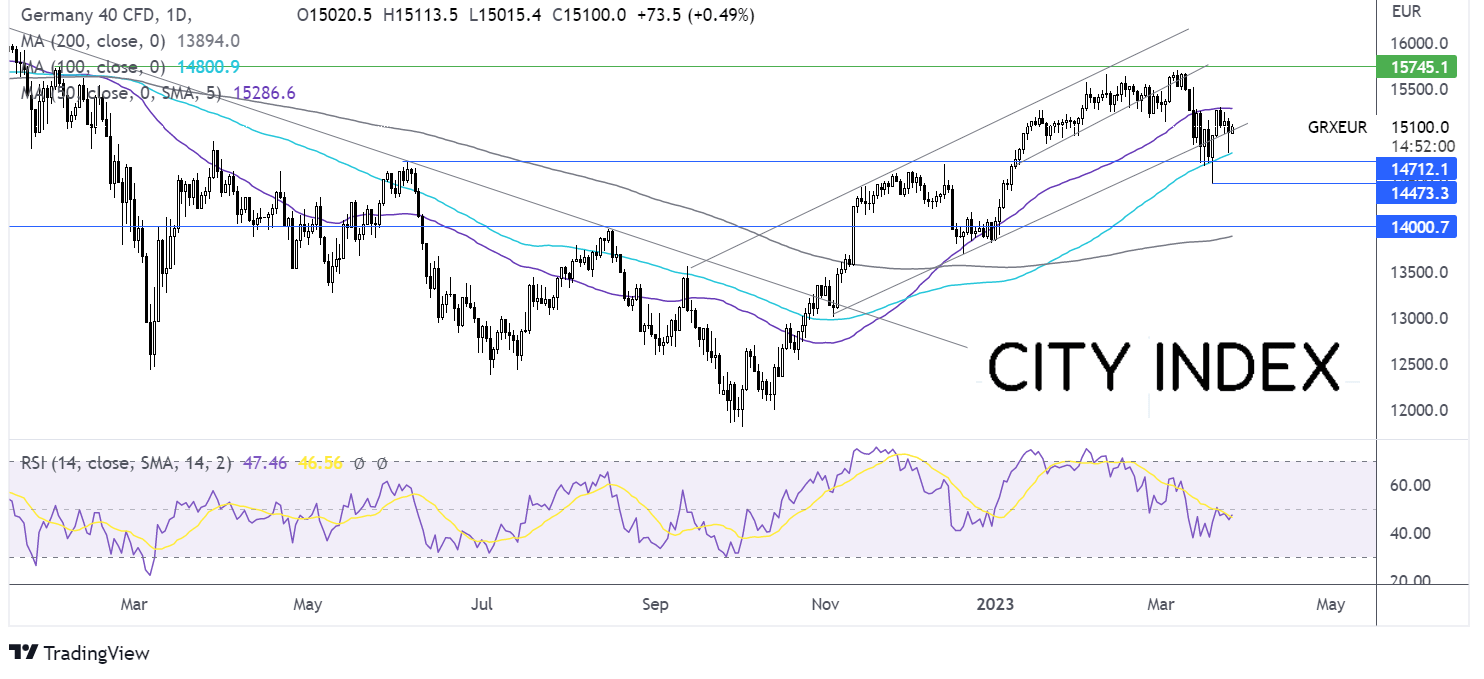

DAX rises as banking jitters ease and with IFO business climate data in focus

- DAX rises as banking jitters calm

- German IFO business climate data to ease to 91

- DAX attempts to break into rising channel

The DAX is pointing to a stronger start after weakness at the end of last week. The index tumbled 1.66% on Friday amid jitters within the banking sector shifted their focus from Credit Suisse to Deutsche Bank. Fears of this German bank being on the edge of collapse sent the share price over 8% lower.

German manufacturing PMI was also weaker than forecast showing a deeper contraction that expected. However, the service sector grew at a faster pace than expected to 53.9 up from 50.9.

Today the market mood is brighter amid hopes that authorities and regulators can ring fence stresses within the banking sector.

Banks will remain under the spotlight. Attention will also be on German IFO business climate data which is expected to slip to 91 in March down from 91.1 and 5 months of improving.

ECB officials Franks Elderson and Isabel Schnabel will also speak today.

Where next for the DAX?

The DAX once again found support on the 100 sma on Friday at 14800, before rebounding. The price is attempting to rise back into the multi-month ascending channel.

A rise above 15000 psychological level is a bullish signal; investors will now be looking for a rise above 15190, Friday’s high to expose the 50 sma at 15286, which is also last week’s high. A rise above here creates a higher high.

On the flip side, failure to push back into the ascending channel could see the price fall back to wards support at 15000 and 14800. A break below here creates a lower low and brings 14700 into focus.

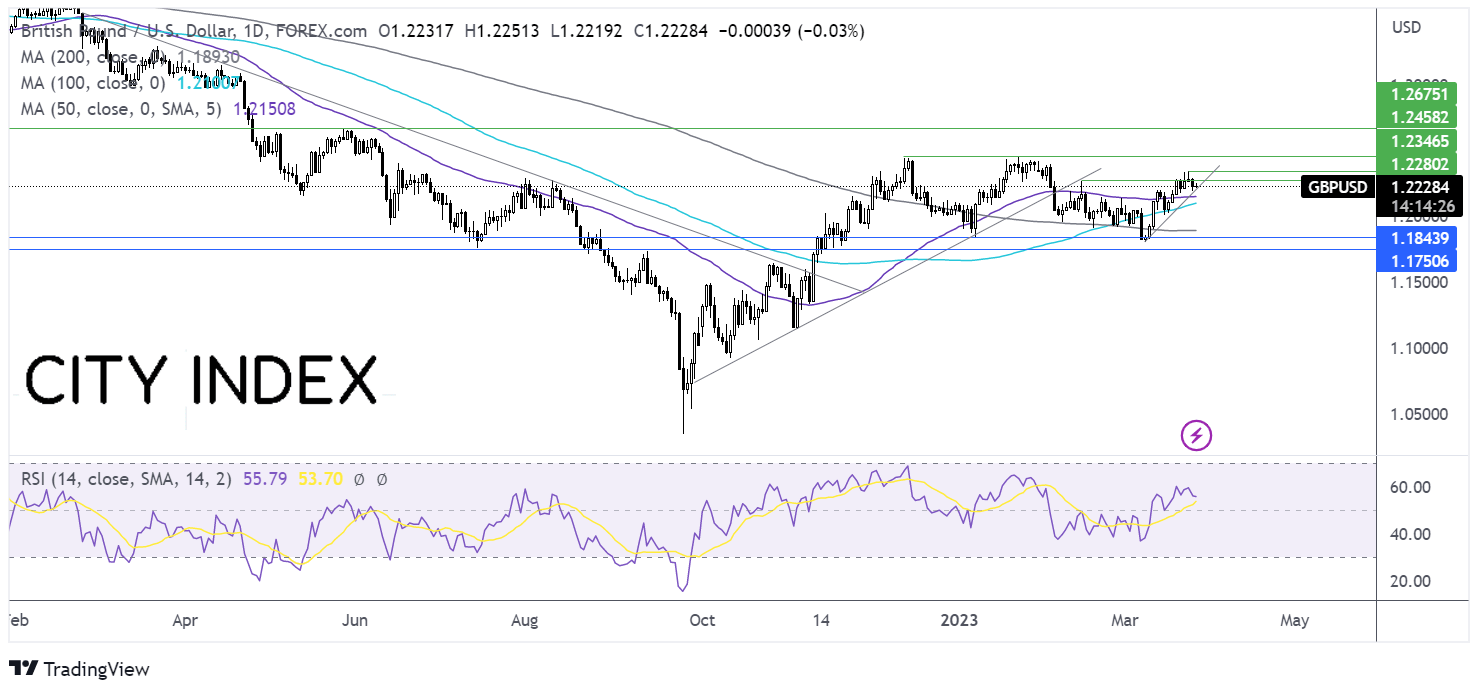

GBP/USD rises ahead of BoE’s Andrew Bailey

- GBP/USD rises after gains last week

- BoE’s Andrew Bailey due to speak

- GBP/USD looks to resistance at 1.2270

GBP/USD is edging higher at the start of the week after booking 0.45% gains across last week.

The pound gained last week after the BoE raised interest rates by 25 basis points to fight persistently high inflation, which rose to 10.4%.

Mixed data on Friday, after UK retail sales rose by more than expected, jumping 1.2% MoM, but the UK composite PMI eased to 52.2, down from 53.1 in February. Still this points to marginal growth in Q1.

Meanwhile the USD fell last week as the ongoing banking crisis saw investors rein in Fed rate hike expectations. As Fed President James Bullard pointed out “Financial stress can be harrowing but also trends to reduce the level of interest rates”.

The markets are pricing in a more than 80% probability of the Fed keeping rates on hold at the upcoming meeting.

Today the pair is edging lower as banking jitters remain and as investors look ahead to a speech by BoE’s Andrew Bailey and a speech by the Fed’s Jefferson.

Where next for GBP/USD?

GBP/USD rebounded from 1.18 the 2023 low, rising above the 50, 100 & 200 sma. The price ran into resistance at 1.2348 last week and has eased back below support turned resistance at 1.2270. The RSI remains above 50 keeping buyers hopeful of further gains.

Buyers will look for a rise above 1.2270 and 1.2348 to create a higher high and extend the bullish trend.

Meanwhile support can be seen at 1.2150 the 50 sma and 1.2090 the 100 sma. A break below here could open the door to 1.2020 the low Wednesday 15 March.