Another day, another U.S-China trade deal related news flow. If we can recall last than 24 hours ago, the media has reported that the signing of the U.S-China “Phase one trade deal” could be delayed until Dec over terms and venue according to an unnamed senior U.S. official that led to some profit-taking activities in Asian stock markets today.

Right before the open of today’s European session, the Chinese Commerce Ministry has issued a more positive response where its spokesman has commented that U.S. and China have agreed to cancel in phases the tariffs imposed over the past few months but did not mention any specify timeline.

The reaction from the markets have been positive so far; “risk on mood” has been switched on with the S&P 500 and Nasdaq 100 futures up by 0.44% and 0.54% coupled with fresh new all-time highs at 3092 and 8262 respectively at this time of writing.

From a technical analysis perspective, major stock indices have now pushed up into significant resistance zones where a negative catalyst can easily flip the table in favor for the bears.

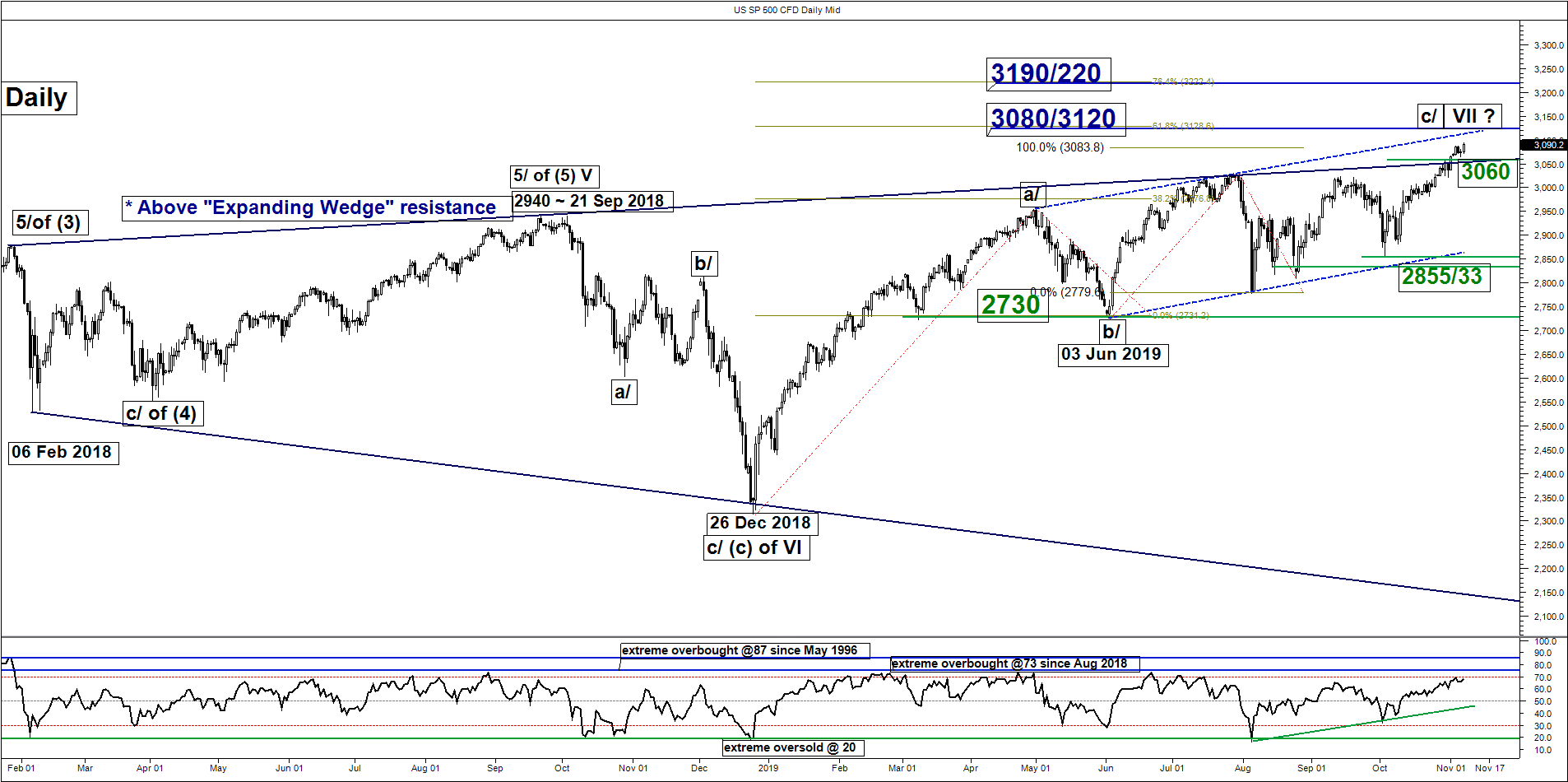

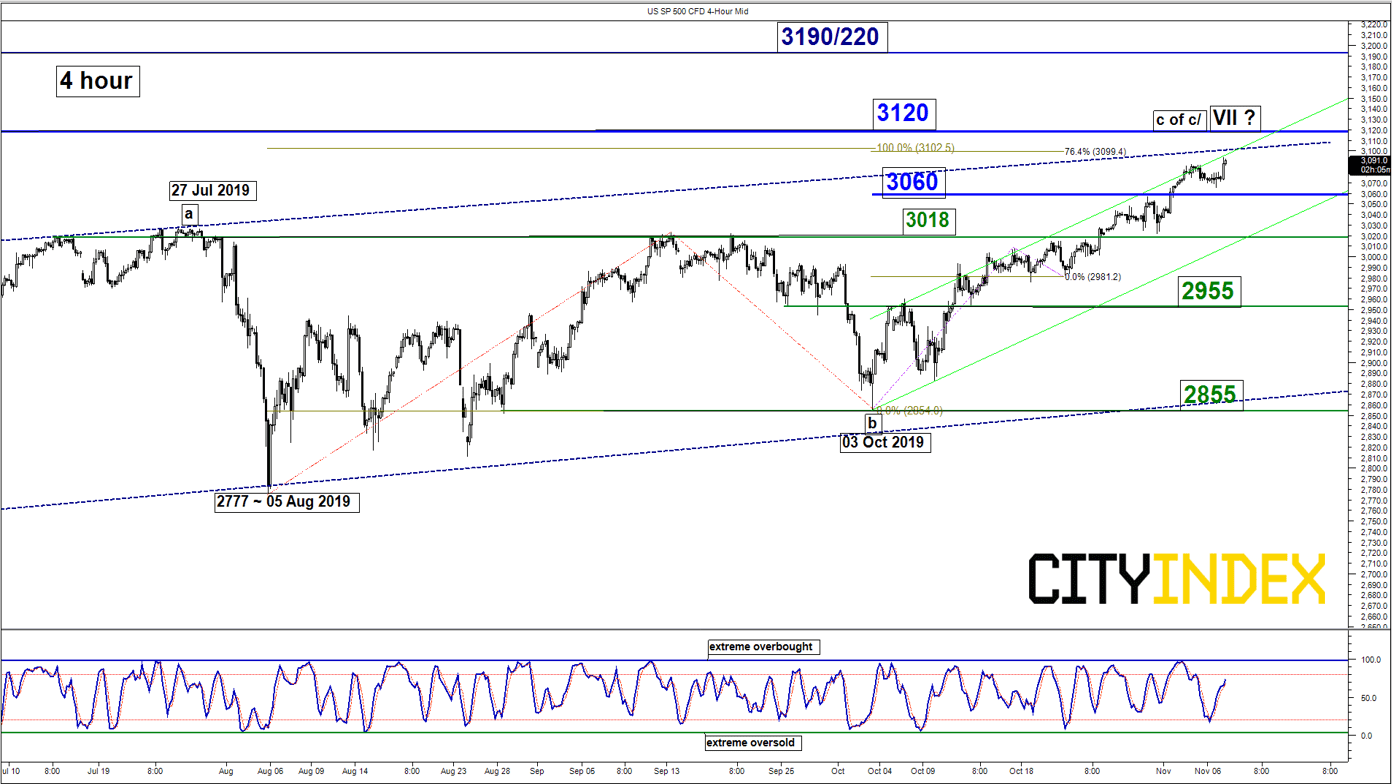

S&P 500 – Watch 3120 key resistance

click to enlarge charts

- The SP 500 Index (proxy for the S&P 500 futures) has pushed up by close to 0.50% at the open of today’s European session and cleared above the major “Expanding Wedge” range resistance now acting as a pull-back support at 3060.

- Even though, the Index is still below the 3120 medium-term pivotal resistance as per highlighted in our weekly technical outlook report earlier (click here for a recap), there are not clear signs of bullish exhaustion at this juncture, prefer to turn neutral now between 3120 and 3060. Bears need to have a break below 3060 to get a foothold to kickstart a potential multi-week corrective decline towards 3018 and 2955 in the first step.

- On flipside, a clearance with a daily close above 3120 sees a further squeeze up towards the next resistance 3190/220 (Fibonacci expansion cluster).

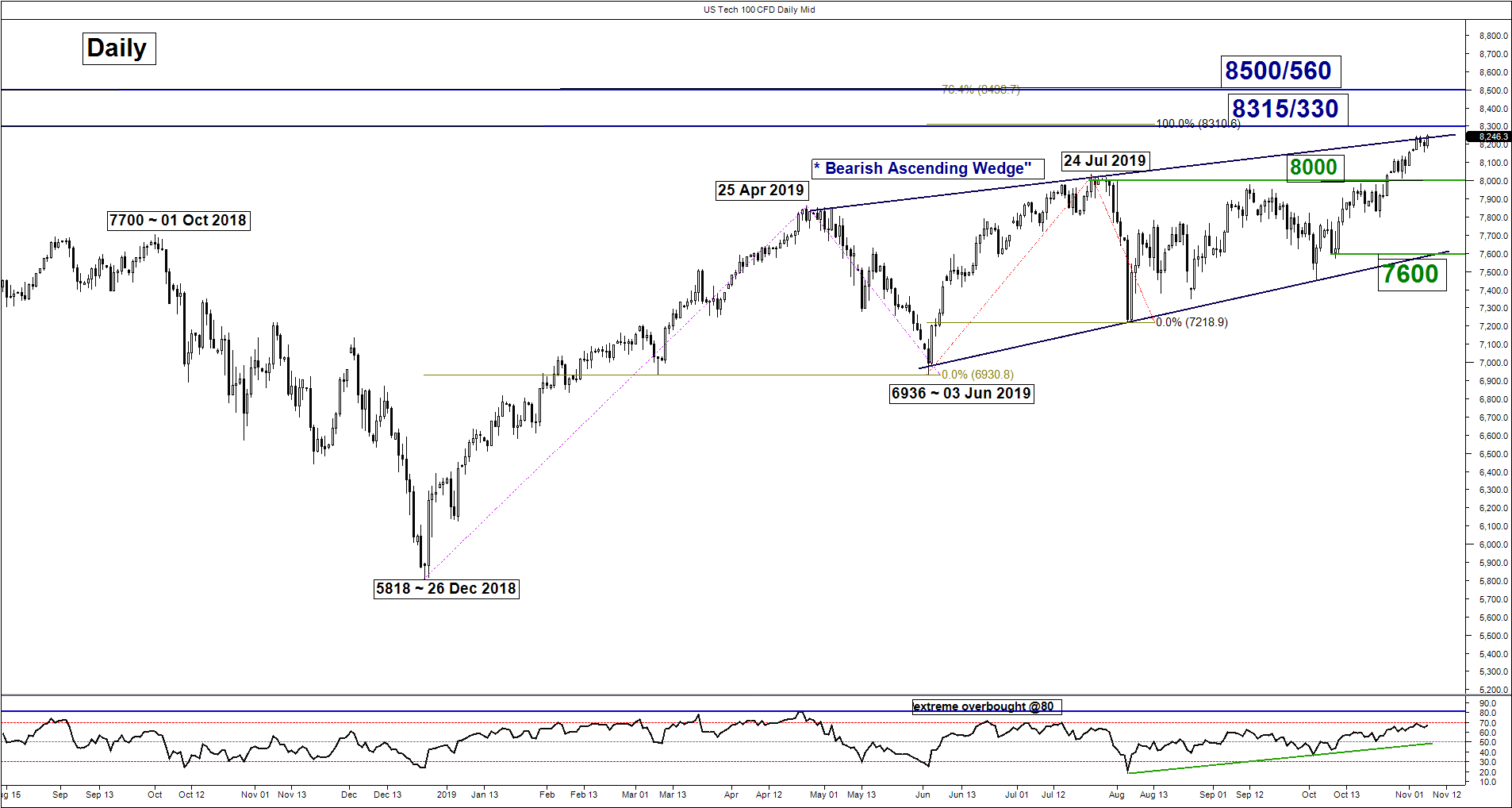

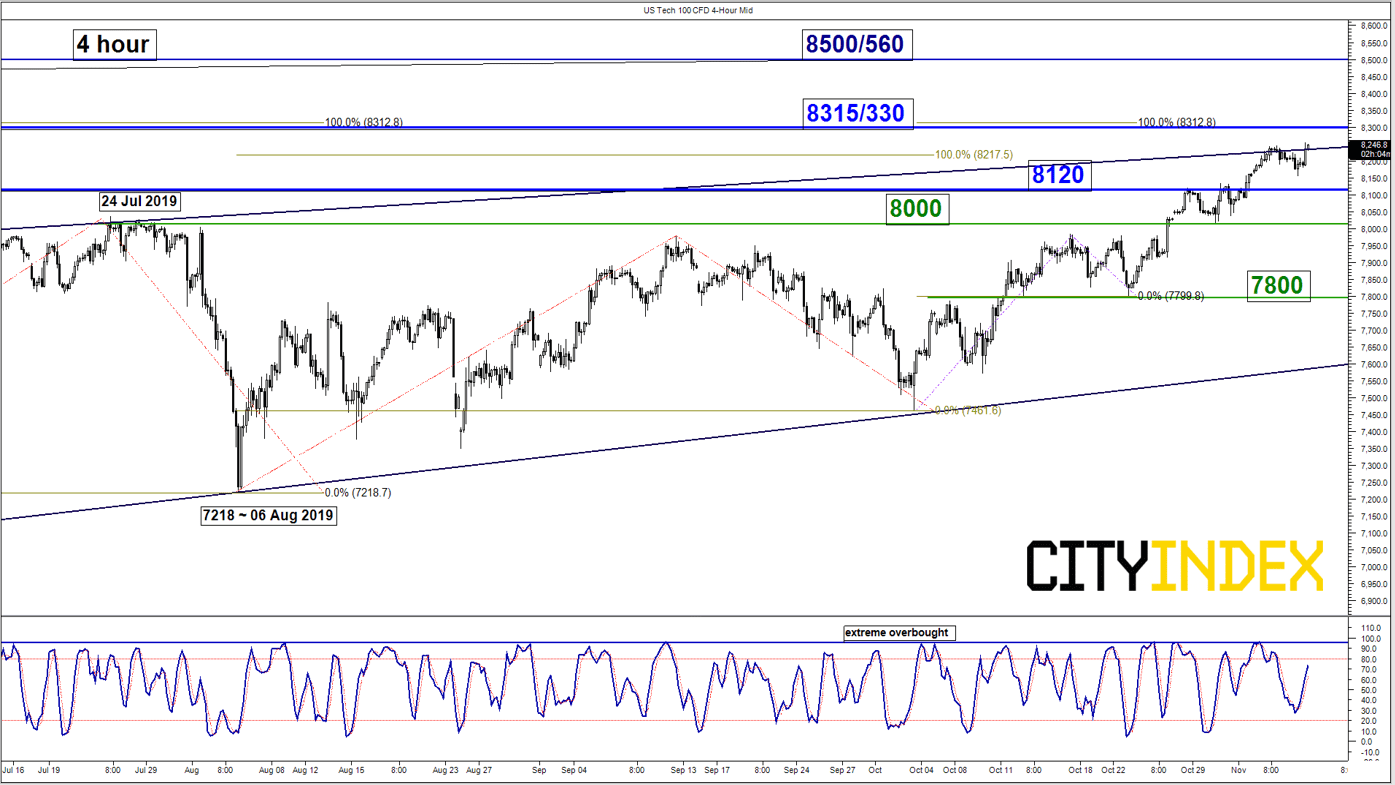

Nasdaq 100 – Watch 8330 key resistance

click to enlarge charts

- The US Tech 100 Index (proxy for the Nasdaq 100 futures) has inched higher as well and it is now challenging the upper boundary of a major bearish “Ascending Wedge” configuration in place since Apr 2019.

- Mix elements as well, bears need to have a break below 8120 (the minor ascending support from 03 Oct 2019 low) to open up scope for a potential multi-week corrective towards 8000 and 7800 next.

- On the flipside, a clearance with a daily close above 8330 sees a further squeeze up towards 8500/560 (Fibonacci expansion cluster).

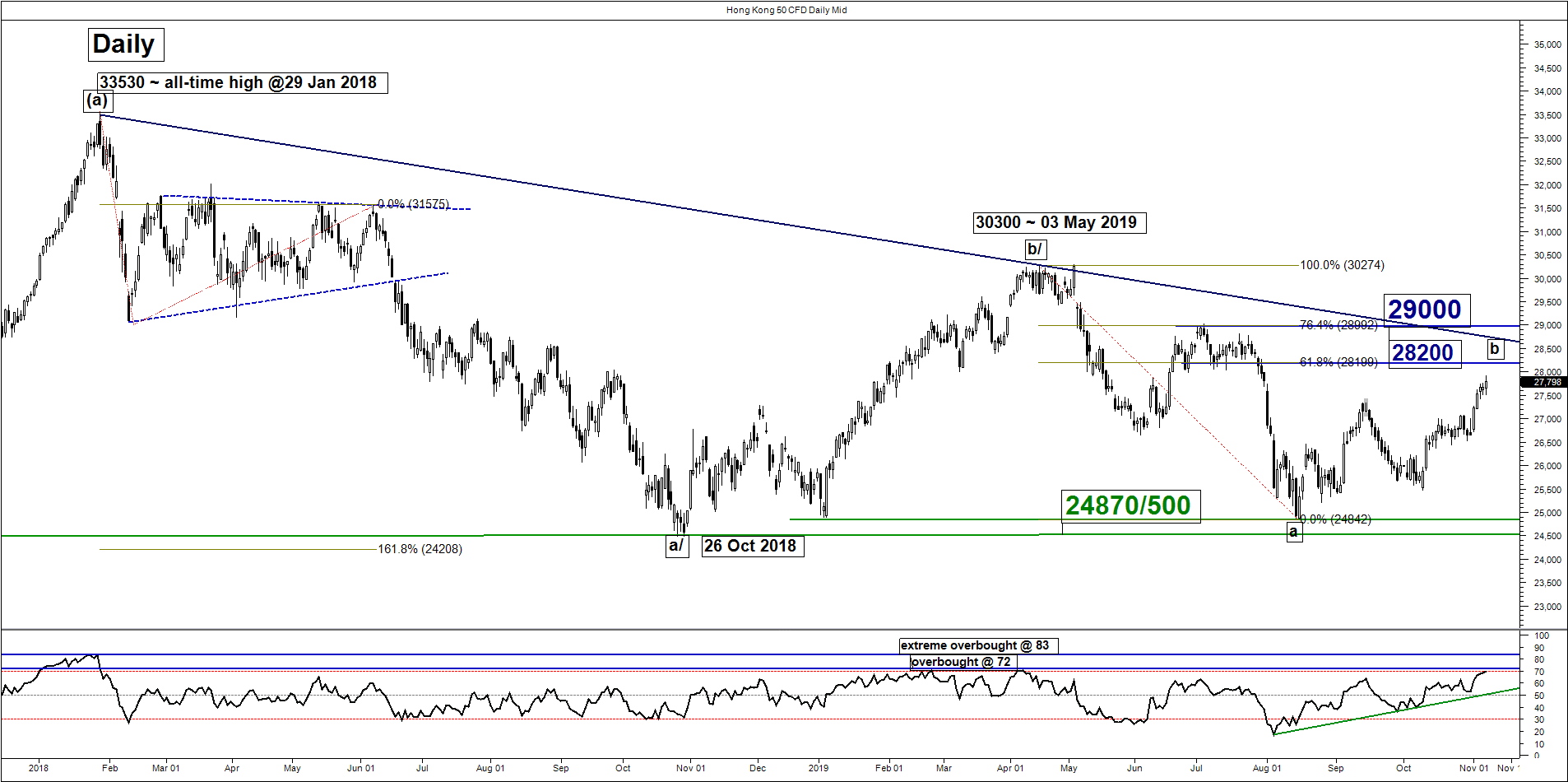

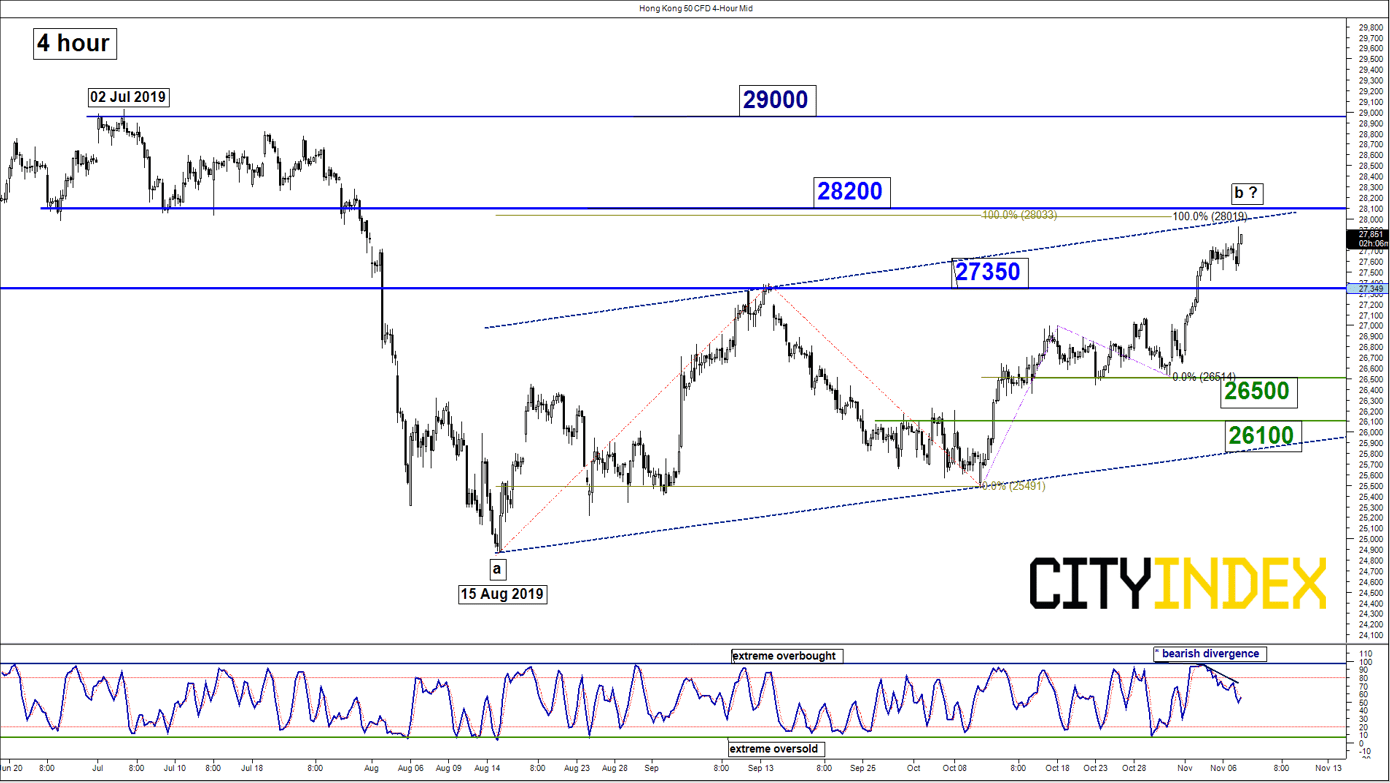

Hang Seng – 28100/200 upside target/resistance almost reached

click to enlarge charts

- The Hong Kong 50 Index (proxy for Hang Seng Index futures) has staged the expected extended corrective push up and almost hit the target/resistance of 28100/200 as per highlighted in our previous report.

- Even though its latest price action is coming close to a significant medium-term resistance at 28200 (upper boundary of a medium-term ascending range from 15 Aug 2019 low, former swing low areas of 25 Jun/09 Jul 2019 & a Fibonacci retracement/expansion cluster) with upside momentum being overstretched (bearish divergence seen in the 4-hour Stochastic oscillator, the current price actions of the S&P 500 and Nasdaq 100 futures are not supportive of a bearish scenario.

- Prefer to turn neutral first between 28200 and 27350. Bears need to have a break below 27350 for a potential corrective decline towards the 26500/100 zone. On the flipside, a clearance with a daily close above 28200 triggers an extension of the corrective rally to target the next resistance at 29000 (the major descending trendline from its all-time high level printed on 29 Jan 2018, 02 Jul 2019 swing high & 76.4% Fibonacci retracement of the previous decline from 03 May high to 15 Aug 2019 low.

Charts are from City Index Advantage