Whilst riots and demonstrations in the US dominated the weekend headlines, the markets were more focused on President Trump’s speech on Friday. A softer tone from Trump combined with encouraging PMI’s from China have resulted in rising risk sentiment at the start of the new week. Traders are buying into riskier assets whilst rotating out of the safe haven US Dollar. Asian stocks pushed firmly higher overnight and European markets are set to follow suit.

China’s recovery in focus

Chinese Caixin manufacturing and non-manufacturing PMI’s have also been a source of optimism. Activity in the Chinese manufacturing sector jumped back into expansion territory in May, at 50.6. This was a tick below expectations of 50.7. Non-manufacturing PMI surprised to the upside, printing at 53.6 indicating the domestic demand continues to pick up after the coronvirus lockdown.

PMI data will remain firmly in focus with releases from UK, Europe and the US expected. The UK is expected to see the May reading is expected to remain close to the preliminary print of 40.6, at 40.7 still firmly in contraction. France and Germany are closed in observance of Whit Monday.

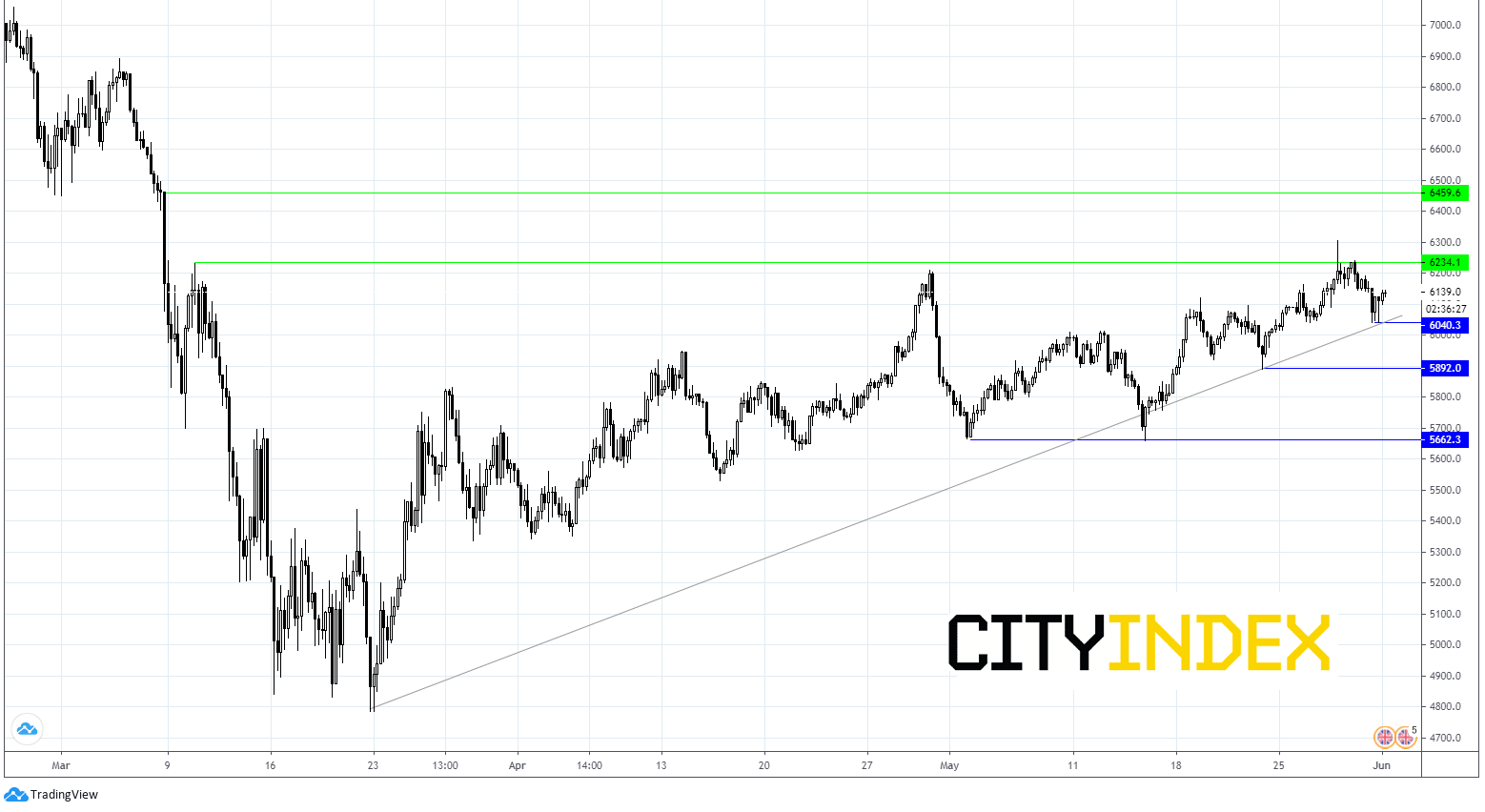

FTSE higher as lockdown measures eased further

Optimum surrounding the reopening of economies continues to drive trading. Asian stock markets hit a three-month high as the post coronavirus recovery continues. Here in the UK, lower covid-19 infection rates and death rates have led Boris Johnson to ease lockdown restrictions further. Primary schools reopen today, people can meet in groups of 6 observing social distancing rules and some outside trading is also allowed to occur. Slowly the UK economy is reopening. Travel and tourism stocks, retailers, property and transport could once again find themselves the centre of bull’s attention.

Oil to target $40?

Oil is holding slipping mild lower on Monday after surging over 6.5% overnight in Asia. 10 weeks after the start of the coronavirus crisis, and a month after prices went negative, oil finally appears to by tracking a recovery, above $37.00. Demand is slowly increasing as fuel needs pick up with reopening economies. Supply is also supporting the pick-up in process as US rigs are being mothballed with an unprecedented urgency and as OPEC dropped production in May to the lowest level in two decades. The focus is now on OPEC and its next meeting, possibly as soon as this week to decide whether to extend the most recent cuts for another three months. Agreement to do so could see oil push above $40 per barrel.

FTSE Chart