Traders Wary as “Super Contango” Drives WTI Toward $10.00

Markets have experienced a tremendous shock as traders try to navigate the fallout of a global pandemic leading to a synchronized halt to commerce worldwide, at least most of the price moves have been generally orderly, if volatile. Beyond some issues with certain illiquid ETFs trading away from their underlying asset values in the peak of the mid-March panic, financial markets have largely fulfilled their role of matching buyers and sellers and facilitating the exchange of assets for cash at a reasonable price over the last couple of months.

While the above is generally true, today’s price action in oil is certainly raising some eyebrows among even the most experienced traders. Using West Texas Intermediate as an example, the May futures contract, which expires tomorrow, is changing hands at just around $11.00 as of writing, down fully 40% today alone! Many less common forms of oil, including Bakken UHC, Alaska North Slope, Edmonton C5 condensate, and Edmonton mixed sweet, are all trading below $5.00 a barrel.

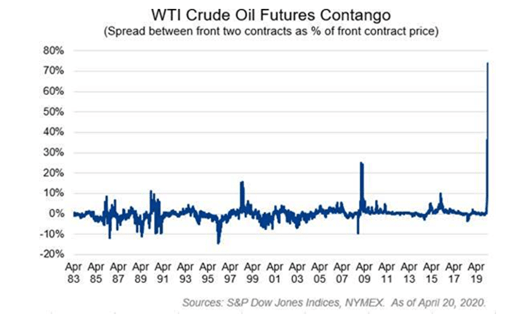

This market distortion is due to a variety of factors, including demand destruction, oversupply, pipeline delays, storage capacity, and popular oil ETFs rolling forward to next month’s June contract, making the May contract far more illiquid. By contrast, the June WTI contract is trading at a (slightly) more reasonable $26.50. This situation, where prices for future delivery are trading above the current spot price, is called contango and is relatively rare. As the chart below shows, this is the biggest percentage difference between the front two oil contracts in over 40 years:

Contango, or “Super Contango” as the case may be, incentivizes traders to take delivery of the physical oil and hold it, thereby capitalizing on the implied appreciation. Concerns about commercial and industrial oil storage capacity have exacerbated the current contango structure, but in the long run, the futures curve term structure is likely to normalize, implying potential appreciation for oil from here once the current temporary issues are resolved.

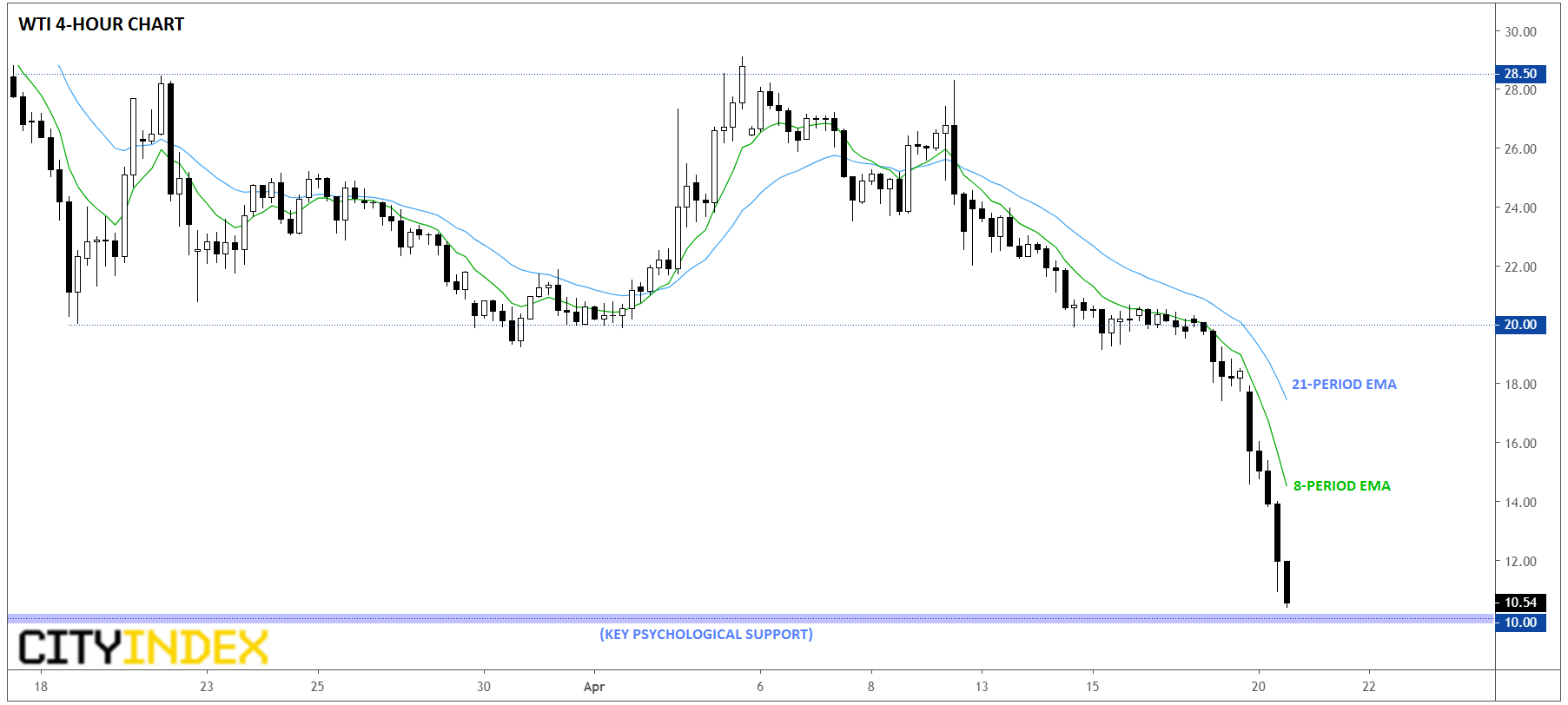

With prices probing 30+ year lows, there’s obviously little in the way of recent support/resistance on a technical basis. That said, traders may watch the $10.00 level as a key area of psychological support over the next couple of days, rationalizing that oil should not be trading a less than a “tenner,” no matter how severe the current market conditions are:

Source: TradingView, GAIN Capital

Even if you don’t trade oil, it’s worth keeping an eye on the market for this critical commodity this week, as further price distortions could hint at stress in the broader financial markets, even if sentiment has stabilized from March’s “peak fear” trading conditions.