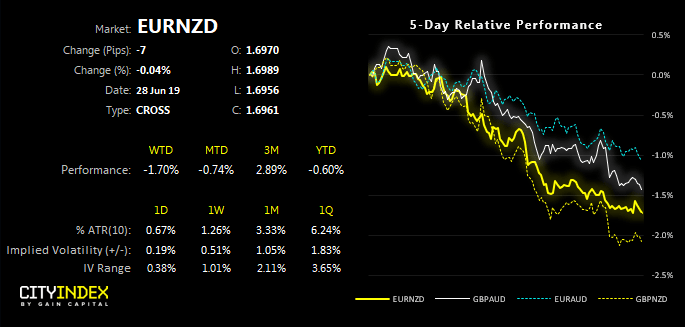

EUR/NZD broke the March trendline following Wednesday’s RBNZ meeting. Now approaching the June low, we could see a corrective bounce towards resistance and pave the way for two bearish potential patterns we’re monitoring.

- Since Wednesday’s RBNZ meeting, where they held rates but were less dovish than expected, NZD crosses have retained strength. With G20 meetings now underway, commodity pairs will likely have a binary effect depending on how successful talks between Trump and Xi are perceived to be.

- NZD strength has forced EUR/NZD to close two days below the bearish trendline and, as it traders near the June, low, we expect a bounce higher, whether technically or G20 driven. However, beyond here we see potential for a bearish swing trade back towards the June low. And, if that gives way, a larger bearish reversal could be underway.

- It’s not the only commodity pair that is taking advantage of European weakness. As we see that GBP/AUD has indeed rolled over and we continue to suspect a larger-bearish reversal is underway since breaking the June low.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM