S&P500 futures on news a previously agreed currency pact with China will be rolled out.

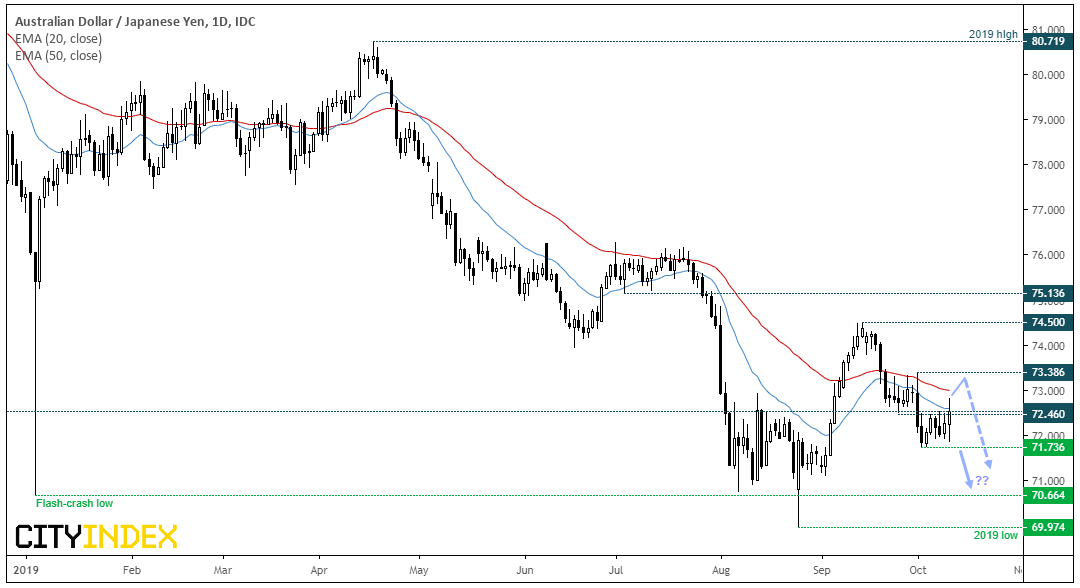

China has “lowered expectations” for progress from this week’s trade talks. That shouldn’t come as too much of a surprise, given the US added 28 Chinese companies to their blacklist yesterday. There’s also reports that China would cut the scheduled 2-day trade talks early by one day. On the upside, reports suggest that the Trump administration may allow US companies to supply non-sensitive goods to Huawei, and that the US may delay next week’s tariff hike. And today, the US is reconsidering currency pact which would ensure China don’t engage in competitive devaluation of the Yuan. Personally, I do not see China agreeing to this. Yet markets took it as a positive step and saw risk assets such as E-mini S&P500 futures and AUD/JPY spike higher.

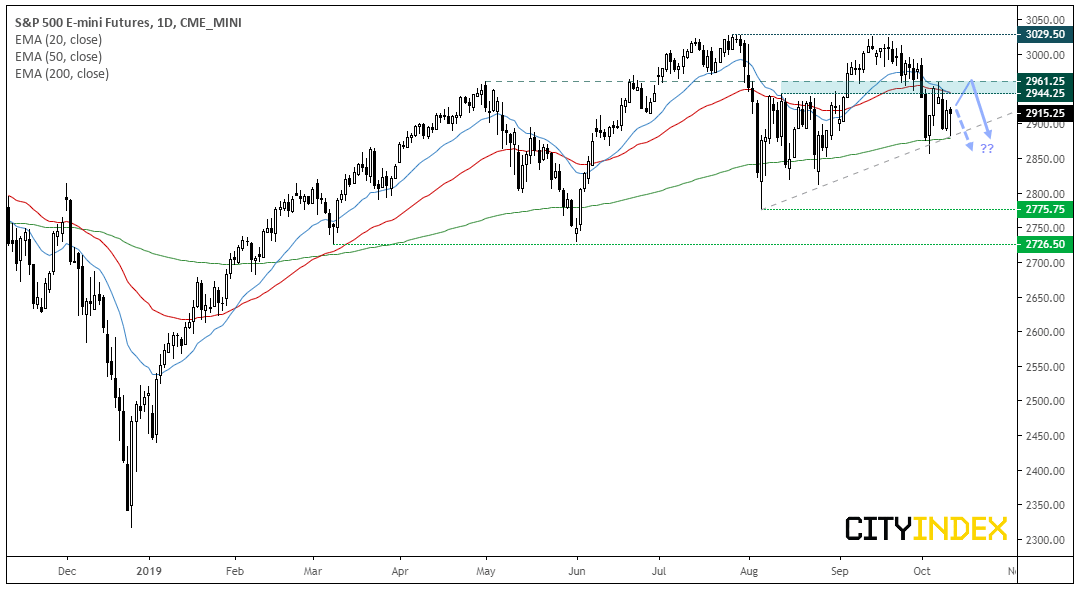

At the time of writing, it remains up for debate as to whether the S&P500 has seen a trough and will break to new highs, or that we’ve seen the top and its to break to new lows. The 20 and 50-day eMA’s are acting as resistance and today’s low rebounded from the 200-day eMA. Whilst prices remain below the 1,961.25 high a downside break is favoured and for prices to head to the 2,775.75 low. If we see this key level breached, then it’s game on for a retest and potential break to new all-time highs.

AUD/JPY didn’t escape the hype either. It burst above key resistance to a 7-day high, although prices have retreated to the 72.46 resistance level. If somehow a trade deal is reached, then we’d expect it to break above 73.39 and warn of a trend reversal. Yet we remain doubtful any such deal will be reached this week so will continue to monitor its potential for a break of key support at 71.74. Currently today is a bullish outside day, yet a close beneath 72.22 would morph this into a bearish outside day and increase the bearish flag potential.