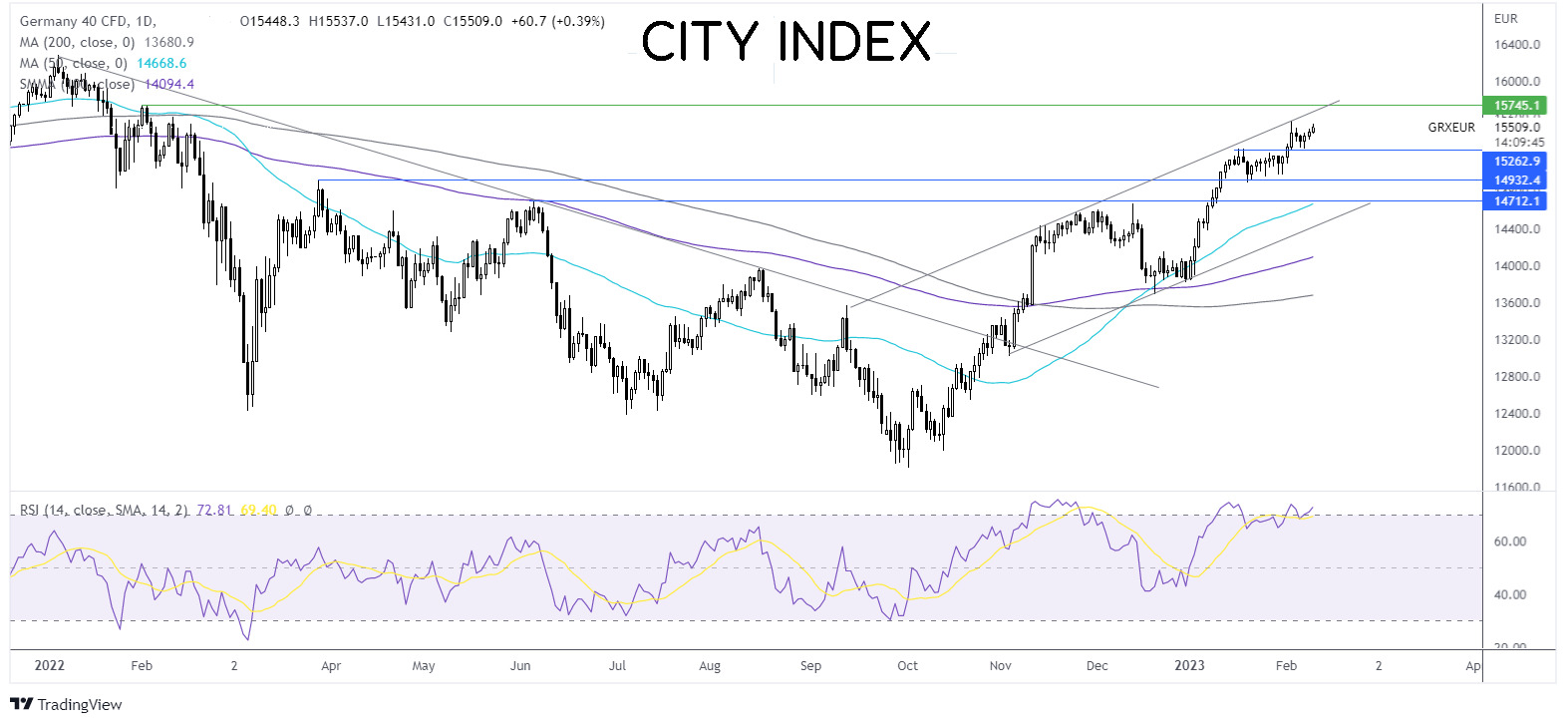

DAX rises as German inflation unexpectedly falls

The DAX is pointing to a stronger start despite a fragile session in Asia and weakness on Wall Street after hawkish commentary from Fed speakers in the previous session. Today investors are pushing the German index higher after latest German inflation data showed an unexpected cooling.

German inflation slowed to 9.2%, down from 9.6% and well below forecasts of a return to double-digit inflation of 10%. The release of the data had been delayed for technical reasons.

The data comes as some ECB members suggest that inflation could be peaking.

More broadly the market mood is improving after comments from Treasury Secretary Janet Yellen and President Biden playing down any escalation of tensions with China.

Where next for the DAX?

The DAX is rising, extending gains back toward the 50-week high of 15570. The RSI is in overbought territory, so buyers should be prudent as the run higher looks over-extended.

Support can be seen at 15270, the January high, a fall below here creates a lower low and opens the door to 14900, the mid-January low and then exposes the 50 sma at 14710.

Meanwhile, buyers could look to rise above 15570, bringing 15670 the rising trendline resistance and 15730 the February high into focus.

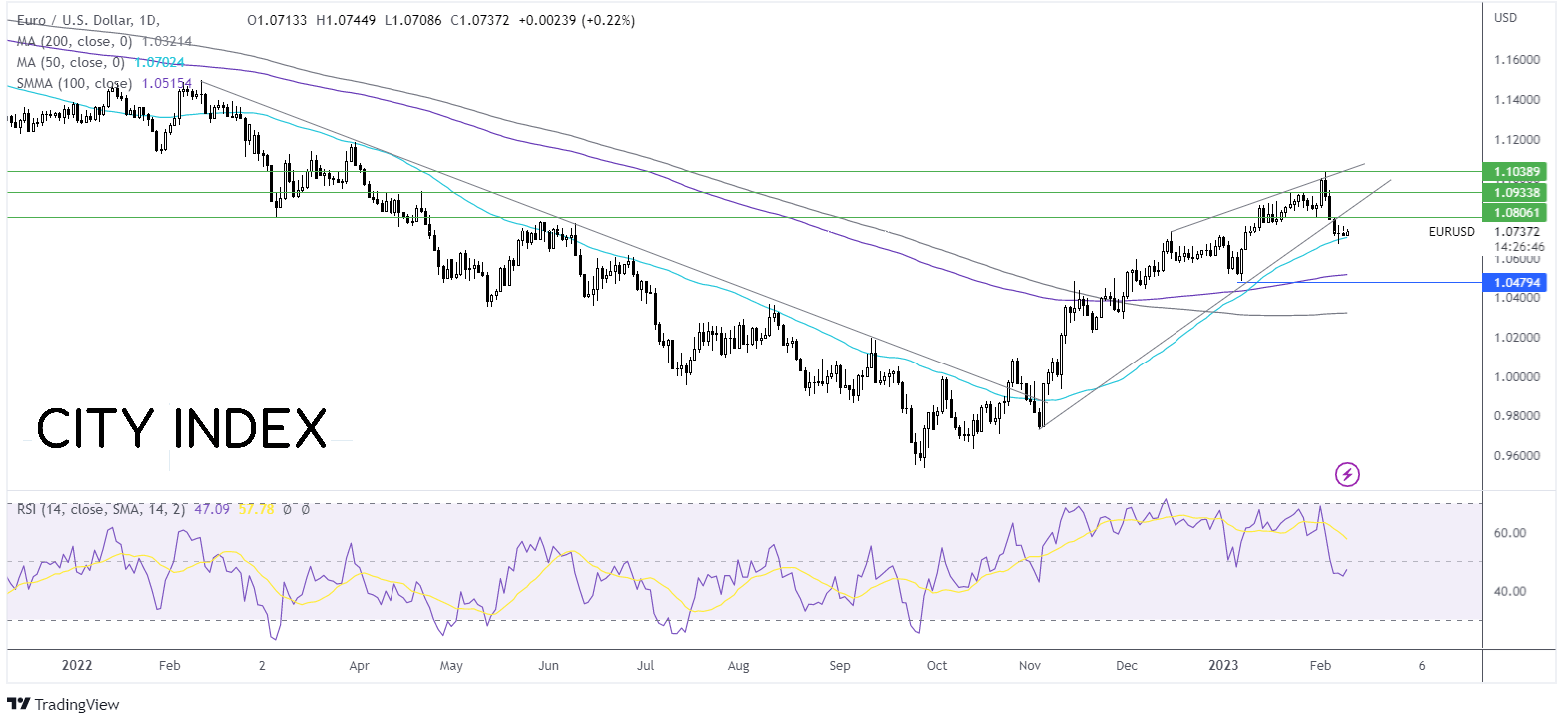

EUR/USD rises after 5-days of declines

EUR/USD heading higher after four straight days of declines. The euro is rising after a chorus of hawkish ECB speakers in the previous session and despite weaker-than-expected German inflation.

In the previous session, ECB member Kazaks said that he saw no reason why interest rate hikes of the current size should stop or be paused after March. His comments were followed by those of Klaas Knot he said that it might be necessary to hike rates at the current pace into May if underlying inflation does not materially improve.

His comments come after German inflation, which unexpectedly cooled in January to 9.2% YoY; this was down from 9.6% in February and below the 10% forecast.

Meanwhile, the US dollar pushed higher yesterday following a chorus of hawkish commentary from Federal Reserve officials. Fed Presidents Christopher Waller and John Williams both said that more rate hikes were needed given the strong jobs market.

Today the dollar is edging lower on an improved market mood and

Looking ahead. US jobless claims figures will be under the spotlight, along with the European Commission’s economic growth forecasts.

Where next for EUR/USD?

After running into resistance at 1.1030, the EUR/USD rebounded lower, breaking out of the downside of the rising wedge pattern. The breakout found support on the 50 sma.

Buyers need to successfully defend the 50 sma and push the price above 1.0790 the weekly high, and back above the rising trendline. A rise above here brings 1.0930 the January high back into focus.

On the flip side, a break below the 50 sma at 1.07 and 1.0680, the weekly low, exposes the 100 sma at 1.0520.