Turkey Reports Huge Drop in Inflation

Headline CPI data released earlier today from Turkey for September came in much worse than expected at 9.26% vs 15.51% expected and 15.01% last. The large miss in inflation data has set up expectations of another rate cut by the Central Bank of the Republic of Turkey (CBRT) when they meet on October 24th. Rates are currently at 16.5%, with expectations for a cut of 1.5% to 15.0%. Rates were as high as 24% earlier this year.

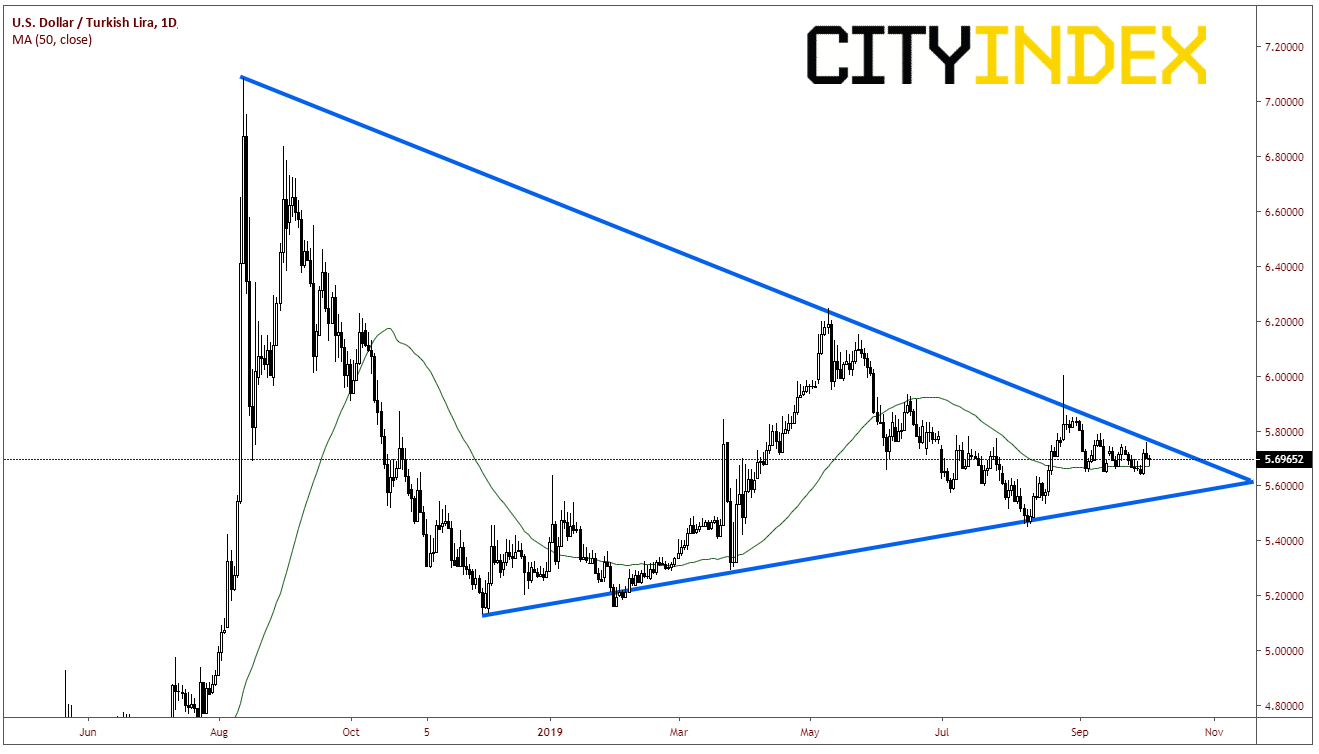

USD/TRY, which is currently trading near 5.6965, is coiling in a large symmetrical triangle on a daily timeframe and riding the 50 Day Moving Average at 5.6719.

Source: Tradingview, City Index

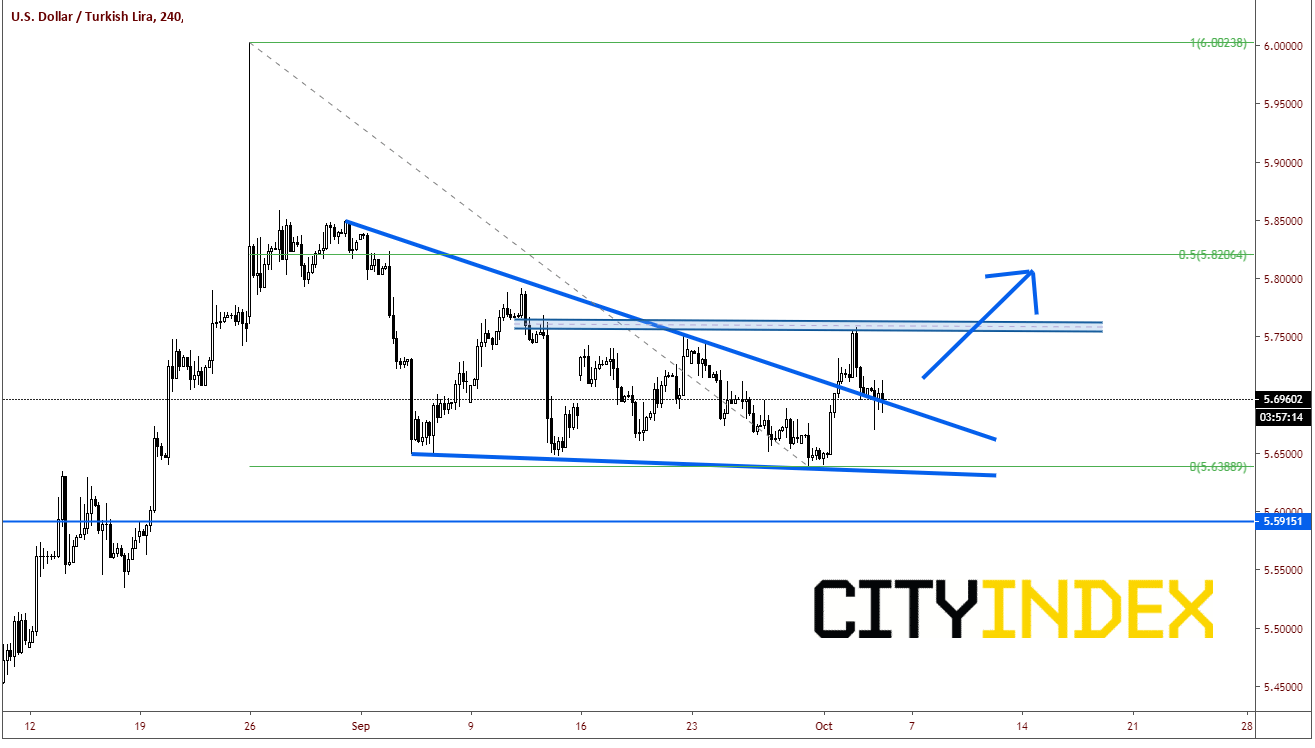

On a 240-minute time frame, USD/TRY put in a failed breakout of a descending wedge and is retesting the breakout point of the descending trendline at 5.6930. Bulls will look to buy this retest for a move higher. First resistance area is between yesterday’s daily highs and horizontal resistance near 5.7239. Above that is the 38.2% retracement from the August 26th spike high to the October 1st low at 5.777, and then the 50% retracement level of that same time period at 5.8206. First support is the descending trendline of the descending wedge (where price is currently sitting just above) at 5.6930. Below that, support is the lows from October 1st at 5.6631, and then horizontal support at 5.5915.

Source: Tradingview, City Index