The conclusion that traders would like to draw is that the weak jobs number will provide the spark for Republican leaders to come “on board” a US$900bn bipartisan proposal to provide pandemic relief.

However, with time running out for a deal to be struck before both chambers depart for Christmas recess on December 18th, a test of patience lies ahead for equity traders. More so as US policymakers have perfected the art of leaving agreement on key policy decisions until the last moment.

Adding to worries for the local bourse the ASX200, the continued deterioration in the Australia - China relationship. Prompting the Australian government forecaster Abares to warn that the value of agricultural exports will decline 7% in 2020-2021, to its lowest level in five years despite bumper production.

One prominent US investment bank has run the numbers if China was to take the extreme step of cutting off all iron ore imports from Australia and preventing Chinese students from attending Australian universities. This would present a material hit to growth, albeit one that the Australian economy would bounce back from.

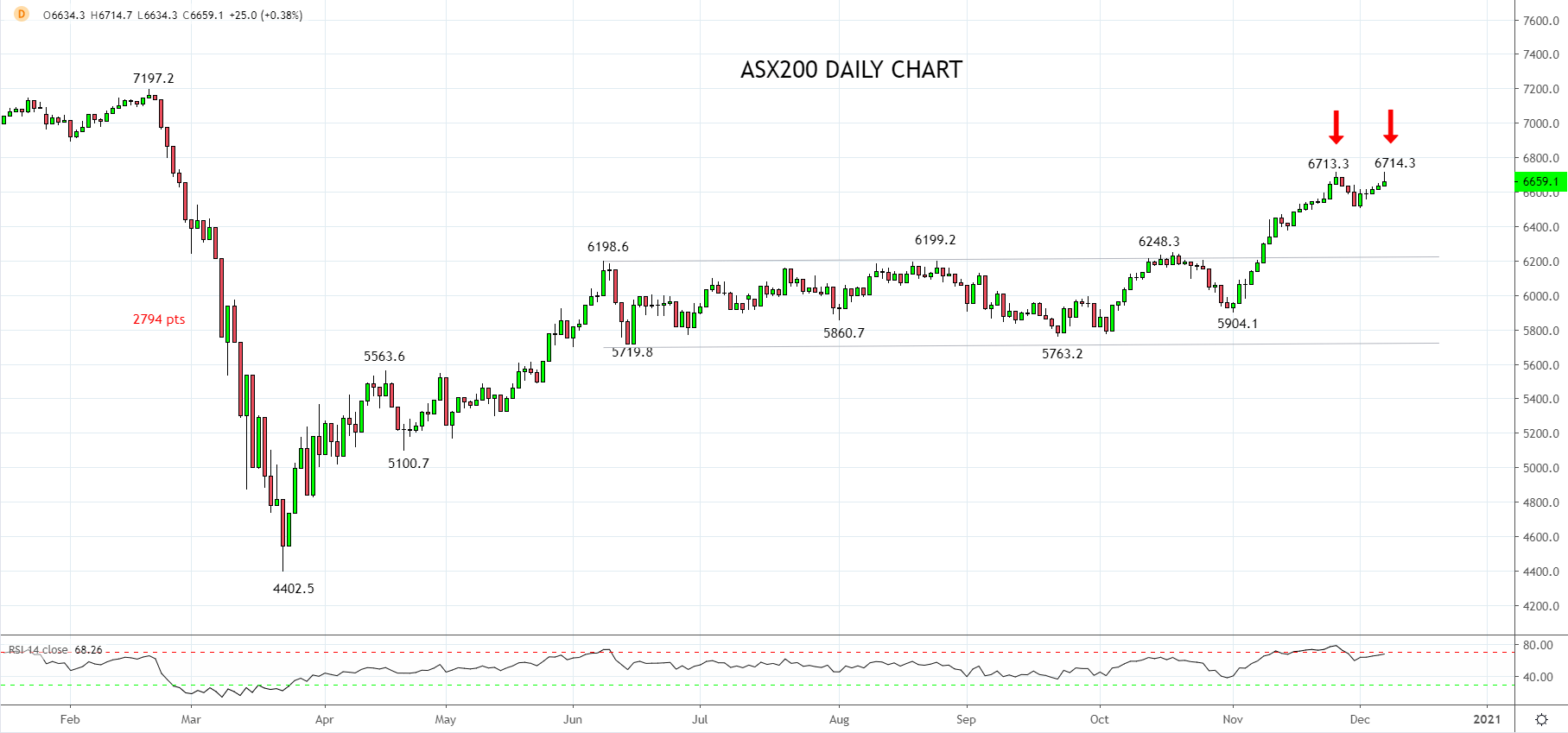

The combination of headwinds partially explains why the ASX200 encountered selling earlier today and leaves in place a potential double top near 6715. I am always a little wary of double tops and more so when they coincide with a loss of momentum type daily candle. A combination that often warns of a short term correction.

As such, I have taken profit on some of the long position I have been holding from just before the US election near 5900, at the current price of 6659. Article link here.

This will allow me to keep a core long position in line with the medium-term bullish view. However, in the short term it will allow some flexibility to rebuild longs on a dip towards support 6300.

Source Tradingview. The figures stated areas of the 7th of December 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation