- After a strong close on Wall Street and record highs in Asia overnight, the Dax is also extending gains to fresh record highs over 14,000 amid vaccine optimism and hopes of a strong economic recovery.

- German industrial production +0.9% vs 0.7% exp.

Learn more about trading indices

US Dollar Index Tests 90.00 ahead of US jobs report

- US Dollar Index is pushing modestly higher ahead of the European open, extending gains from the previous session.

- The closely watched jobs report is expected to show a continued weakening in job creation with just 71k new jobs expected in December down from 245k in November.

Read my colleague Matt Weller’s NFP preview piece

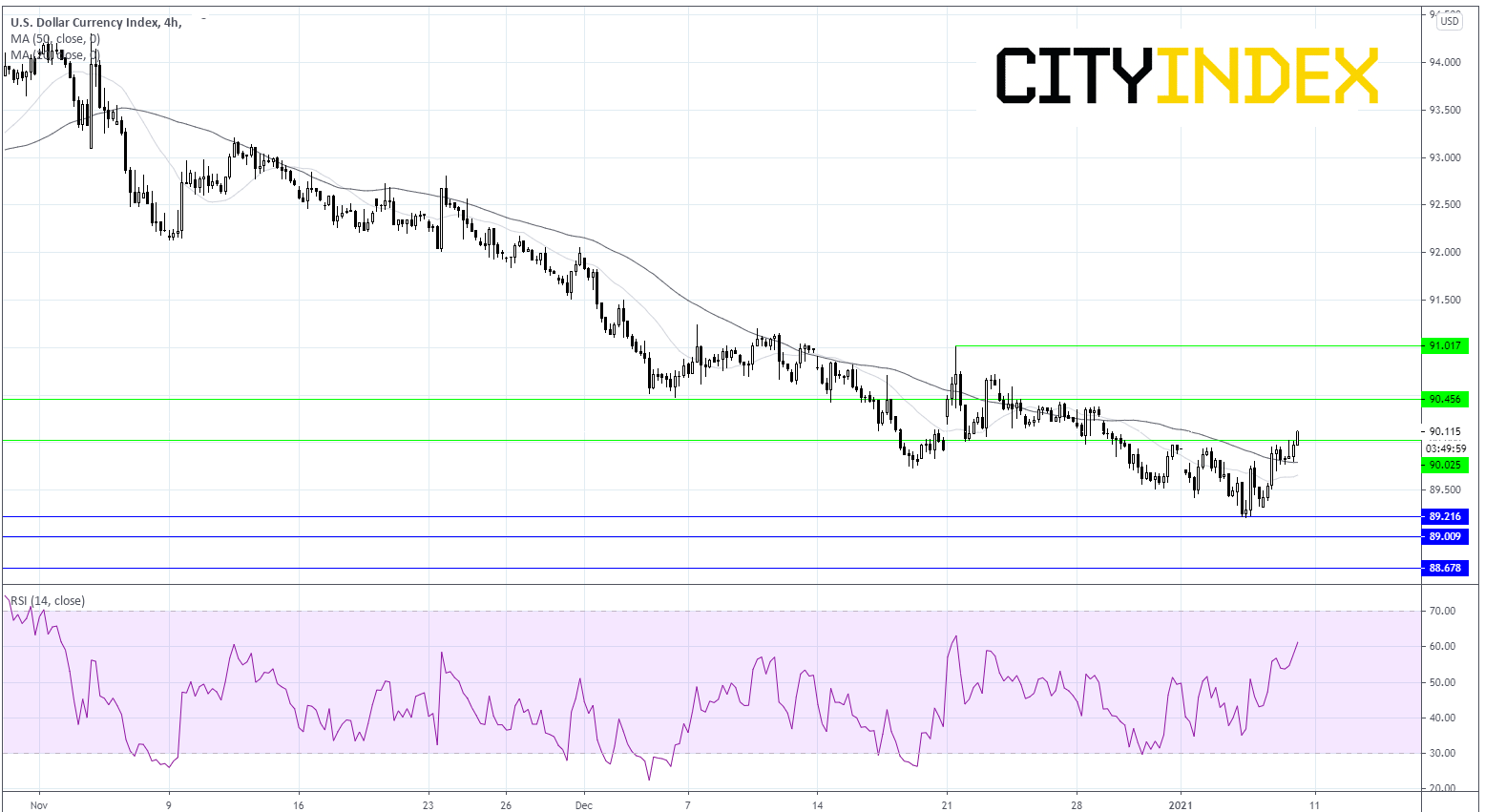

The US Dollar Index has been trending lower since late March last year and whilst the trend on the daily chart is still bearish, the 4 hour chart is showing signs of a reversal at least in the near term.

DXY has picked up off its fresh multi year low of 89.20 and heading towards the key psychological level of 90.00.

DXY pushed above its 50 sma and its 100 sma on the 4 hour chart whilst the RSI is also in bullish territory above 50 but below 70 the over bought level. These signals suggest there could be some more upside on the cards.

However, that would depend on whether DXY price can push above immediate resistance at 90.00. A break above this key level could bring 90.44 into focus. A break above this level could negate the current bearish trend and bring 90.60 into play before 91.00.

On the flip side look out for 89.2 January low and multiyear low, prior to 89 a key level in 2018 and 88.6 a high from 2010.

Learn more about trading forex