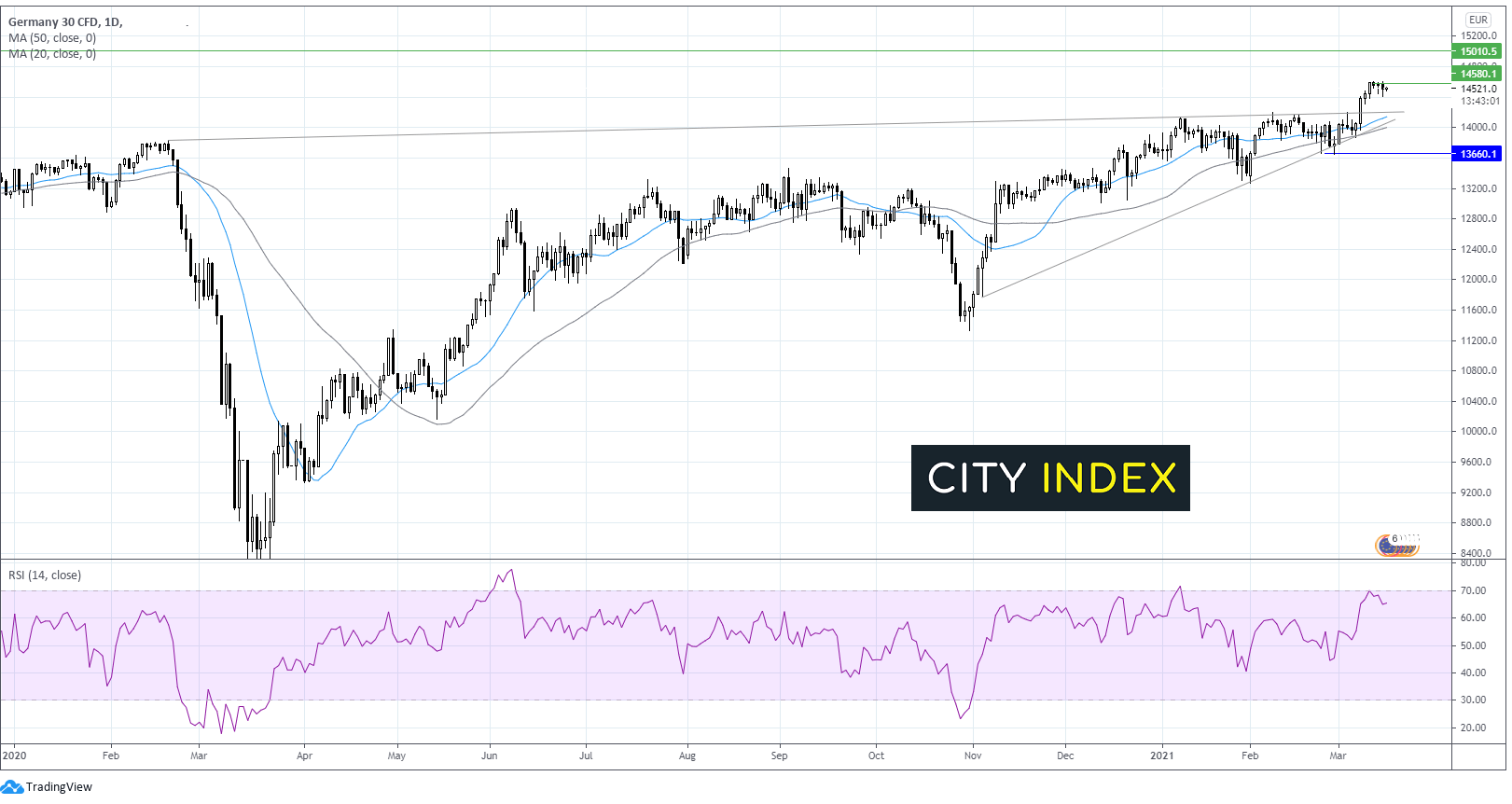

Support can be seen at 14200 trendline followed by 14000 round number and 13660 swing low February 24.

WTI picks off lows ahead of API data

With covid cases rising again in the likes of Germany, France and Italy and the AstraZeneca vaccine suspended concerns over further lockdowns and demand are weighing on crude.

The slow vaccination programme in the region is adding to the concerns.

Concerns that the Texas storm could continue to boost inventories are also weighing. Inventories increased by 12.8 million in the week ending 5th March.

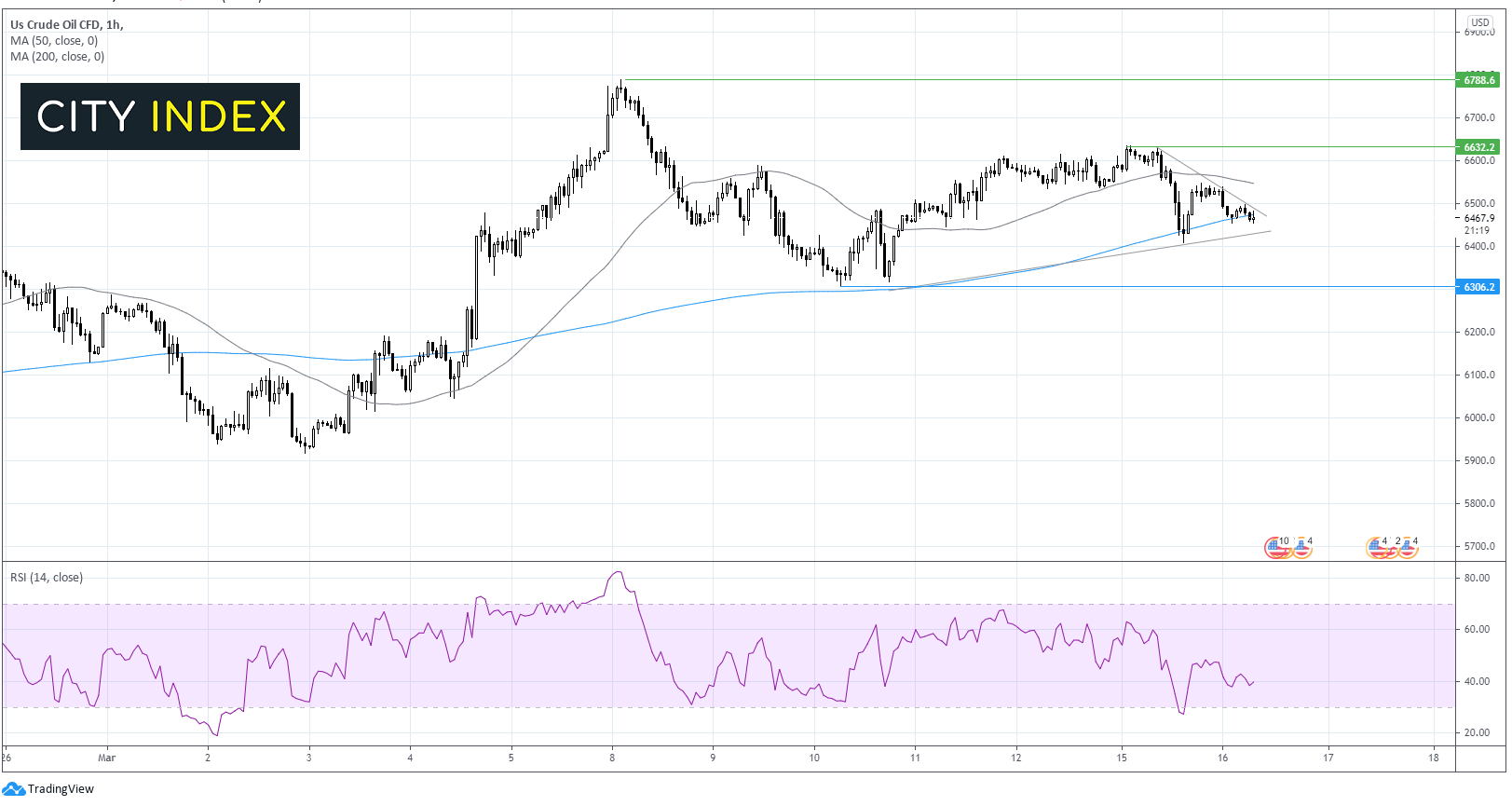

Where next for WTI US crude oil?

WTI is extending losses for a third straight session. After picking up off 64.00 low yesterday, the price is currently testing the 200 hour moving average at 64.75. Whilst the RSI is mildly bearish it is pointing northwards so further trimming of losses could be in store.

Should this level hold then oil could look to target $65.00 the upper band of the descending trendline dating back to yesterday. A break above this level could see the 50 sma tested at 65.50 ahead of 66.30 Monday’s high. A meaningful move above this level will negate the bearish trend.

Failure for the 200 HMA to hold could see the bears look to break through the lower band of the ascending trend line before targeting 63.00 low March 10.