The markets are stabilising after the biggest rout since the financial crisis on Monday. US futures are on the rise, US bond yields are picking up, Asian markets traded higher overnight, and crude has jumped 7% as it recovers from losses of 30% at its worst in the previous session.

Reasons why the market is rebounding?

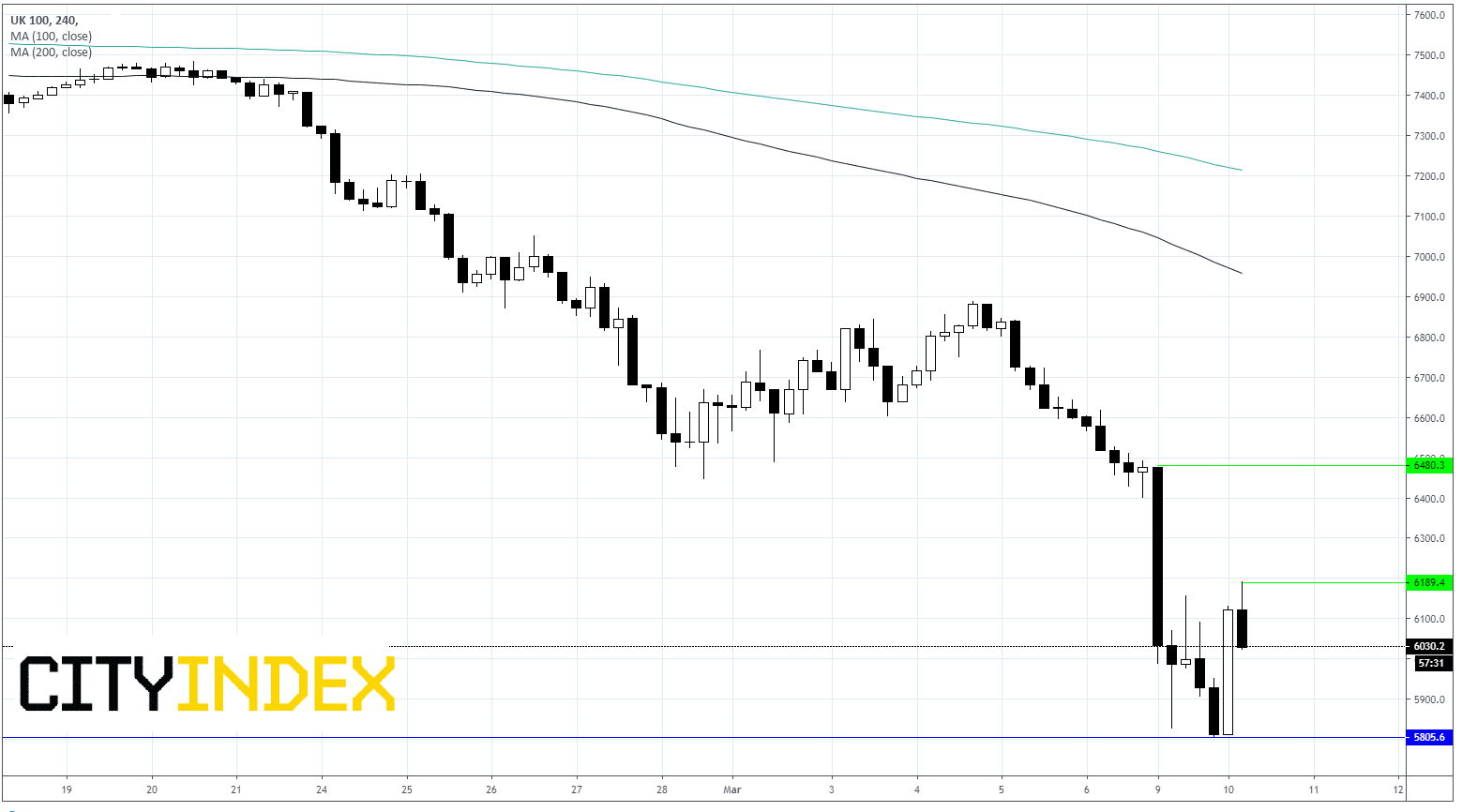

In the cold light of day, yesterday’s frenzied selling looks very overdone. Today the market appears to be gaining some perspective following a sell off which saw the FTSE and the S&P briefly move into bear market territory. The million-dollar question is whether this is a dead cat bounce or the start of a more meaningful recovery?

In the cold light of day, yesterday’s frenzied selling looks very overdone. Today the market appears to be gaining some perspective following a sell off which saw the FTSE and the S&P briefly move into bear market territory. The million-dollar question is whether this is a dead cat bounce or the start of a more meaningful recovery?

A Temporary Issue

Wuhan, the epicentre to the deadly outbreak is opening its borders once again after a symbolic visit from President Xi. This serves as a reminder to the markets that coronavirus is a temporary issue. Furthermore, China only had 43 new cases yesterday, like the UK. However, this is significantly down from the 3000 new daily cases at the height of the outbreak. So even as Italy goes into full lock down mode, there is light at the end of the tunnel and a V shaped recover can’t be completely written off.

Wuhan, the epicentre to the deadly outbreak is opening its borders once again after a symbolic visit from President Xi. This serves as a reminder to the markets that coronavirus is a temporary issue. Furthermore, China only had 43 new cases yesterday, like the UK. However, this is significantly down from the 3000 new daily cases at the height of the outbreak. So even as Italy goes into full lock down mode, there is light at the end of the tunnel and a V shaped recover can’t be completely written off.

Economic support

An announcement from President Trump that he will ask Congress for economic relief for workers has also helped lift sentiment. A cut from the Fed combined with economic support from Washington is not the same as the Fed standing alone. US futures are on the rise, US treasury yields are rebounding from the record low and the battered US dollar staging a comeback.

An announcement from President Trump that he will ask Congress for economic relief for workers has also helped lift sentiment. A cut from the Fed combined with economic support from Washington is not the same as the Fed standing alone. US futures are on the rise, US treasury yields are rebounding from the record low and the battered US dollar staging a comeback.

Markets are clear that they want to see serious stimulus efforts to stave off the collapse in the financial markets and a global recession.

The UK Budget tomorrow and Thursday’s ECB meeting will be in focus and could help the market decide whether the actions being taken are sufficient to stem the market fallout and recession fears

The UK Budget tomorrow and Thursday’s ECB meeting will be in focus and could help the market decide whether the actions being taken are sufficient to stem the market fallout and recession fears

What Next?

It certainly feels too early to call the bottom of this selloff. However, the market is giving signals that with the right response, a combined effort from central banks and governments this may not necessarily be the start of a bear market run.

Latest market news

Today 08:18 AM

Yesterday 10:40 PM