Turkey's Inflation Rate Continues to Plummet

Turkey’s Inflation Rate (YoY) for October dropped to 8.55% from 9.26% in September, and from 15.01% in August. In January of this year, the inflation rate was 20.3%! The drop this month was primarily due to a slowdown in food and housing prices. The Central Bank of Turkey (TCMB) doesn’t meet again until December and a cut is widely expected. The question will be “How Much?”. The TCMB cut interest rates in October to 14% from 16.5% in September. As recently as June, overnight interest rates were at 24%! Separately, Fitch maintained its BB- rating for Turkey, one notch above Moody’s and S&P. The rating agency also raised its outlook to stable from negative. Fitch didn’t think geopolitical risks would hurt the Turkish Economy.

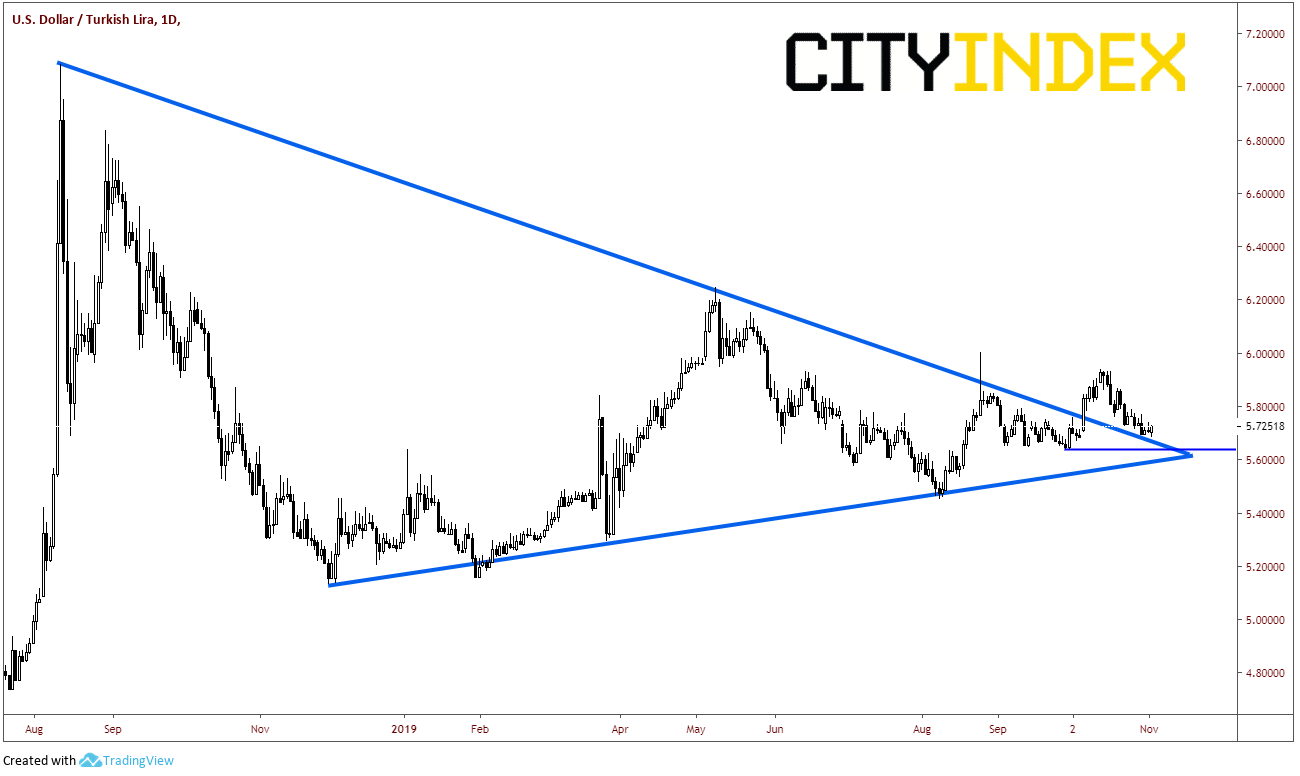

On October 4th, USD/TRY broke out of long-term symmetrical triangle dating back to August of 2018. Price has recently pulled back and is retesting the downward sloping trendline of the triangle near 5.6760. Below that is horizontal support at 5.6367.

Source: Tradingview, City Index

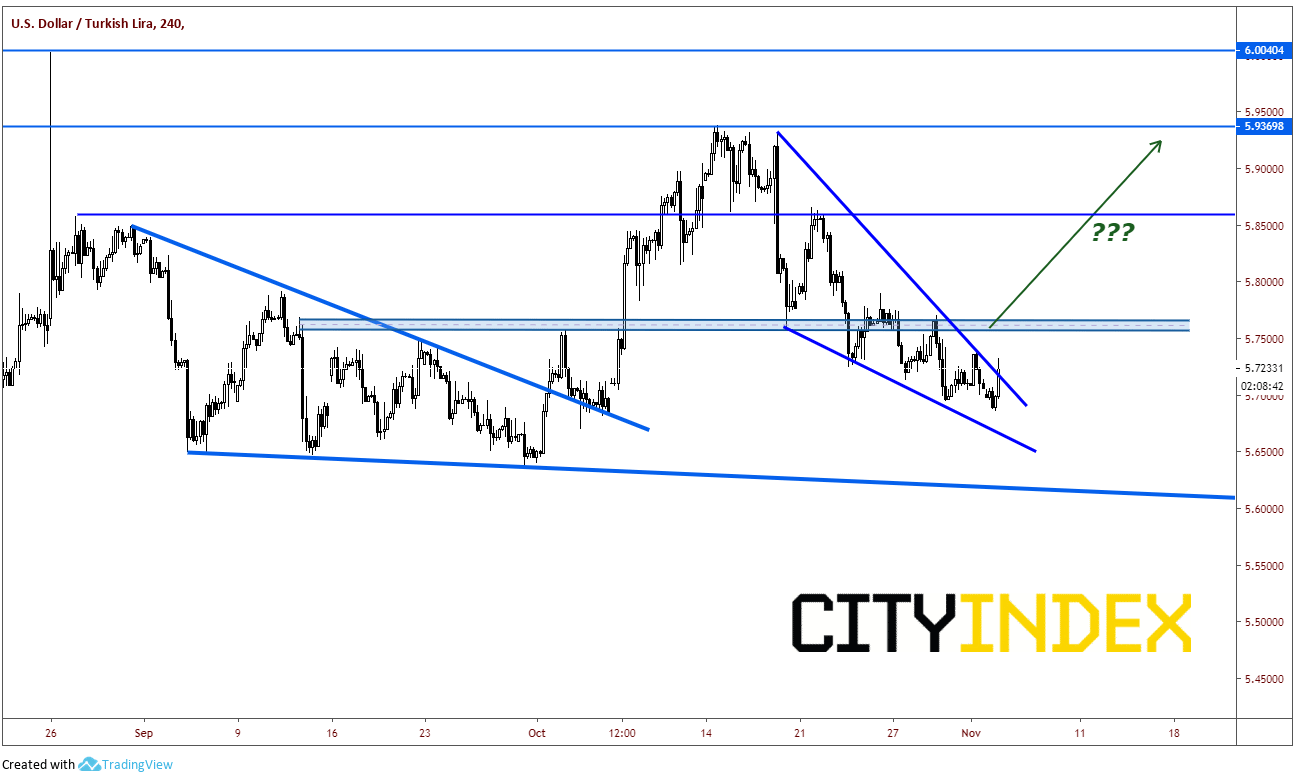

On a 240-minute chart, USD/TRY broke out of a falling wedge on October 4th and a few days later came back to retest the trendline. After a false break below the downward sloping trendline, price broke higher. The target of a falling wedge is a retracement of the entire wedge. Price retraced the entire move, and then some, to 5.9370. From there, USD/TRY began to form ANOTHER falling wedge. Currently, price is attempting to break out of the second falling wedge. If price follows the same pattern as the breakout of the first falling wedge, price could retrace the entire wedge formation, heading back towards 5.9370. Now that USD/TRY has broken above the trendline, support will be a retest of the trendline near 5.7156. Below that, support will be at the bottom trendline of the wedge near 5.65. If price breaks below there, a support trendline from early September comes across near 5.6175.

Source: Tradingview, City Index