The US Dollar was mixed against all of its major pairs on Thursday.

On the U.S. economic data front, Initial jobless claims fell by 249 thousand last week to 1.19 million, the lowest since March. Continuing claims decreased to 16.1 million in the week ended July 25th from 16.9 million in the prior week.

On Friday we can expect the monthly payroll report with June Non farm Payrolls expected to reach 1.48 million, down from 4.8 million in May. The U.S. unemployment rate is anticipated to decline slightly to 10.5% from 11.8% in May. Finally, wholesale inventories are anticipated to drop 2% on Month in June, in-line with May.

The Euro was bullish against all of its major pairs except for the AUD and GBP. In Europe, June German Factory Orders were released at +27.9%, much better than +10.1% expected. In the U. K., the BoE has kept its interest rates and Quantitative Easing at GBP 745 billion unchanged, as expected.

The Australian dollar was bullish against all of its major pairs.

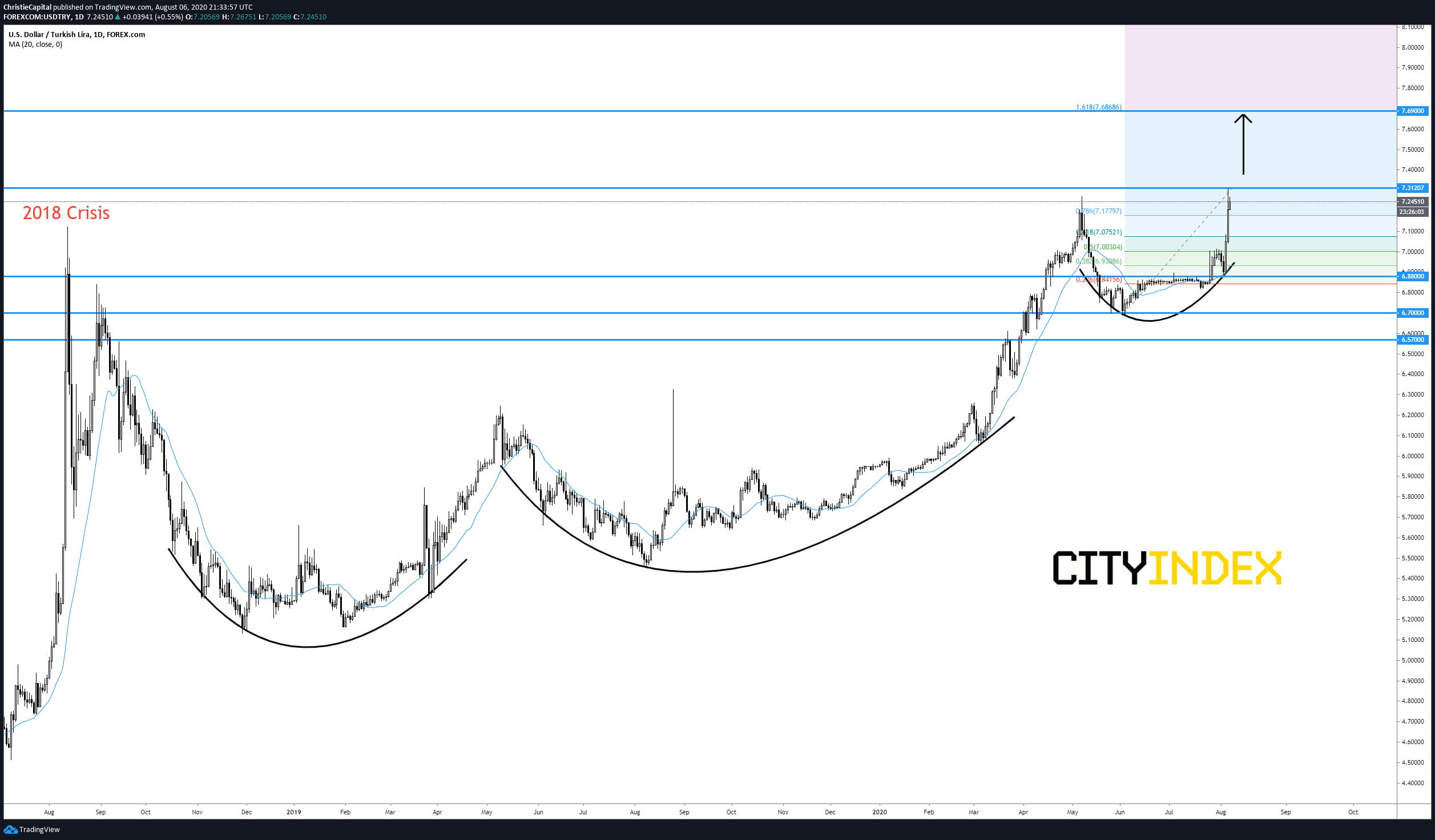

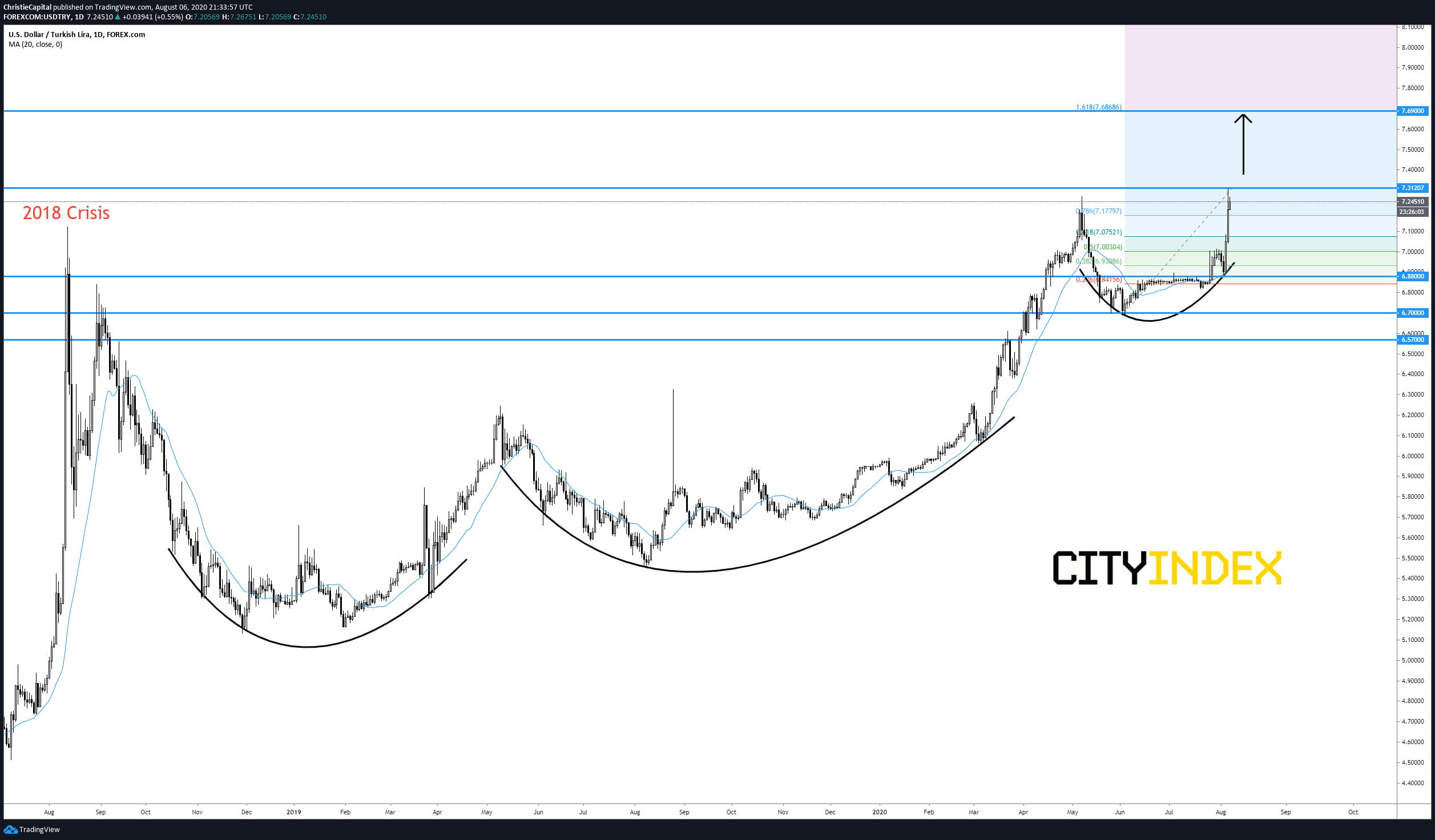

Turkey's Lira tumbled to record lows on Thursday. Turkey's central bank said it was closely monitoring developments. "The Central Bank will use all available instruments to reduce the excessive volatility in the markets in line with the price stability and financial stability objectives," according to a statement by the central bank. A similar move in the USDTRY happened back in 2018 when political tensions with the United States caused the lira to fall to $7.24 per USD.

Looking at the chart, the USDTRY has regular periods of bottom basing patterns which price action just broke out off at the $7.00 resistance level which now may test as support. A Fibonacci projection can be made from the swing low of $6.70 to the swing high of $7.38 (record high) to give a 61.8% Fibonacci target of $7.69 on the upside as there is no more prior resistance. A break below Support at $6.88 could potentially signal the end of the uptrend.

It is hard to predict where the pair will go from here amid extreme volatility however for now, the Turkish Lira remains under extreme pressure and the uptrend in the USDTRY continues.

Source: GAIN Capital, TradingView

Happy Trading

On the U.S. economic data front, Initial jobless claims fell by 249 thousand last week to 1.19 million, the lowest since March. Continuing claims decreased to 16.1 million in the week ended July 25th from 16.9 million in the prior week.

On Friday we can expect the monthly payroll report with June Non farm Payrolls expected to reach 1.48 million, down from 4.8 million in May. The U.S. unemployment rate is anticipated to decline slightly to 10.5% from 11.8% in May. Finally, wholesale inventories are anticipated to drop 2% on Month in June, in-line with May.

The Euro was bullish against all of its major pairs except for the AUD and GBP. In Europe, June German Factory Orders were released at +27.9%, much better than +10.1% expected. In the U. K., the BoE has kept its interest rates and Quantitative Easing at GBP 745 billion unchanged, as expected.

The Australian dollar was bullish against all of its major pairs.

Turkey's Lira tumbled to record lows on Thursday. Turkey's central bank said it was closely monitoring developments. "The Central Bank will use all available instruments to reduce the excessive volatility in the markets in line with the price stability and financial stability objectives," according to a statement by the central bank. A similar move in the USDTRY happened back in 2018 when political tensions with the United States caused the lira to fall to $7.24 per USD.

Looking at the chart, the USDTRY has regular periods of bottom basing patterns which price action just broke out off at the $7.00 resistance level which now may test as support. A Fibonacci projection can be made from the swing low of $6.70 to the swing high of $7.38 (record high) to give a 61.8% Fibonacci target of $7.69 on the upside as there is no more prior resistance. A break below Support at $6.88 could potentially signal the end of the uptrend.

It is hard to predict where the pair will go from here amid extreme volatility however for now, the Turkish Lira remains under extreme pressure and the uptrend in the USDTRY continues.

Source: GAIN Capital, TradingView

Happy Trading

Latest market news

Yesterday 08:33 AM