Twitter (TWTR): Strong Upside Momentum

Twitter (TWTR): Strong Upside Momentum

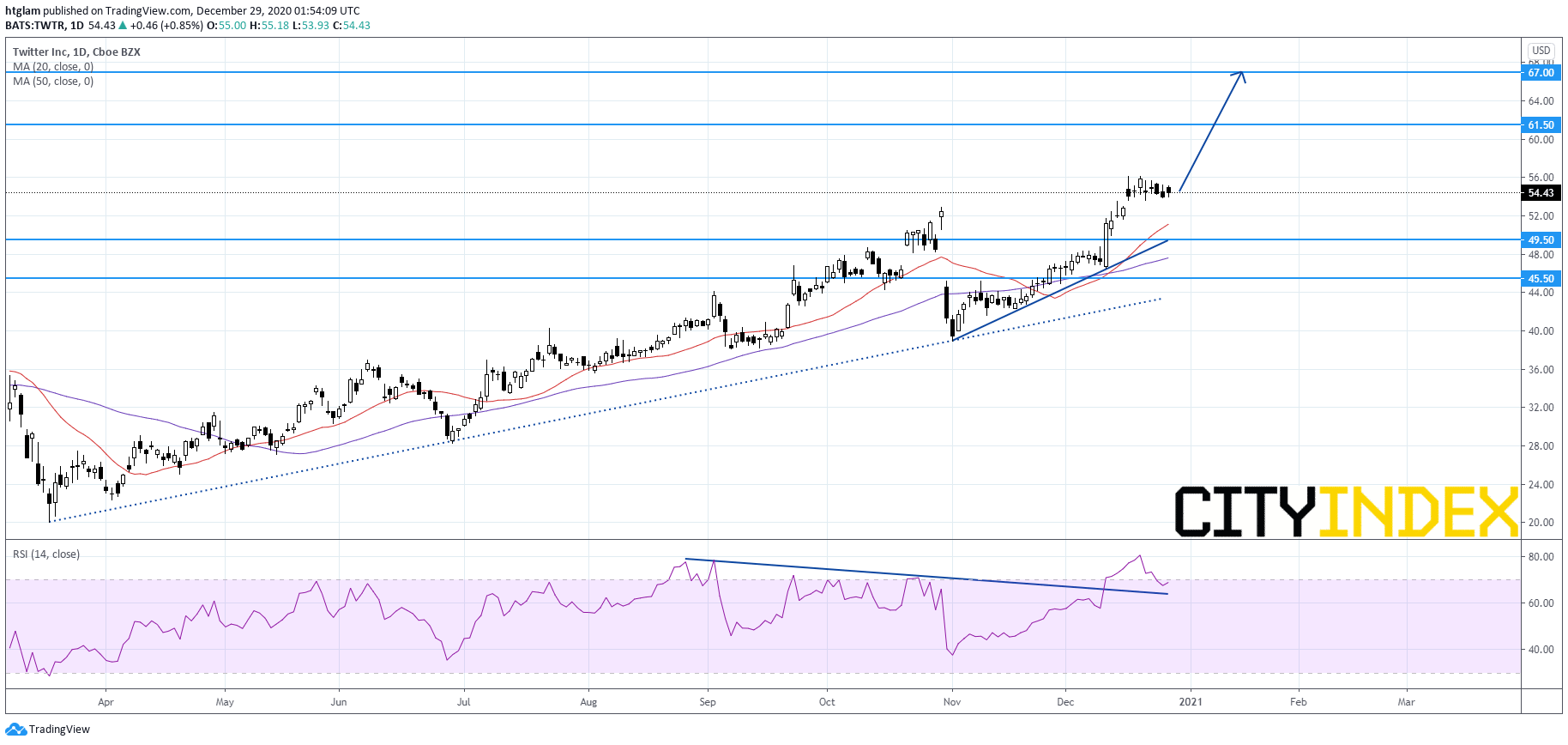

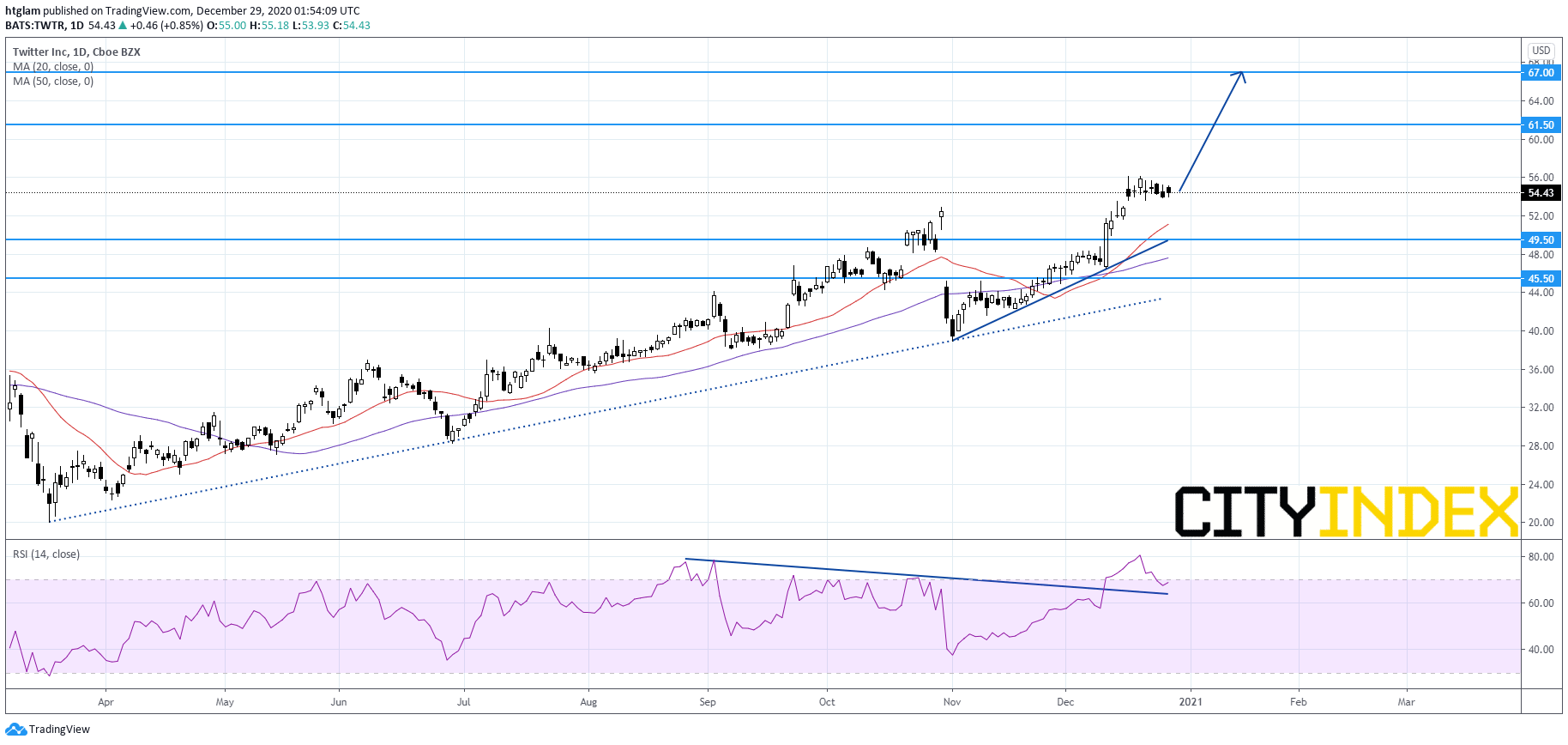

American social networking service provider Twitter (TWTR) has surged by more than 10.0% so far in December, after a 12.5% rally in November. On December 10, the company initiated an integration with Snap's app, where Snapchat users would be able to share tweets directly to their Snapchat story. It is reported that Twitter will test a similar feature on Instagram.

American social networking service provider Twitter (TWTR) has surged by more than 10.0% so far in December, after a 12.5% rally in November. On December 10, the company initiated an integration with Snap's app, where Snapchat users would be able to share tweets directly to their Snapchat story. It is reported that Twitter will test a similar feature on Instagram.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM