Trump Has COVID, NFP Whiffs, Eyes on USD/JPY

Just when you thought 2020 couldn’t get any more chaotic and unpredictable, we learned overnight that President Trump and First Lady Melanie Trump have contracted COVID-19. The President is reportedly asymptomatic and will cancel all in-person events for the foreseeable future as he and his wife convalesce at the White House.

Looking ahead, it’s unclear what this means for the election, and much will depend on the severity of the President’s symptoms. Some analysts have speculated that a swift recovery, if seen, could engender a wave of sympathy and boost Trump’s poll numbers, while others view the development as a clear condemnation of the President’s handling of the virus of a whole. Regardless of what ultimately happens, the news injects another dose of uncertainty into an already acrimonious election process.

The market reaction to this news was swift if not overwhelming, with US index futures selling off a quick -1%, gold spiking back above $1900, and the yield on the benchmark 10-year treasury bond falling back to 0.66%. In the FX market, the safe haven Japanese yen gained a quick 60 pips against the buck to trade at a 7-day low near 105.00 on the news.

Just as traders were waking to the news, the regularly-scheduled NFP report showed that the US created just 661k new jobs in September, well below the 900k jobs expected. Adding insult to injury, average hourly earnings rose just 0.1% m/m, missing economists’ estimates for +0.5% growth. Though the unemployment rate did fall by 0.5% to 7.9%, it was due entirely to a contraction in the labor force (that is, the number of Americans looking for a job) rather than improvements in the labor market itself. In short, the labor market recovery appears to be stalling at the same time that COVID-19 infections are worryingly ticking up again across multiple areas in the country.

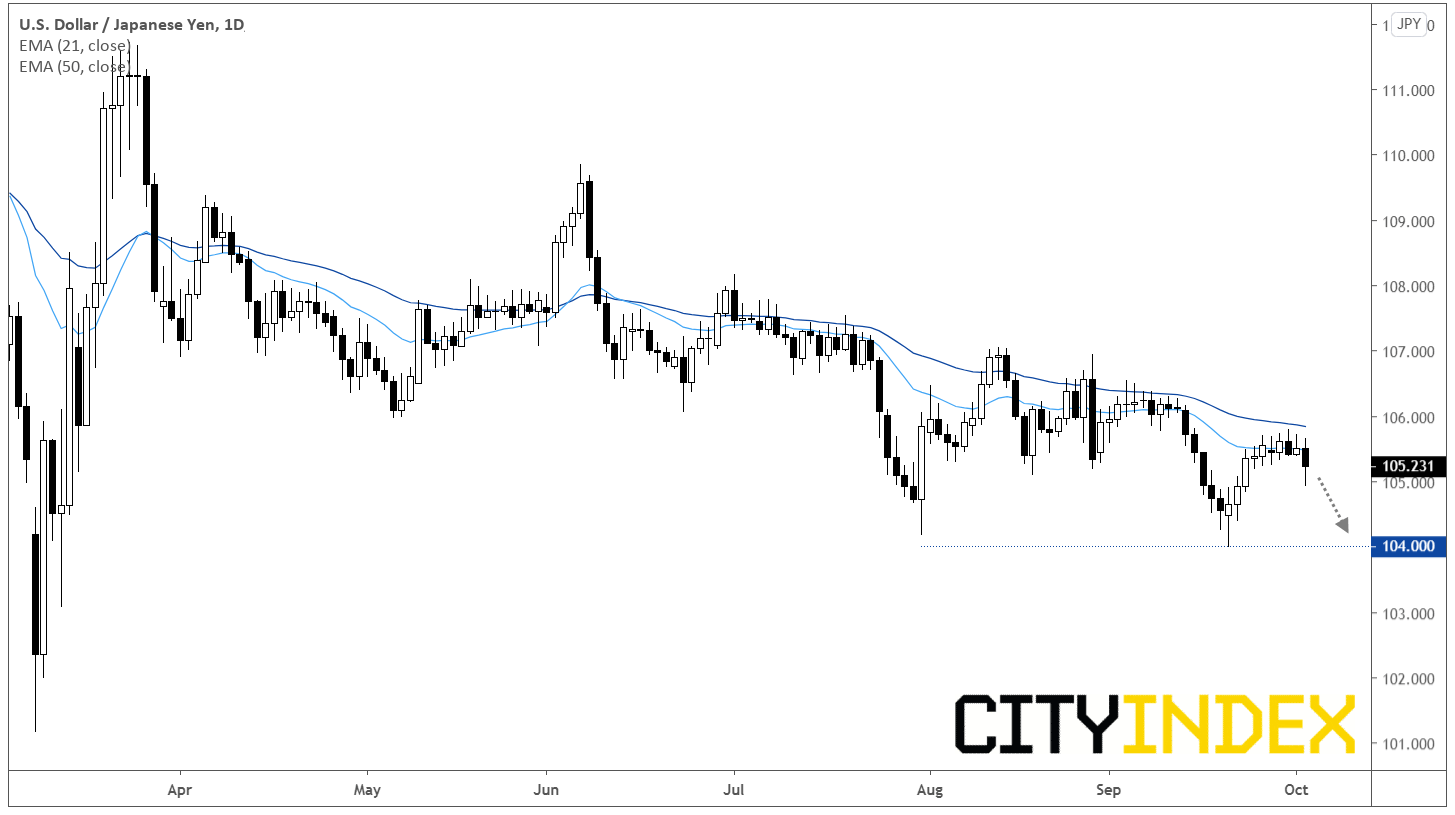

Moving forward, the combination of these developments could start to weigh on USD/JPY in the days to come as the marginal trader favors the yen as the preferred global safe haven over the world’s reserve currency. Technically speaking, USD/JPY remains below its downward-trending 21- and 50-day EMAs, and if bears are able to push the pair below the overnight lows near 105.00, there’s little in the way of additional support until September’s 7-month low near 104.00.

Source: GAIN Capital, TradingView