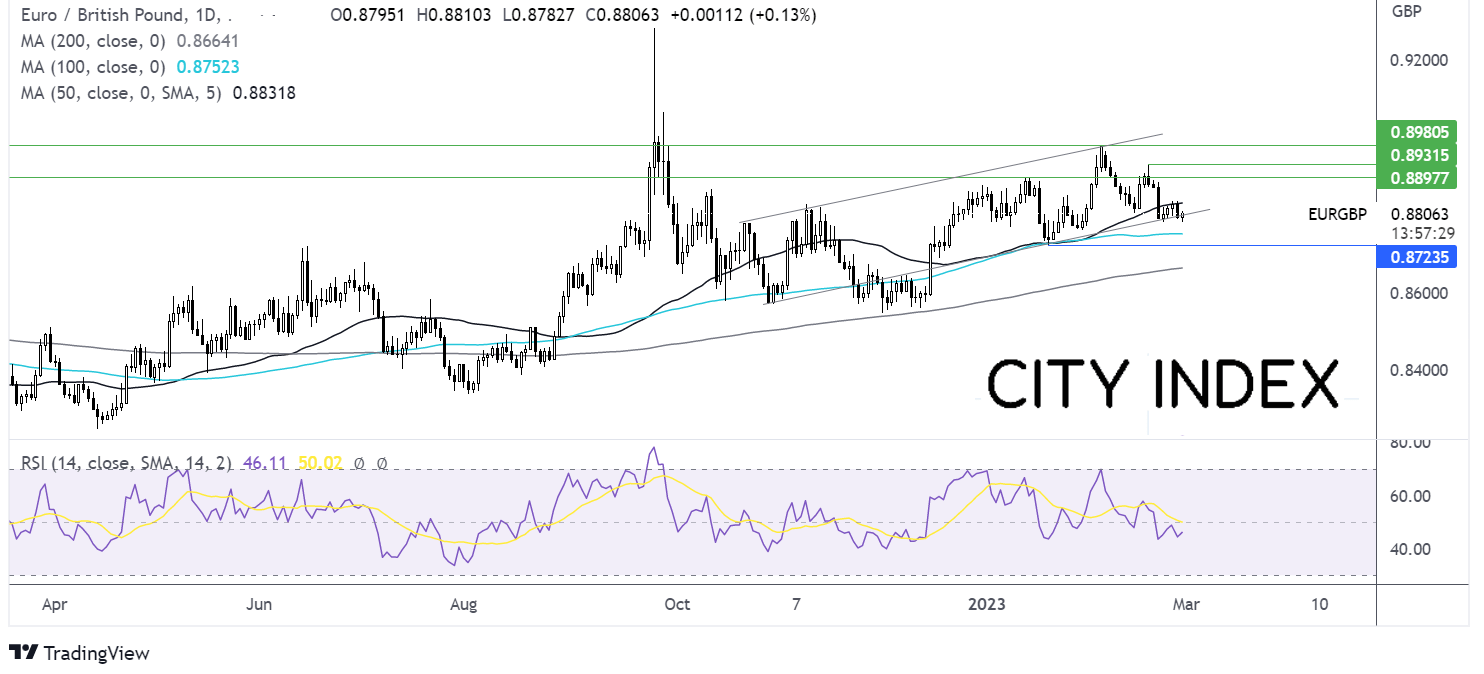

Where next for USD/CAD?

USD/CAD is extending its breakout from the falling channel, rising above the 50 & 100 sma. Buyers will look for a rise above 1.3665, the February high, and to extend the bullish trend towards 1.3685 the 2023 high.

Sellers could look for a break below 1.35 the 100 sma to expose the 50 sma at 1.3470. A break below 1.3440 is needed to create a lower low.