Risk sentiment was initially hit when the World Health Organization announced on Wednesday that coronavirus is now a global pandemic. Whilst this doesn’t automatically mean any change in policy response, as each country is responsible for their own policy, it does bring an extra layer of fear to the public and the markets.

Following on from the WHO pandemic announcement, President Trump announced a travel ban from mainland Europe to the US, in addition to a package of measures to support workers and businesses in an attempt to mitigate some of the strains on US the economy. However, there was still no news on the payroll tax cut which needs to make its way through Congress.

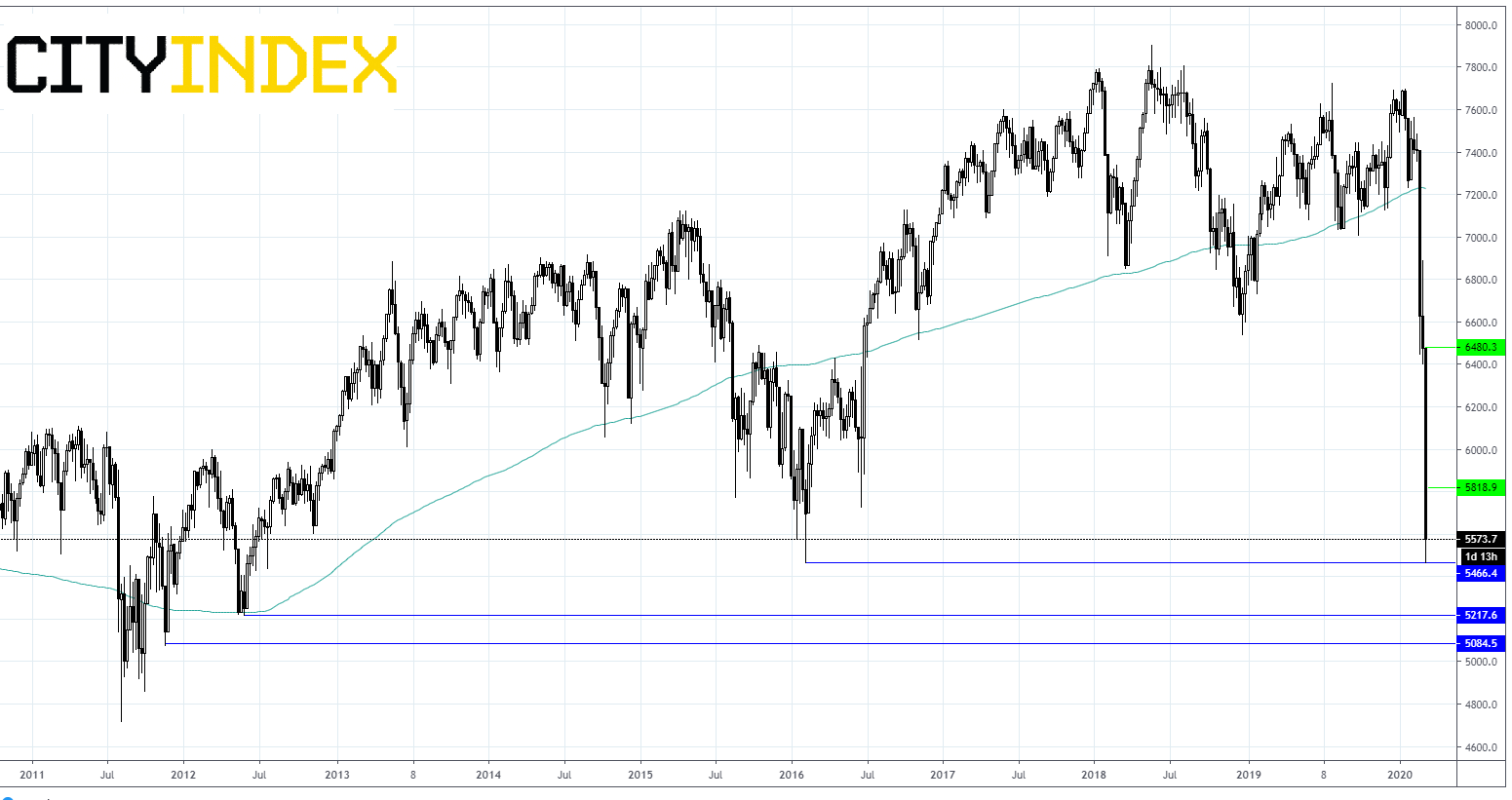

It also comes following a coordinated approach from the BoE and the UK Government on Wednesday. Even then the FTSE closed the session 1.4% lower.

ECB up next

Attention will now turn to the ECB. contrary to the BoE and the Fed has not yet acted to counter the escalating crisis. However, the ECB has significantly less room to manoeuvre given the negative rates and current asset purchase programme.

The broad expectation is that the ECB will take action. The ECB are expected to make a 10-basis point rate cut taking it to -0.6%. They are also expected to increase asset purchases, or bond buying, to €40 billion per month. This will be the first real test for ECB Governor Christine Lagarde and she may have to sacrifice unity among policy makers in order to not underwhelm the market.

However, evidence has shown that big coordinated moves has failed to underpin the market so can a 10 basis point cut by the ECB really do anything? On the other hand, not acting could inject further fear into a very scared market.