EUR/GBP holds gains post central bank announcements & ahead of PMI data

EUR/GBP is holding steady after four straight days of gains. The pair rallied 0.5% yesterday as investors digested the BoE and ECB interest rate announcements and considered the ECB the most hawkish of the two.

While both central banks raised interest rates by 50 basis points, the BoE downwardly revised its inflation forecast for this year and removed the more hawkish elements of the statement, hinting at a 25 bps hike in March.

Meanwhile, the ECB hiked by 50 basis points and said that the disinflationary process hadn’t started and hinted to another 50 bps hike in March.

Attention is now turning towards UK & Eurozone composite PMI data, which are expected to confirm the preliminary readings of 47.8 (UK) and 50.2 in Europe.

Eurozone PPI data is also due and is forecast to show the inflation cooled to 22.5% YoY in December, down from 27.1%.

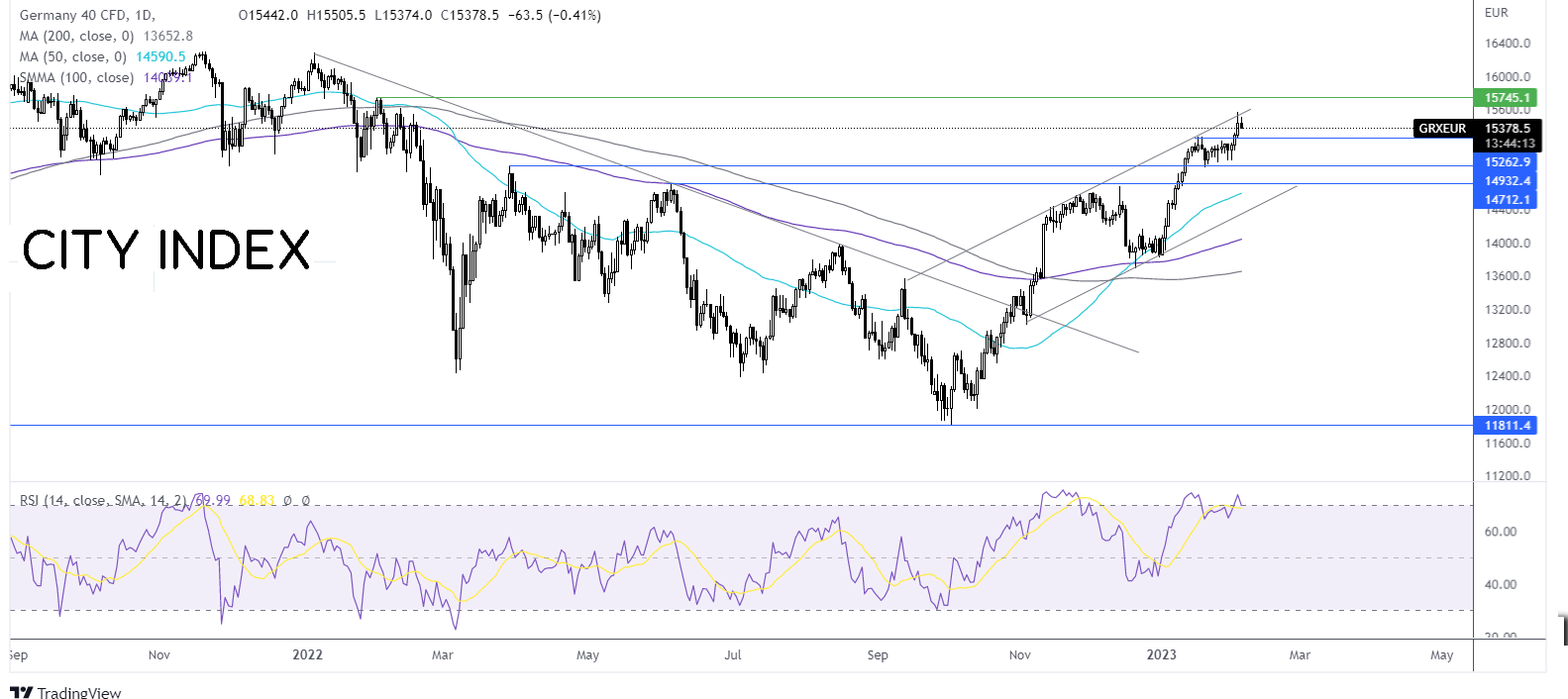

Where next for EUR/GBP?

After rebounding off the rising trendline support at 0.8760, EURGBP pushed higher and broke above 0.89, the previous 2023 high running into resistance at 0.8955. The RSI supports further upside while it remains below 70, overbought territory.

Buyers could look for a rise over 0.8955 to extend the bullish run towards 0.90 round number.

Meanwhile, immediate support can be seen at 0.89, with a break below here opening the door to 0.8850 the January 24 high and 0.8775 the rising trendline support.

DAX falls as risk sentiment falters & ahead of NFP

The DAX is heading lower, paring gains from the previous session as investors continue digesting the central bank bonanza, disappointing data from big tech after the close and look ahead to the release of EU S nonfarm payroll reports.

Apple, Amazon & Alphabet, technology bellwethers, posted results on Thursday after the close which showed the economic slowdown crimping demand for e-commerce, digital advertising, electronic devices and cloud computing, sending the stocks sharply lower and hitting risk sentiment more broadly across the financial markets.

The negativity is setting European stocks off to a weaker start on Friday. Across the European session, German composite PMI data is expected to confirm 49.7 in January, up from 49 in December.

Sentiment in the afternoon will be driven by the US non-farm payroll data, which is expected to show 190k jobs created last month. Wage growth is forecast to hold steady at 0.3%, and unemployment tick higher to 3.6%.

The weaker ADP payroll figure but stronger US jobless claims numbers suggest that notoriously volatile numbers from payroll figures could come in roughly in line with expectations. A weaker-than-forecast report could support a less hawkish Fed and give stock markets a boost.

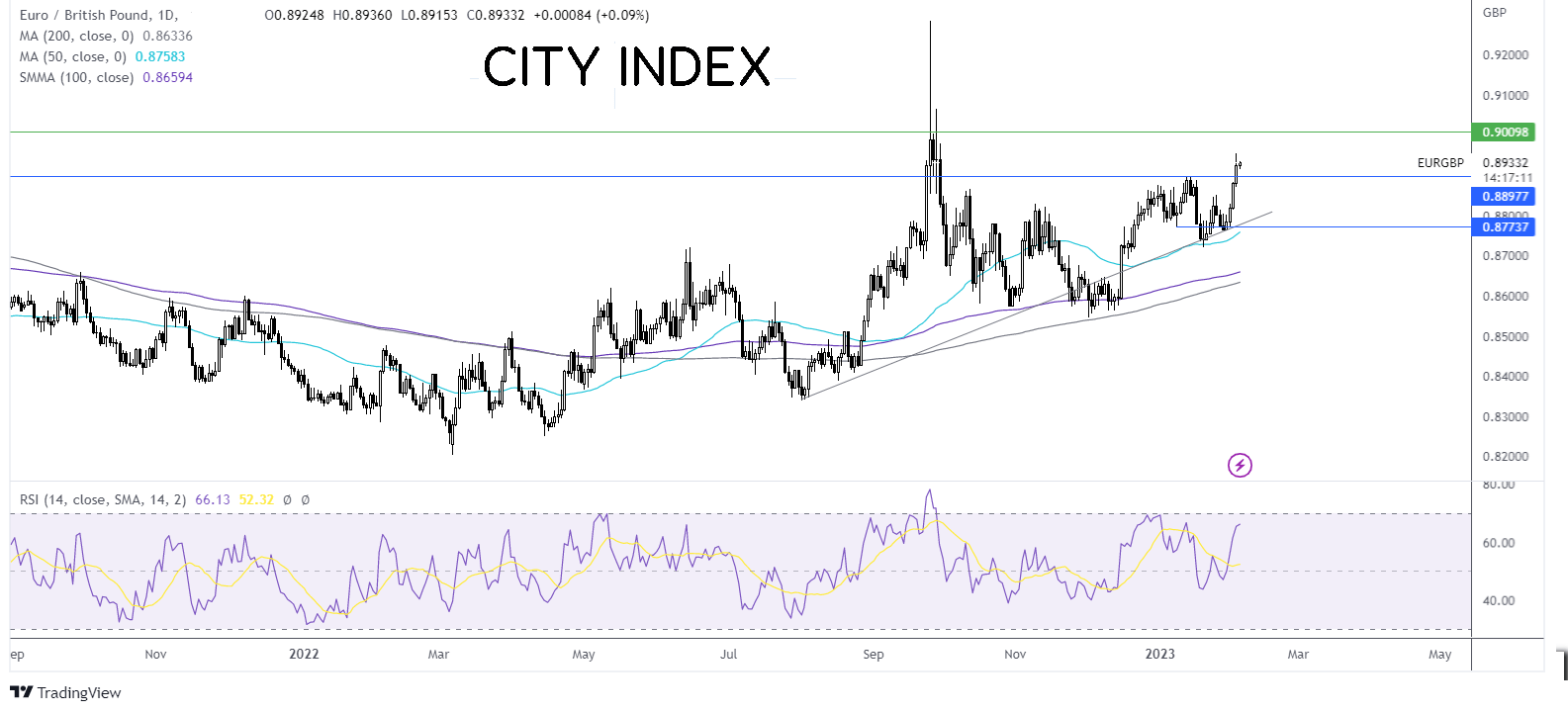

Where next for the DAX?

The DAX trades at the upper end of the multi-month rising channel. The price broke above resistance at 15270, the mid-January high, running into resistance at 15570. The RSI is in overbought territory so buyers should be cautious; a fall lower or some consolidation could be on the cards. The long upper wick on yesterday’s candle suggests that there much acceptance at the higher price.

Sellers could look for a break below 15270, opening the door to 14900 the January 19 low and 14700 the December high.

Bue5rs could look for a rise above 15570 to create a higher high and bring 15745 the February high into play.