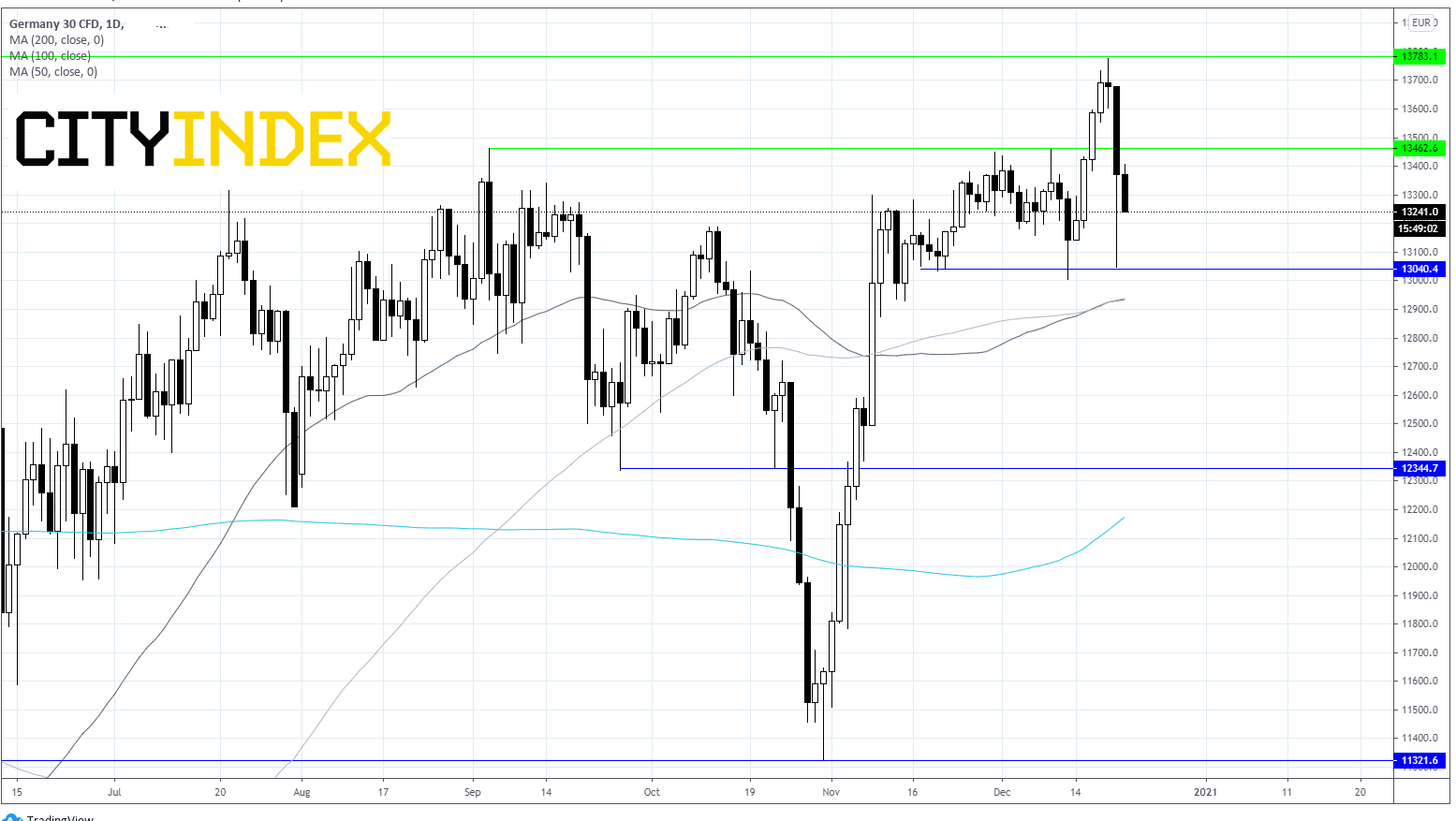

Europe experienced its worst session in over a month as fears of the new covid strain hit saw investors take risk off the table.

News that US Congress has agreed $900 billion covid rescue package and $1.4 trillion government spending package saw US markets pair losses.Could weak GFK data send the Dax through 13040?

• Dax futures extending sell off on covid fears

• German GFK expected to decline to -9.5 from -6.7

Learn more about index trading opportunities

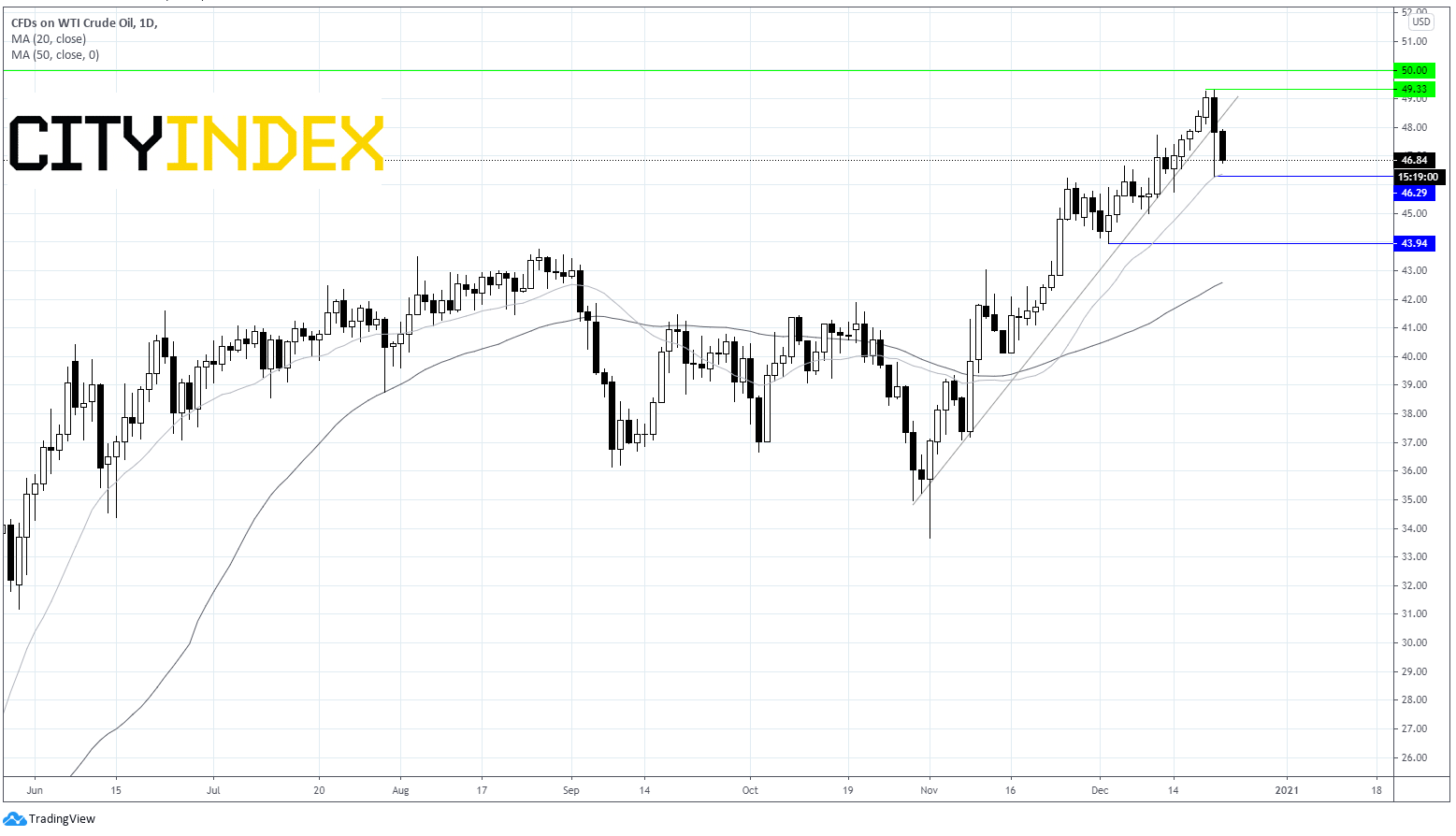

US stimulus bill fails to boost WTI

• WTI is extending losses on Tuesday, adding to steep losses from Monday as a new strain of covid in the UK triggered concerns over fuel demand recovery.

• The UK has tightened its lockdown measures and a growing number of countries have closed their borders to UK freight and travelers.

• Congress’ approval of giant US spending bill could offer some support

• Look to API inventory data later in the session.

WTI slid sharply lower in the previous session falling through its steep ascending trendline which dates back to late October.

WTI found support at the 20 sma on the daily chart at around $46.40 rebounding off this level to settle around $1 higher.

WTI is once again trading on the back foot and is looking to test the 20 sma and yesterday’s low of $46.40. A break through here could negate the near term bullish trend opening the door to a deeper sell off towards $44.00.

It would take another leg lower towards 50 sma at $42.50 to negate the medium term bullish outlook.