The Turkish lira is sliding once again amid renewed concerns that President Recep Tayyip Erdogan is ruining the nation’s economy, just as inflation was starting to ease back. His decision to replace the Turkish Central Bank’s Governor over the weekend has backfired with the lira taking a tumble. Undoubtedly, some investors are concerned that monetary policy will now be loosened prematurely, and this could prevent a convincing drop in inflation.

Turkey has been fighting runaway inflation and capital flight for the past few years due to political and economic instability, triggering sharp interest rate hikes by the Turkish central bank and imposition of strict capital controls. Some progress was made as consumer prices eased to 15.7% in June from a year earlier – compared with 18.7% in May and 19.5% in April.

However, Erdogan has long been against interest rate hikes, which he thinks causes inflation despite conventional economic theory suggesting otherwise. So, he took matters into his own hands and decided to replace CBRT’s Governor Murat Cetinkaya on Saturday, undermining in the process the central bank’s independence — just weeks before it is scheduled to decide on monetary policy.

Cetinkaya was criticised by investors for tightening policy too slowly during the height of the currency crisis last summer and then came under pressure from the government for not lowering interest rates again. Last September, under Cetinkaya’s leadership, the CBRT hiked the benchmark interest rate by 625 basis points to 24% and it has stayed at that level since. Cetinkaya had promised earlier in the year to maintain tight monetary policy until a “convincing” fall in inflation was observed.

Clearly, Cetinkaya was not convinced by the recent sharp falls inflation and Erdogan was not convinced the central bank governor was doing his job properly, so he had to go. Investors are concerned that if Erdogan the central bank – now under the leadership of former Deputy Governor Murat Uysal – decides to sharply cut rates on July 25, this will prevent inflation from decelerating further and could cause more economic pain down the line. A reduction in interest rates will make the Turkish lira less attractive for yield-seeking investors in any case. This is also why the lira is falling today.

But Erdogan’s decision to replace the central bank head may not be a bad thing after all. It could be that inflation may ease further anyway with the global economy slowing and with capital controls in place in Tukey. The potential rate cuts by the CBRT could stimulate economic growth rather than lead to inflation in the coming months and years. But for now, traders are selling the lira and will be asking questions later.

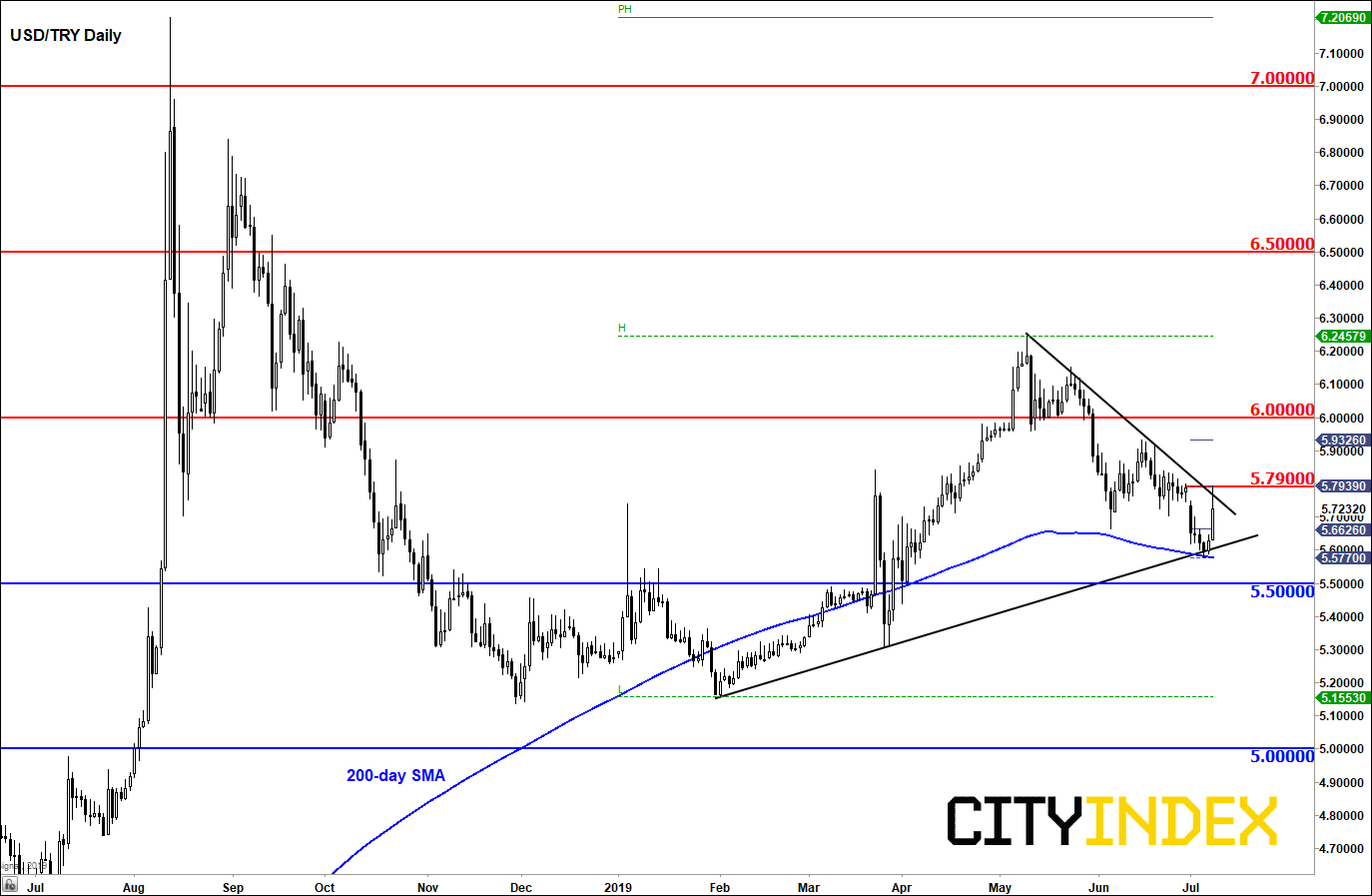

Source: eSignal and City Index.