Dax attempts to climb higher, German CPI, EZ & US consumer confidence in focus

European bourses are edging higher after more record highs on Wall Street. Asian shares were pressured by concerns over Delta variant.

Attention will turn to German CPI data which is expected to show that inflation eased in June to 2.3% YoY, down from 2.5% in May. On a monthly basis CPI is expected to tick lower to 0.4% down from 0.5%.

Eurozone consumer confidence could also impact on sentiment as could US consumer sentiment data due later

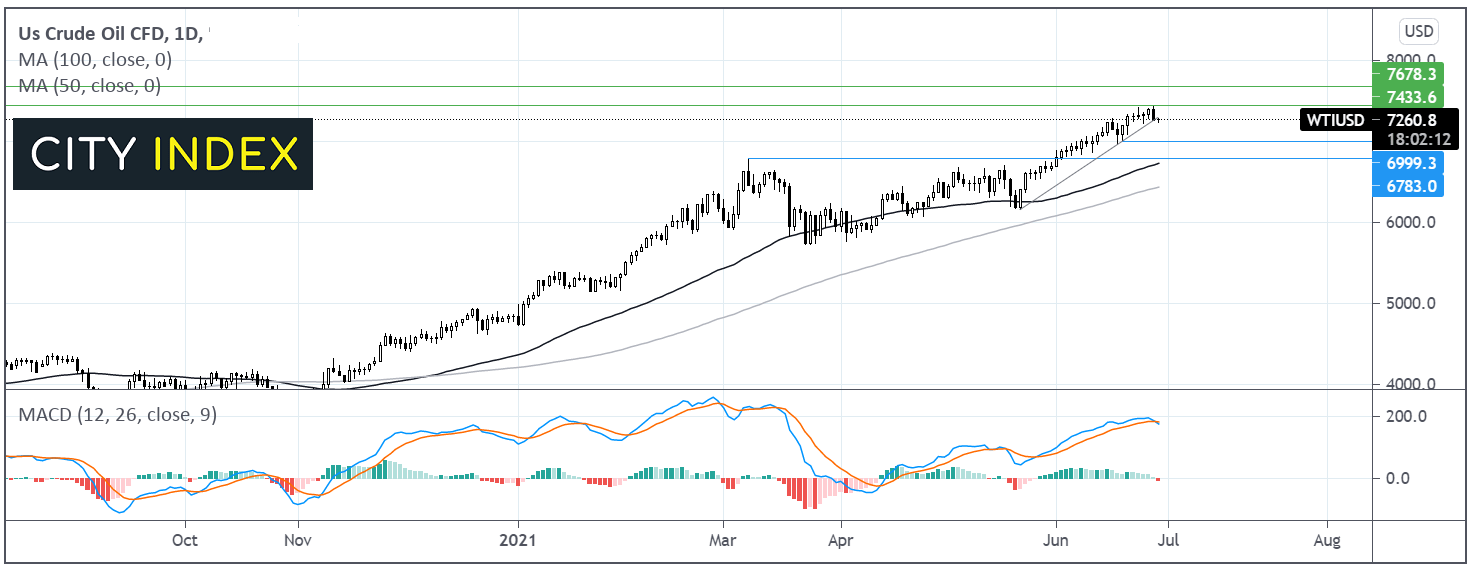

Where next for the Dax?

The Dax has been trending lower since reaching its all-time high of 15800 on June 15. The index trades below its two week descending trendline and below its 50 & 100 sma on the 4-hour chart.

The 50 sma crossed below the 100 sma in a bearish signal. The MACD also appears to be forming a bearish crossover keeping the sellers hopeful.

Support can be seen at 15500 a level which has capped losses several times in June. A break below here could see the sellers attach 15440. It would take a move below this level for sellers to gain traction and target 15270.

Any recovery would need to retake the 50 sma at 15585 followed by 15630 the confluence of the 100 sma and the descending trendline, which could prove a tough nut to crack. Beyond there buyers could eye 15750 and then the all-time high beyond 15800.

Oil ahead of API inventories

Oil prices fell on Monday and downside pressure could continue as investors digest rising delta variant covid cases and look ahead to the OPEC+ meeting later in the week.

The cartel will meet on Thursday where they are expected to increase supply by around 500,000 barrels per day amid the ongoing economic recovery.

That said the highly infectious Delta variant of covid is unnerving the market as Australia enter a two week lockdown and the UK is struggling to contain it.

API crude oil inventory data is due later today.

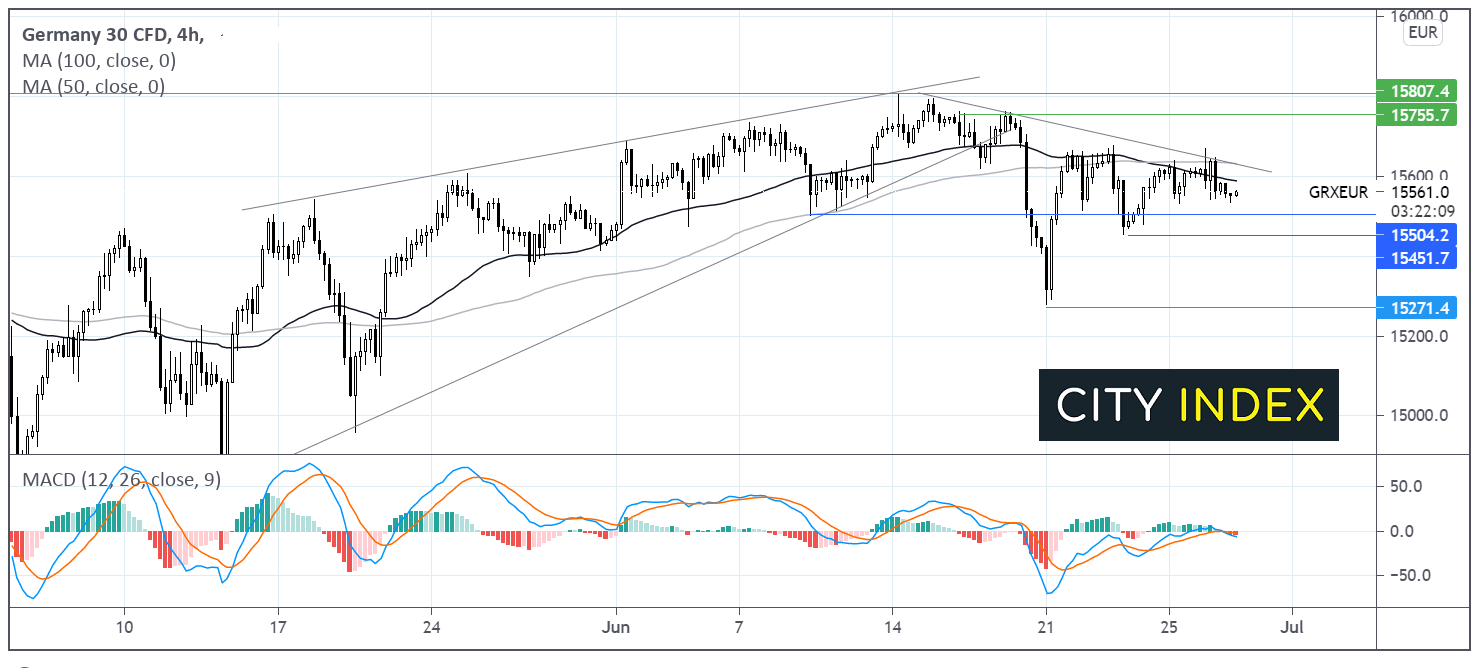

Where next for oil prices?

WTI crude oil is attempting to break below its ascending trendline dating back to late May. The RSI is forming a bearish crossover supporting further losses.

Any move lower would need to meaningfully clear below the trendline support, which would open the door to 70.00 the key psychological level. A break below there could open the door to 67.70/40 zone the March 9 high and 50 sma.

Failure to break meaningfully below the ascending trendline could see the oil price continue on its scent back towards 74.20 last week’s two and a half year high ahead of 76.80 the October 2018 high.